It’s a world of laughter, a world of tears

It’s a world of hopes and a world of fears

There’s so much that we share that it’s time we’re aware

It’s a small world after all

(FROM “IT’S A SMALL WORLD AFTER ALL’” A DISNEY SONG WRITTEN BY RICHARD AND ROBERT SHERMAN IN 1964)

By Scott Welch, CIMA®, Chief Investment Officer & Partner

Reviewed by Carter Mecham, CMA®, IACCP®

As we analyze small cap stocks in today’s market environment, we might also paraphrase country singer Martina McBride: “I’m little but I’m (supposed to be) loud” (parenthetical comment added).

With large cap growth stocks dominating the markets for the past twenty years, the tiny but mighty small cap has nearly faded from memory. While small caps have underperformed for the past few years, history suggests that this trend will revert and if it does, they may enjoy an extended heyday.

Below, we dive into what’s driven US small cap underperformance and why investors may be wise to allocate to them before they stage a comeback.

A Brief History

Let’s begin by going back to academia. Back in 1992, Kenneth French and Eugene Fama published their now iconic “Three-Factor Model” thesis for determining asset prices. Those three factors are:

- The market return, or beta (β)

- A premium associated with small cap stocks versus large cap stocks (i.e., “size”), and

- A market premium associated with a high book/market ratio versus a low book/market ratio (i.e., value).

Regular readers of our blogs know that we are firm believers in factor-tilted portfolio construction, focusing primary on value, quality, size, and dividends. So, our model portfolios contain allocations to all of these factors, including size.

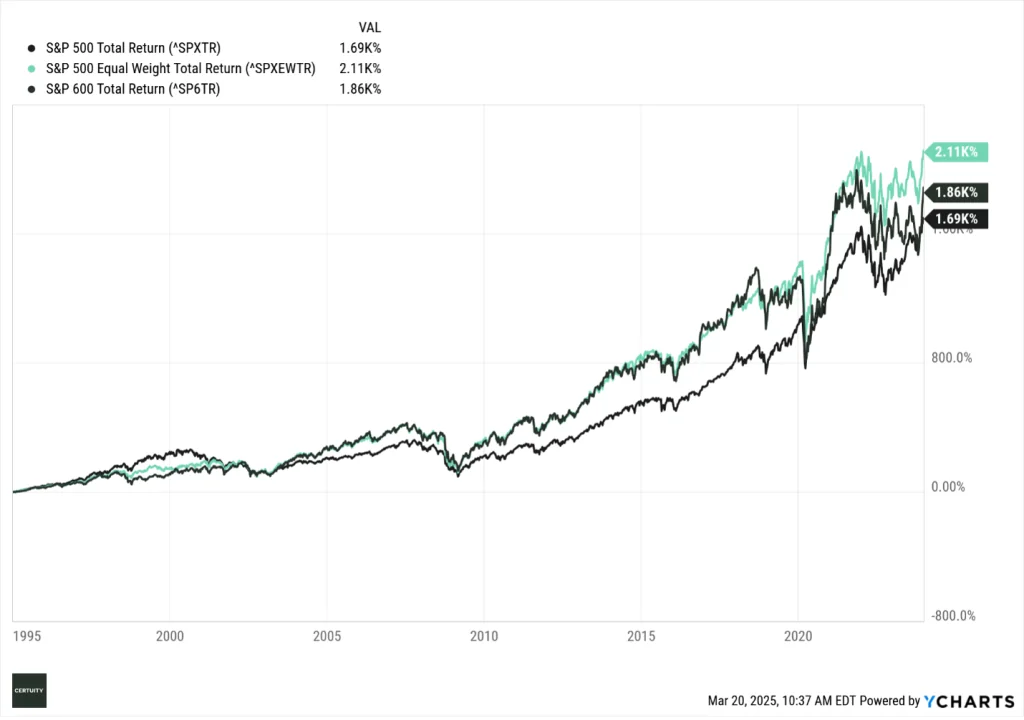

Historically, this has been a good decision. If we examine the period from 1995 through the end of 2023, we see that size delivered excess performance relative to the S&P 500 (i.e., β) performance, and it was really only around 2020 that the S&P 500 began to catch up on a cumulative basis.

