Professional Sports Market Insights: The Top 6 Things Investors Should Know

The world of professional sports has emerged as a dynamic and exclusive industry that garners worldwide attention. The professional sports market is diversified, attracts substantial capital, and may provide attractive investment opportunities, including potential access for high- and ultra-high-net-worth investors, family offices, and institutions. As investors continue to seek diversified investment opportunities that extend beyond traditional asset classes, the realm of sports presents an attractive prospect. The projected continued influx in capital and activity should lead to more investment opportunities.

While the allure of being associated with storied sports franchises and celebrated athletes is obvious, understanding this market requires a comprehensive understanding of the intricate dynamics that drive value for the sector, leagues, teams, and ancillary businesses. Below are 6 important factors that impact investments in professional sports teams.

1. Valuations Across Leagues and Teams

While sports franchises can be difficult to evaluate from the traditional private equity or buyout lens (i.e. standard EBITDA multiples), there are tangible drivers that support the valuation trends over the past decade, such as larger media rights deals, rising game-day revenues, asset scarcity, and more

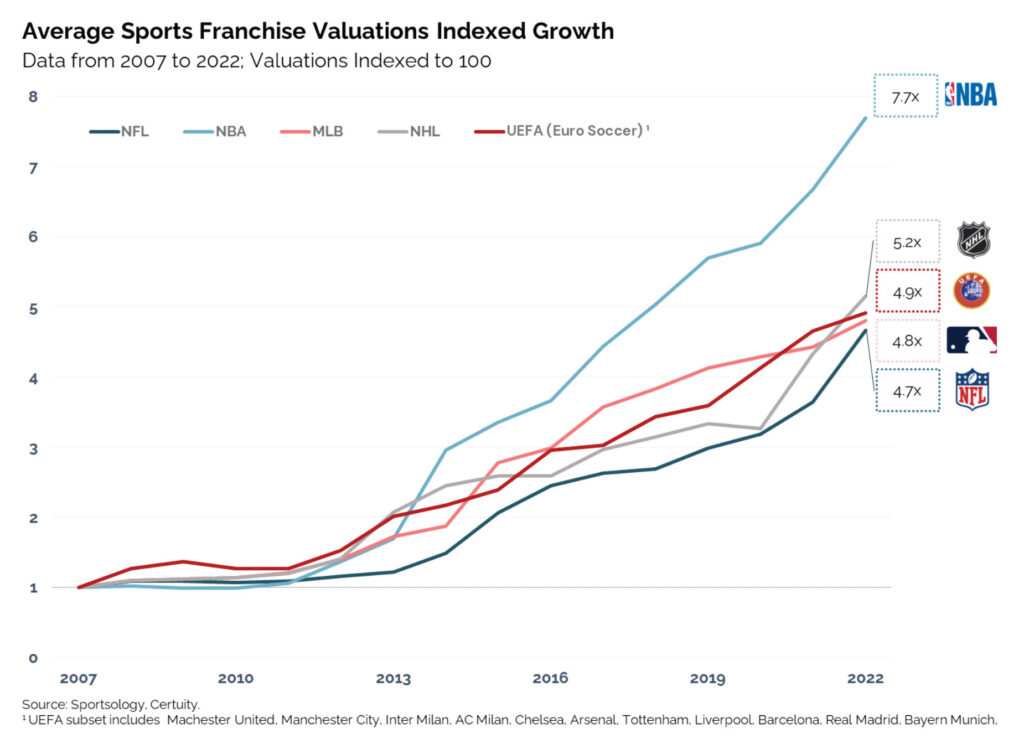

Since 2007, franchise valuations across the Big Four and European soccer have increased roughly 5x to 8x on average. The NBA has been a clear outlier, rising ~8x due to the global presence/appeal, prominent player base, institutional-friendly investor guidelines, and attractive media assets. The table below provides high-level valuation and financial data across leagues/sports. As you can see, financial profiles and valuations are dynamic and ever-changing, varying widely by league and team.

