By Constantine S. Hatzivassiliou, Managing Director

If you are like many private foundation leaders, you are likely feeling frozen right now about how, and whether, to rebalance your investment portfolio.

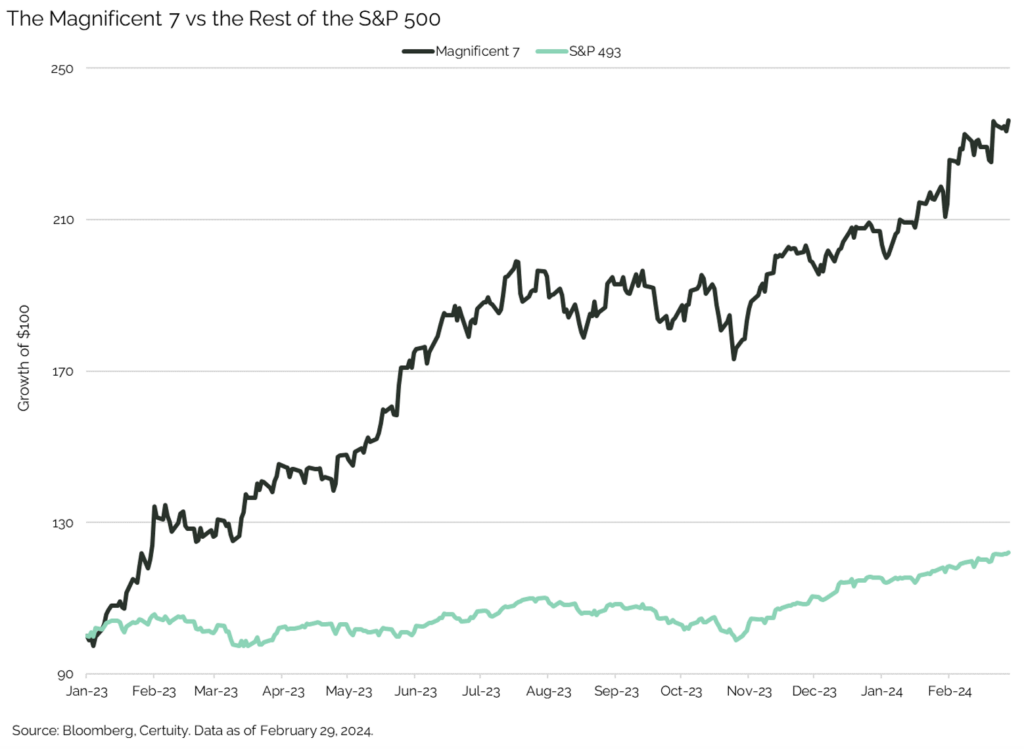

The equity portion of your portfolio is probably flying high after the outperformance of the equity market in 2023, particularly tech stocks like the “Magnificent 7,” but how long can that last? Conversely, your vintage, laddered bond portfolio is likely producing relatively low yields in this high interest rate environment. Do you hold your bonds to maturity to recoup the face value, or rebalance to a more attractive debt instrument (private debt is currently paying 10%) before interest rates (hopefully) drop?

It’s no wonder foundation leaders are feeling torn on what to do. The opportunity cost is high. The reality is that you have a fiduciary responsibility to ensure your foundations’ investment portfolios are appropriately balanced for risk and return.

To help with the tricky task of rebalancing portfolios in this dynamic market environment, I recommend foundation leaders weigh these considerations when approaching different asset classes:

- Equities. As referenced above, there was a phenomenon in the equity markets last year colloquially called the “Magnificent 7.” This handful of stocks overwhelmingly drove market performance in 2023 and through to today. For example, as of June 14, 2024, Nvidia is up 208% and Meta is up 85% over the past year. If you own those stocks, you may be feeling quite good, but as the foundation’s fiduciary, you have a legal duty to ensure your portfolio adheres to your investment policy statement (IPS). With the run up of equities, your portfolio may be out of whack.

Working with your advisors, I urge you to conduct a comprehensive analysis to find the best solution for the equity portion of your portfolio. For example, you could decide to gift stocks that have had huge gains to meet your 5% required mandatory distribution (RMD) in 2024. You may incorporate an option strategy to pick up additional yields, and / or for stocks that have reached new highs, you may choose to create an option strategy to protect downside exposure. When it comes to high-dividend value stocks, which have significantly underperformed growth stocks recently, you may want to consider using the value stocks in your portfolio as part of an options strategy, which could yield income to offset or potentially exceed your minimum RMD.

- Fixed Income. Fixed income has been another story. Have you succeeded in managing UP the yield curve? With interest rates now high and mature fixed income assets generating relatively low yields, consider whether you should rebalance out of underperforming bonds. Most foundations have a third to half of their portfolios allocated to bonds. If a foundation has owned an intermediate- or long-duration fixed income portfolio over the last five years, it’s likely “in the red.” As interest rates have risen, the face value of bonds has correspondingly decreased.

The challenge foundation leaders are facing is rooted in the Fed forecasting lower interest rates in the coming months. Do you rebalance, likely at a loss, out of existing fixed income instruments to lock in new debt instruments at higher yields? That depends on how much duration you have left in your bond portfolios and whether there have been any downgrades in the credit worthiness of the bonds you hold. The math may suggest you rebalance some or all of your portfolio, and if permitted, incorporate high-yield and public/private debt instruments, such as Polen Opportunistic High Yield or Ares Capital Corp 1.

- Alternatives. If your IPS permits, alternatives should make up a considerable portion of your foundation’s investment portfolio (at least 25%), which can provide low correlation to the typical 60/40 equity/fixed income portfolio model. That being the case, alts can serve as the linchpin for rebalancing a foundation’s portfolio and decreasing overall risk exposure.

As an example, most private foundations utilize real estate investment trusts (REITs) to meet their real estate investment objectives. However, REITs are generally not the most efficient way to get exposure to real estate. Rather, investing in real estate directly as a limited partner, as opposed to a publicly traded REIT, offers greater control over the investment vehicle and the likelihood of higher returns. Another non-traditional asset class that foundation leaders may want to consider are distressed municipal bonds, which can yield 10+% returns with the right manager. Thankfully, there is a broad universe of other alternatives to explore. The key is to appropriately leverage them to bring balance to your investment portfolio.

Finally, to mitigate your liability as a foundation fiduciary, engage outside experts to review your policies and procedures, particularly related to risk. Because of the chaotic nature of the markets in 2023, there is a good chance that your investment allocation has fallen out of your IPS standards (assuming your foundation has an investment policy statement, which although they are essential, many foundations do not).

Bring together your financial advisors, attorneys, and accountants to conduct a comprehensive review of your policies to ensure you are in compliance and that you are satisfying your fiduciary responsibilities.

Contact Certuity to further explore how best to rebalance your foundation’s portfolio.

- Certuity employees, including the author of this article, own long positions in Ares Capital Corp (ARCC). ↩︎