Source: Ycharts, data from January 1995 through December 31, 2023. You cannot invest in an index and past performance is no guarantee of future results.

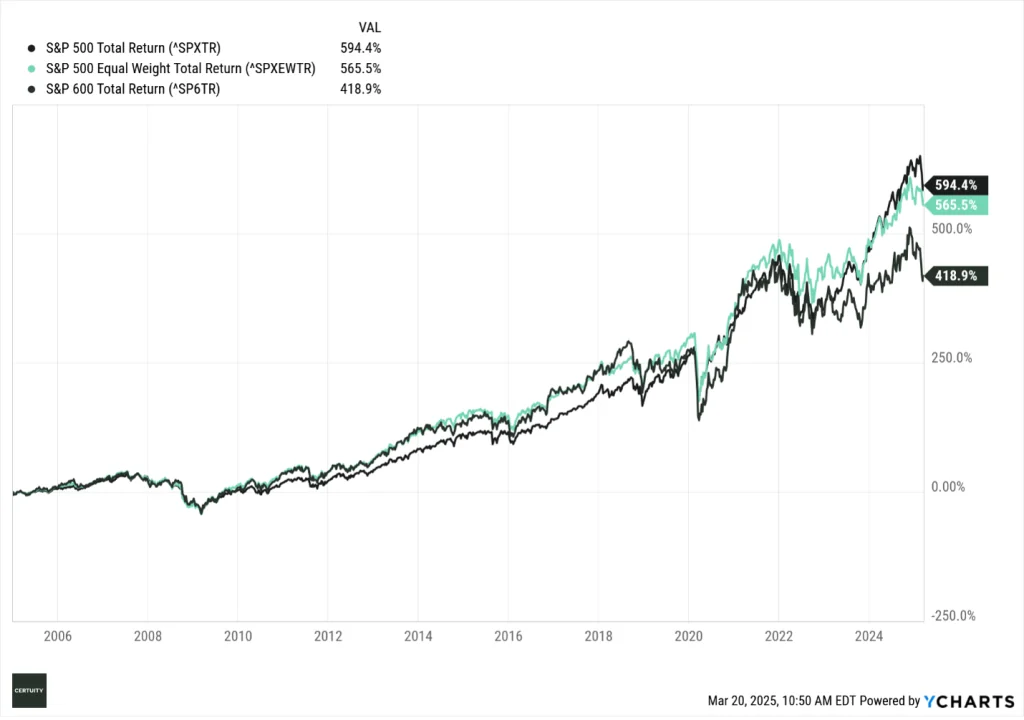

Of course, as we all know, since roughly 2005, and especially in the past five years, large cap growth stocks have absolutely dominated market performance (though this has changed so far this year).

Source: Ycharts, data from January 2005 through March 19, 2025. You cannot invest in an index and past performance is no guarantee of future results.