2. Diversified Business Models

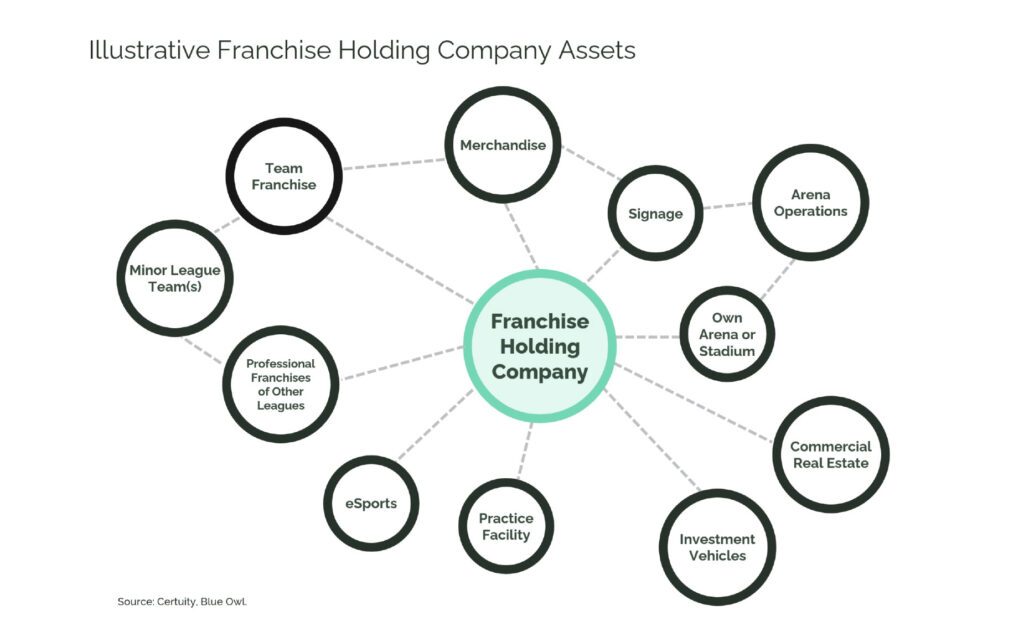

A professional sports team is more than just a name on a jersey. The holding companies manage not only the core team(s), but also multiple ancillary businesses, including broadcasting rights, merchandise sales, arena operations, licensing agreements, and even real estate ventures tied to sporting venues. Strong operators are critical, as they can add value across the holding company(ies) while also enhancing the fans’ gameday experience.

3. Key Growth Drivers, Especially Media Rights

Professional sports are ever-evolving and dynamic, with new leagues and teams continually capturing the public’s interest. Recent examples include the pickleball craze and women’s soccer. So, what actually drives the growth of a particular sports league relative to another?

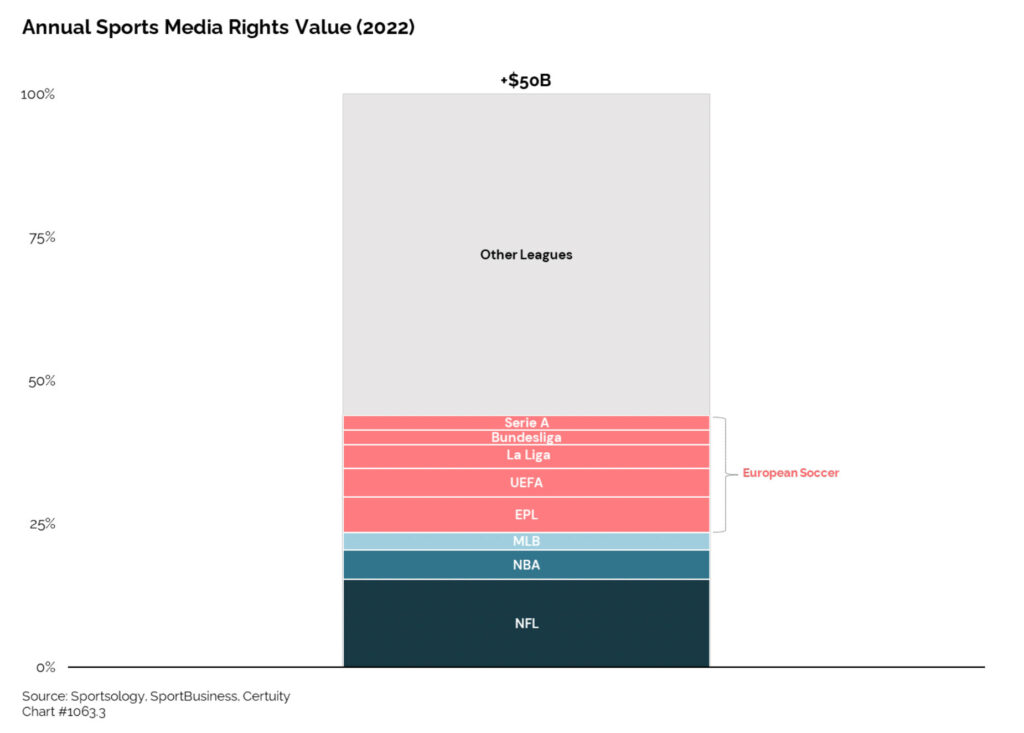

Key growth drivers include media rights, commercial partnerships and sponsorships, matchday/gameday revenue, and efficiently managing cost structure. Media rights are particularly important as global viewership across major sports leagues is high compared to other media assets. Sports is still one of the few events that fans love to watch live.