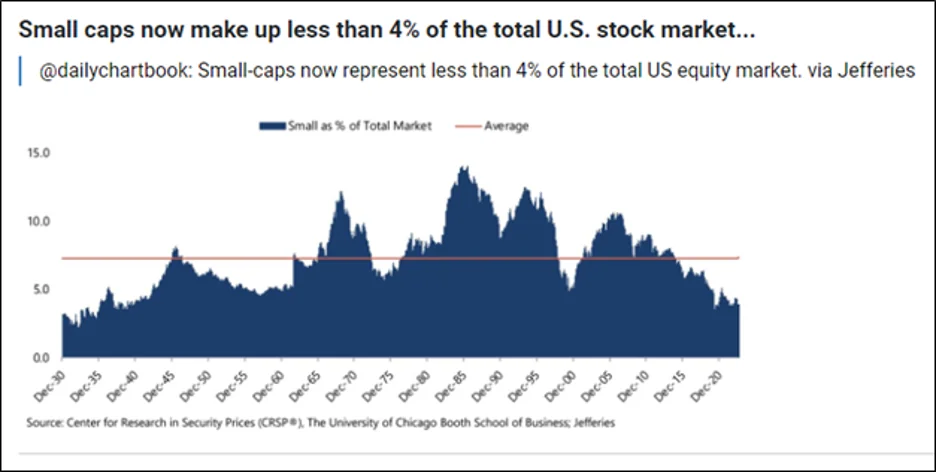

This massive “factor rotation” over the past ten years has made it easy for many investors to forget that the small cap premium existed at all, or that somehow “the market” has simply fundamentally shifted away from pricing in a small cap premium.

There is some truth to this, as many small cap stocks have moved from the public into private markets. [This is one reason we remain so bullish on private equity – that’s where the action is re: smaller cap stocks.]

Source: Frontier Asset Management, January 2024.

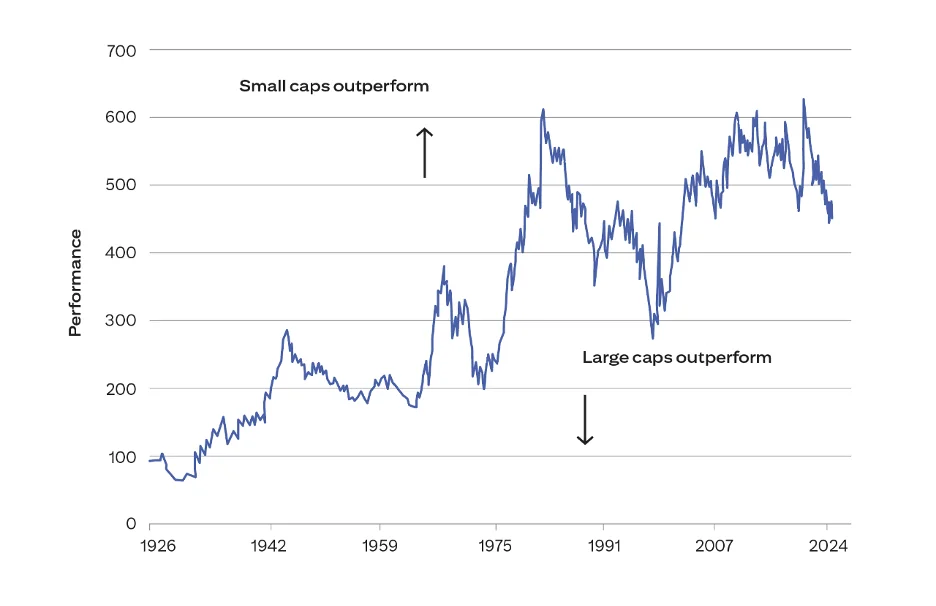

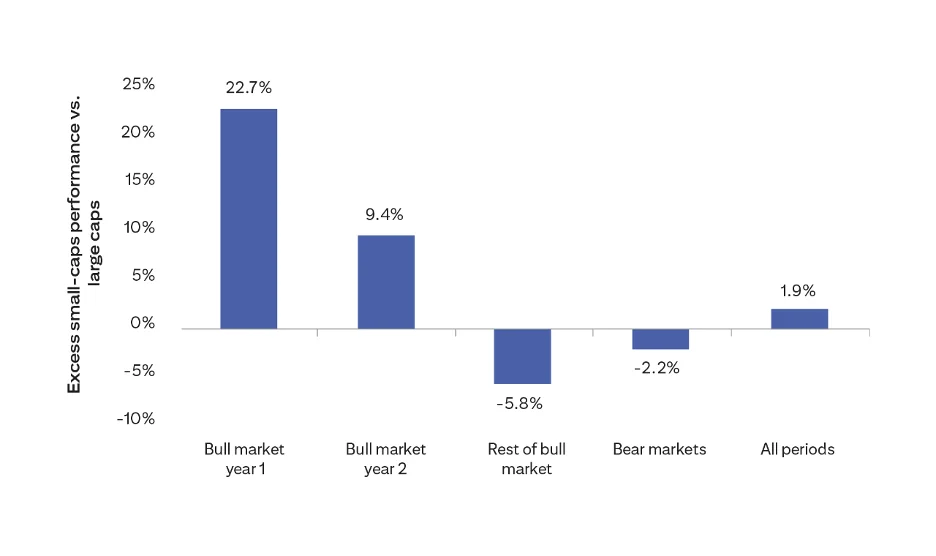

Another aspect of small cap investing is the duration of the periods when small caps are outperforming. Risk factors rotate as a matter of course over time, but what we see is that when small cap stocks do outperform, they tend to do so for extended periods of time.

Source: Citi Private Bank, “Why small can be beautiful in the stock markets,” February 2025.

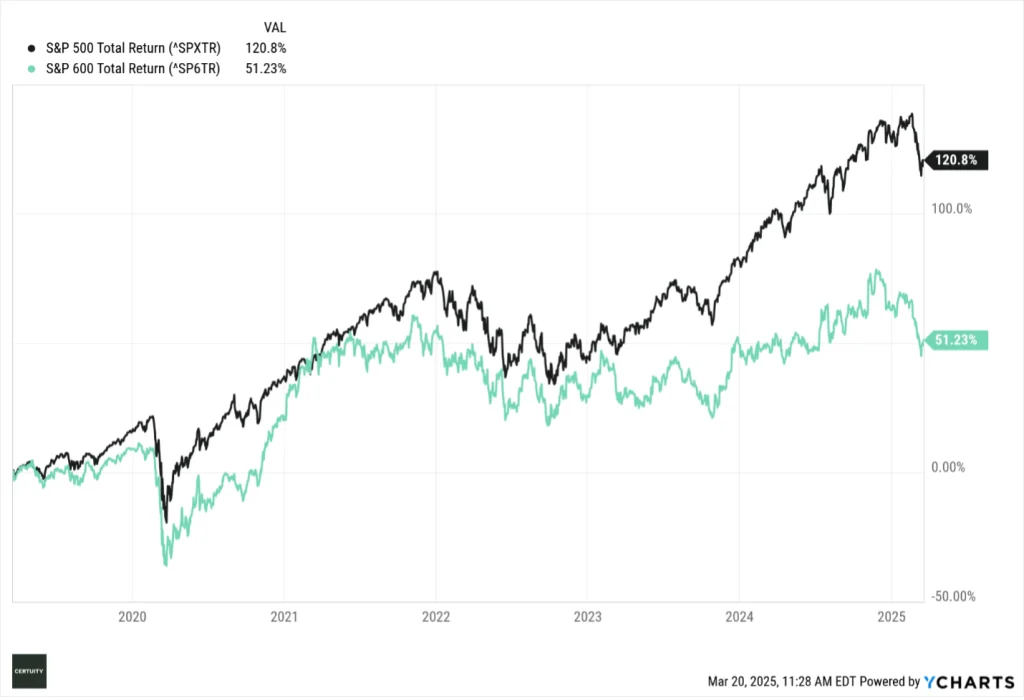

Of course, we have now been in a period of dramatic underperformance for at least the past five years, especially over the past twelve months.

History suggests this will mean revert at some point.

Source: Ycharts, 5-year data through March 19, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Source: Ycharts, 12-month data through March 19, 2025. You cannot invest in an index and past performance is no guarantee of future results.