The media rights deals (television and streaming rights) have also become a major source of revenue and growth driver for professional sports leagues, as the total media rights value is +$50 billion and growing. The demand for content and the evolving technological reach of content is expected to grow. Sports franchises and leagues continue to embrace innovation and technological integration – with advancements, such as streaming services, virtual reality experiences, sports betting, and data analytics further enhancing fan engagement, monetization, and operational efficiency. Further, with the evolution of linear media (conventional TV broadcasting where viewers watch pre-scheduled programs in real time), more broadcasters and streaming platforms compete for the rights to air games, so the value of these contracts has increased substantially. Leagues like the NFL, NBA, and English Premier League have secured lucrative media deals that significantly boost their revenues, which in turn increases the overall valuation of the teams.

4. Barriers to Entry

Ownership opportunities across professional sports have traditionally been restricted to a select group of investors, especially within the “Big Four” leagues (MLB, NBA, NFL, NHL). In the earlier years of professional sports, teams often relied on individual business owners or local groups of investors who had personal interest in a team’s success. As sports gained popularity, particularly starting in the 21st century, more substantial capital inflows began to occur, ultimately leading to stricter and more formalized owner regulations, such as investor restrictions and league approval and vetting processes. Because of this, investing in professional sports can carry more challenging barriers to entry than many traditional businesses.

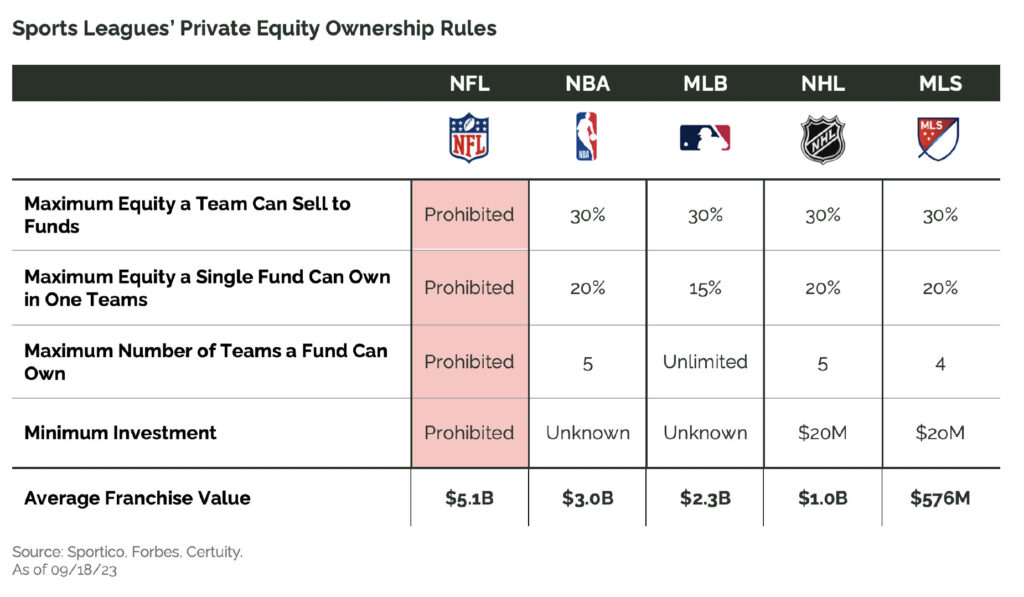

Further, institutional ownership rules vary by league. Below is a table that provides a summary:

In 2021, the NBA loosened its ownership rules to welcome private equity firms as limited investors, with an eye toward broadening its pool of potential buyers. Major League Baseball did so in 2019, and the NHL followed suit in 2021. More recently, the NBA further relaxed its ownership policy to permit sovereign wealth funds to buy limited shares in teams, setting a 20% cap on any single fund or investment firm’s stake in a given team. No more than 30% of a single team can be owned by a combined group of funds. Thus far, NFL owners have opposed private equity and institutional ownership. Specifically, a big advantage for NBA ownership is that it can attract more bidders, which in turn should boost sale values.

While the increasing sophistication of institutional capital in sports will open up more opportunities and increase liquidity, the underlying scarcity value and high barriers to entry will remain and should continue to support the valuations of professional sports teams.

5. Portfolio Diversification Benefits

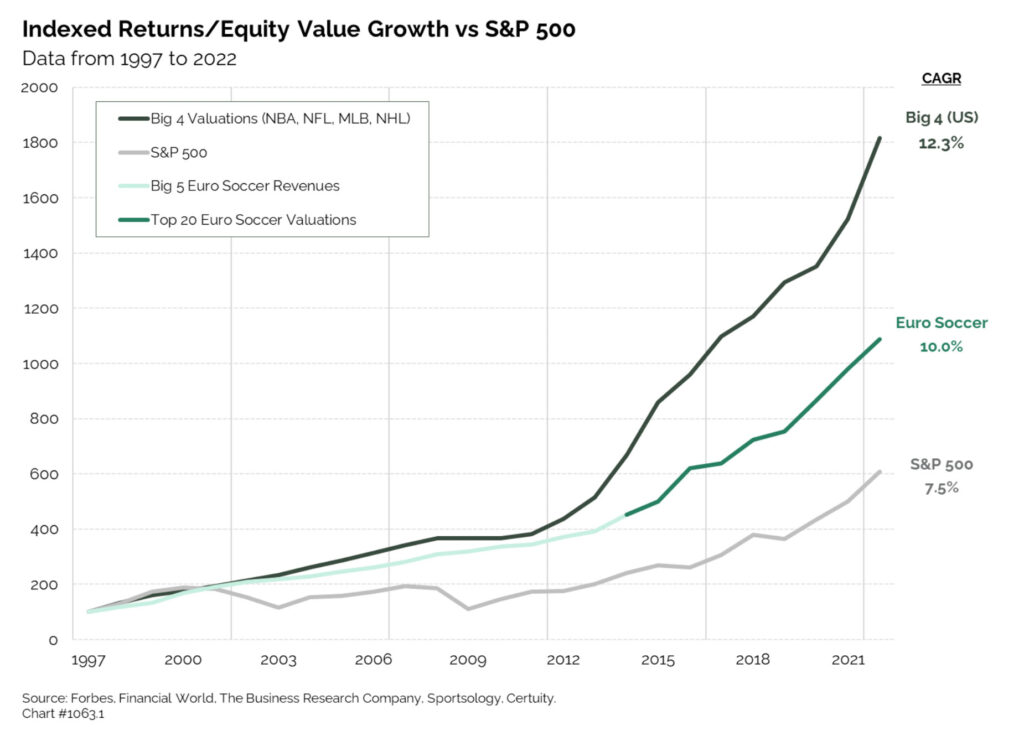

Professional sports is big business. Over the past 25 years, growth across both the Big Four and European soccer has outpaced the S&P 500 by roughly 5% and 2.5%, respectively