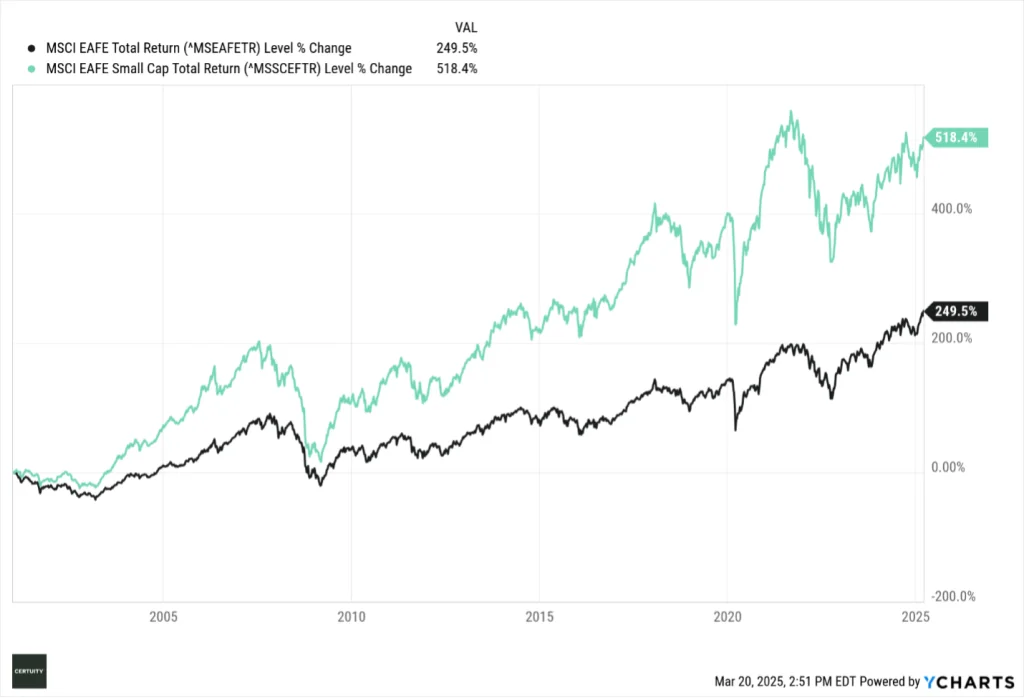

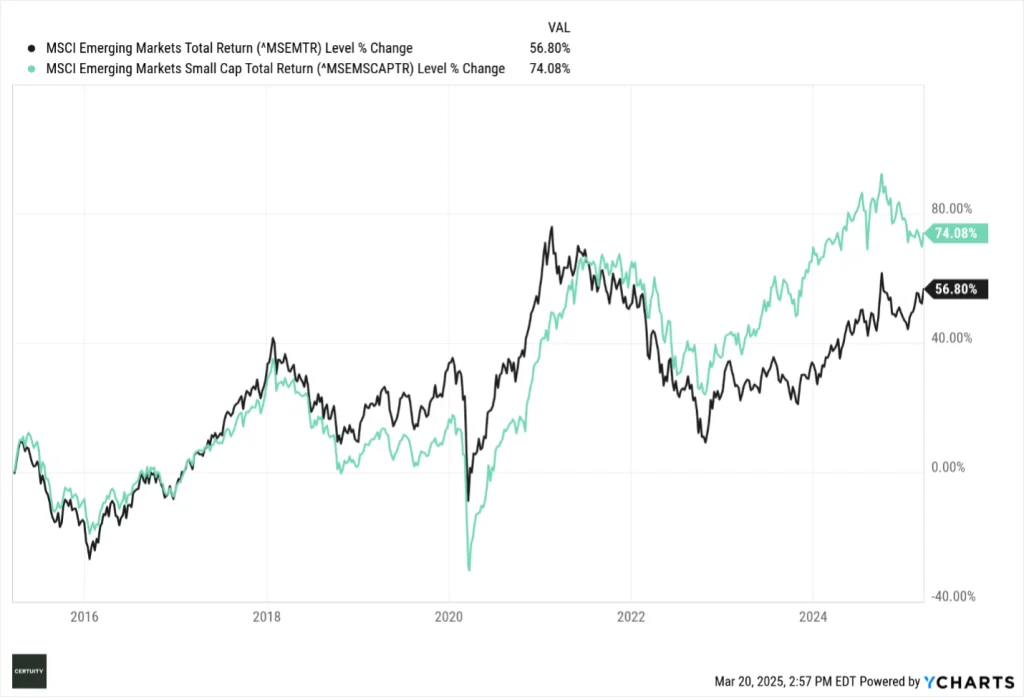

An interesting contrast to the US markets is the long-term performance of EAFE and EM small caps relative to their large cap counterparts.