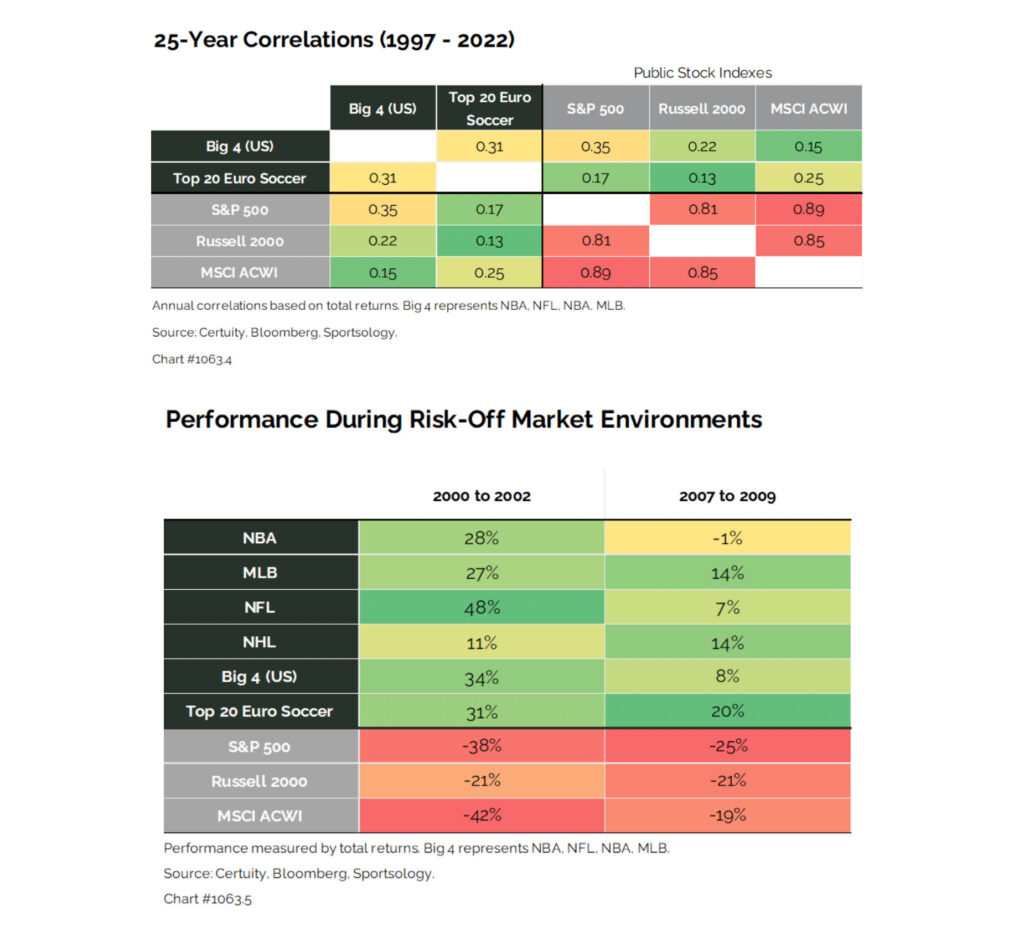

Consider, for example, that an investment in professional sports may provide private equitylike returns, while reducing risk by, among things, increasing portfolio diversification. This means that the performance of sports investments tends to be less influenced by market fluctuations, providing a ballast against economic uncertainties. Sporting events and franchises are influenced by a diverse set of factors, ranging from team performance and player dynamics to fan engagement and media rights. Such multifaceted drivers of value can contribute to a more stable and resilient market (as it relates to professional sports). Below are correlations of pro sports versus public equity indexes and performance during previous risk-off environments.

6. Key Considerations – Risks and Complexities

An investment in professional sports entails unique considerations. First, due to limited liquidity, such investments are illiquid and typically require a longer investment horizon (7+ years). Other significant barriers include accessing deal flow, meeting investment minimums, dealing with cross-ownership provisions, and complying with league-specific ownership regulations.

Investments in professional sports teams also present inherent operational risks, such as managing players and staff, overseeing arena operations, negotiating media rights, and handling sponsorship agreements. It is critical to evaluate an operating group’s expertise and skillset in managing a sports franchise effectively, considering the complexities. In addition to these operations, investing in sports exposes investors to “live event risk” and potential unforeseen disruptions, as exemplified by the COVID-19 pandemic.

Furthermore, in addition to conducting fundamental research, it is critical to understand the underlying investment structure. For instance, investing in an unprofitable team may necessitate investors to contribute additional capital annually. Due diligence is key, and includes not only market risk factors, but research into specific sports leagues or teams of interest in order to understand the associated risks.

Conclusion

The professional sports market presents a blend of financial opportunity, portfolio diversification, and emotional connection. Of course, the market also presents a variety of inherent risks and considerations that are unique to this market. The market insights discussed above are just the starting point to understanding the opportunities and risks presented in the professional sports arena.

Dylan Kremer, Co-Chief Investment

Officer Office: (561) 486-0079

Email: [email protected]

certuity.com

Legal Disclaimer

Certuity, LLC, a Delaware limited liability company (“Certuity”), is a United States Securities and Exchange Commission (“SEC”) registered investment adviser. Certuity® is a registered trademark of Certuity Holdings, LLC. Alts Plus, AltsPlus and Alts+ are trade names of Certuity, LLC.

This document is for information purposes only and is not investment advice, or is it intended as an offer or solicitation, or as the basis for any contract to purchase or sell any security, or other instrument, or to enter into or arrange any type of transaction as a consequence of any information contained herein.

Certain information contained herein has been obtained or derived from unaffiliated third-party sources believed by Certuity to be reliable. Neither Certuity nor any of its affiliates or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein Some of the materials contained herein may be characterized as “forward-looking statements”, which can be identified by the use of forward- looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology, and which may include, among other things, projections of future performance, estimates, forecasts, scenario analysis, or pro forma information. Such forward-looking statements are based on assumptions with respect to significant factors that may not prove to be accurate.

All analyses and projections depicted herein are for illustration only, and are not intended to be representations of performance or expected results. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment or investment strategies. Although information in this document has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness, and it should not be relied upon as such. This document may not be reproduced or circulated without our written authority