We strategically allocate to EAFE small caps within our model portfolios.

Source: Ycharts, data from January 2001 through March 19, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Source: Ycharts, 10-year data through March 19, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Why Have US Small Caps Underperformed?

There are several reasons for the US small cap underperformance:

1. Risk and Reward: A primary reason for the historical outperformance by small cap stocks is that they are viewed to be riskier than large cap stocks so, more risk is supposed to translate into higher returns. That dynamic has been turned on its head by the dominance of the mega-cap tech stocks over the past several years. Investors have not attributed higher return to higher risk – they have rewarded growth, growth, growth.

2. Economic sensitivity: Because they are smaller companies with fewer resources than larger companies, small cap stocks tend to be more sensitive to underlying economic conditions. A potentially slowing economy combined with increased uncertainty over ongoing tariff policies are hitting small companies harder than larger companies as investor sentiment shifts increasingly to a “risk off” mode.

Source: Citi Private Bank, “Why small can be beautiful in the stock markets,” February 2025.

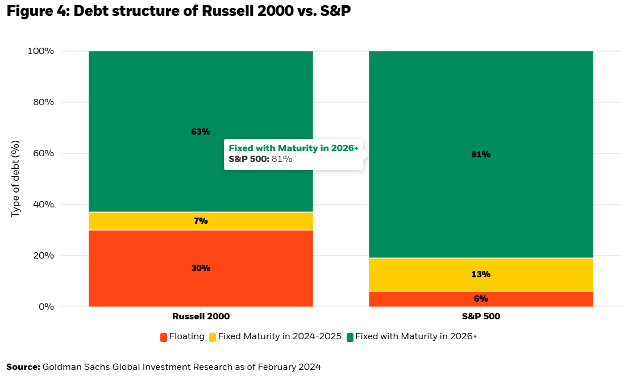

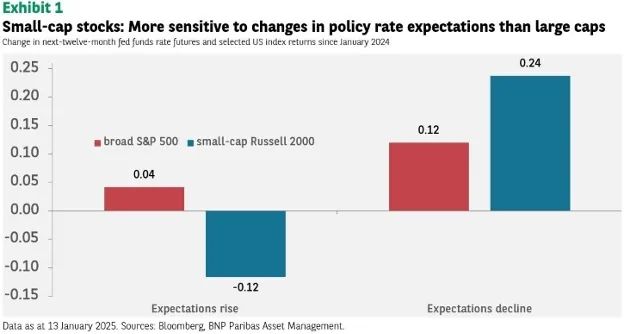

3. Interest rate sensitivity: Many small cap companies fund themselves primarily with floating rate or unrated high yield debt (this certainly is true in the private credit markets). Uncertainty over the future direction of rates is generating uncertainty for small cap companies, which may be less willing to take on additional debt to fund future growth.

Source: BNP Paribas Asset Management, “The outlook for US small caps in 2025”, January 2025.

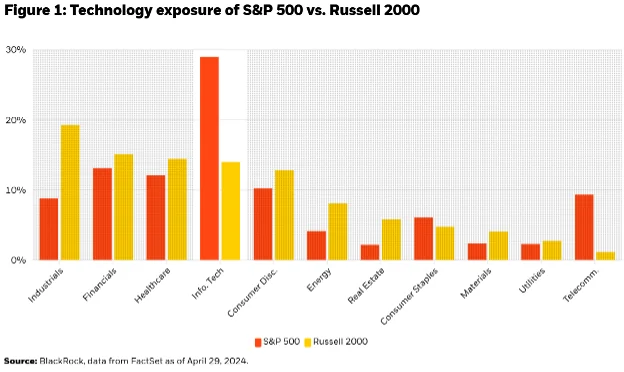

4. Technology exposure: Information technology has been the primary growth sector in the markets for the past several years, but small cap stocks have far less exposure to this sector than large cap stocks.

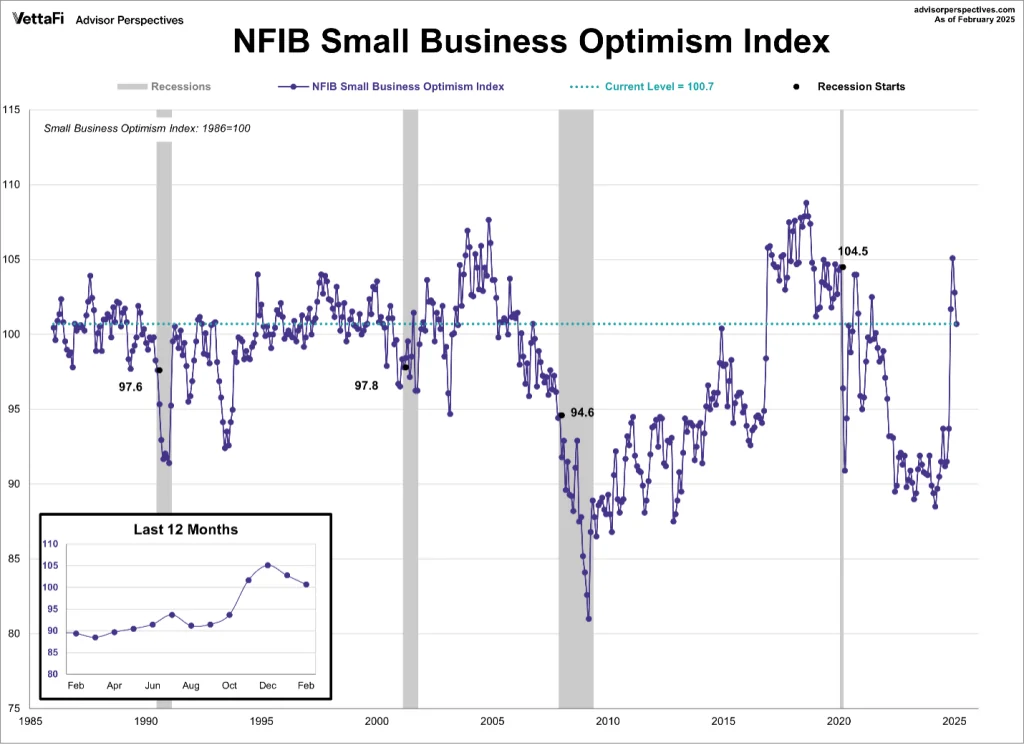

5. Business owner sentiment: Small business owners are particularly sensitive to ongoing changes in taxes, regulations, inflation, interest rates, and economic conditions. If they are bearish on these issues, they “pull back” with respect to hiring, capital expenditure, and expansion plans.

The National Federation of Independent Businesses (NFIB) is a small business advocacy group that publishes a monthly index on small business owner sentiment. We see a steady decline during the Biden administration followed by a massive spike following Trump’s election, only to see that cool over the past 1-2 months are tariff and economic uncertainty increased.

Source: NFIB and VettaFi Advisor Perspectives, data through February 2025.

What’s Next for Small Caps?

The market probably needs increased clarity on the economy, interest rates, and Administration policies on regulations, taxes, and tariffs before small caps will be poised for a “comeback.”

But longer term, more patient investors will see positive aspects in both earnings projections and in relative valuations.

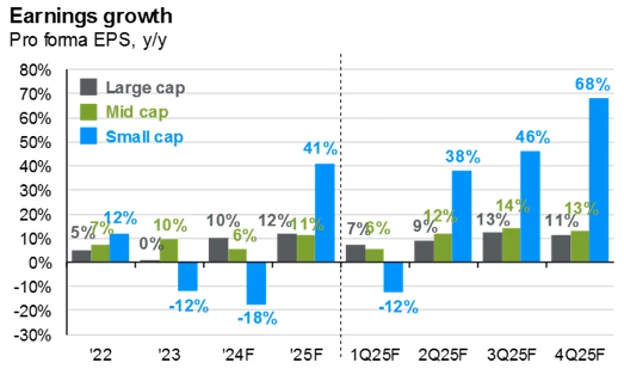

JP Morgan expects small caps earnings to falter through Q1 of this year but then bounce back strongly as the year progresses.

Source: JP Morgan “Guide to the Markets,” as of February 28, 2025.

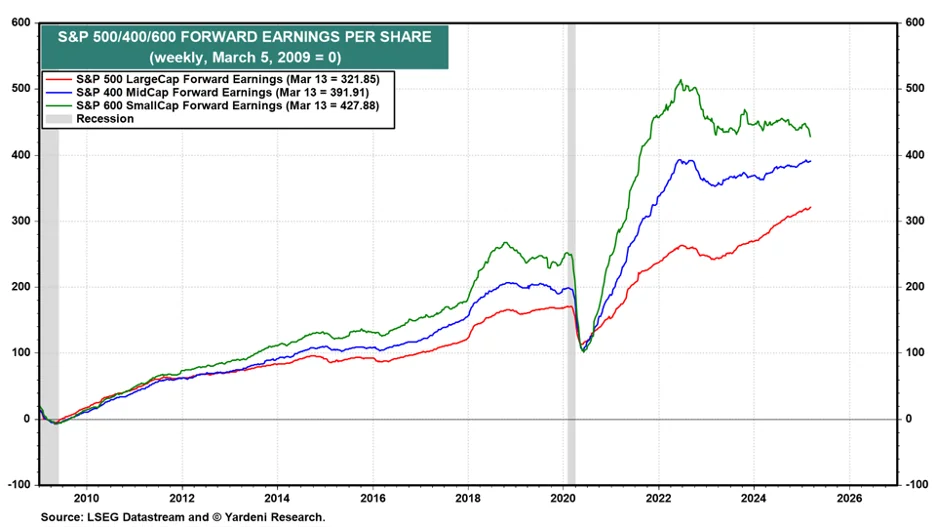

Yardeni Research is likewise forecasting an improved earnings outlook for small cap stocks.

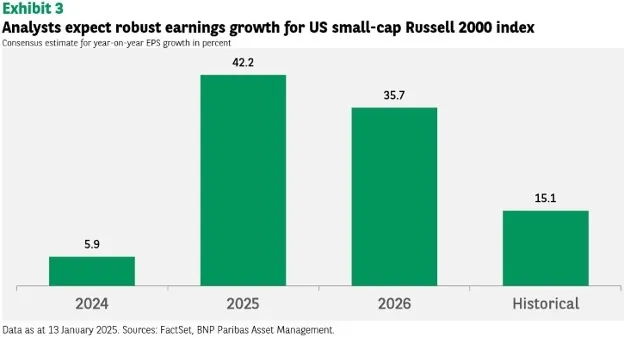

As is BNP Paribas Asset Management.

Source: BNP Paribas Asset Management, “The outlook for US small caps in 2025”, January 2025. You cannot invest in an index and past performance is no guarantee of future results.

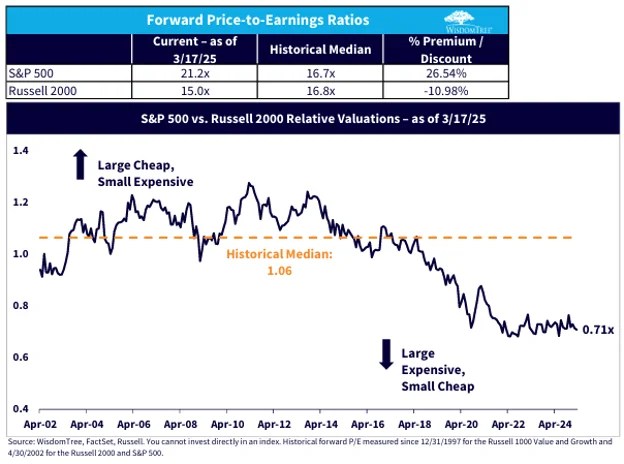

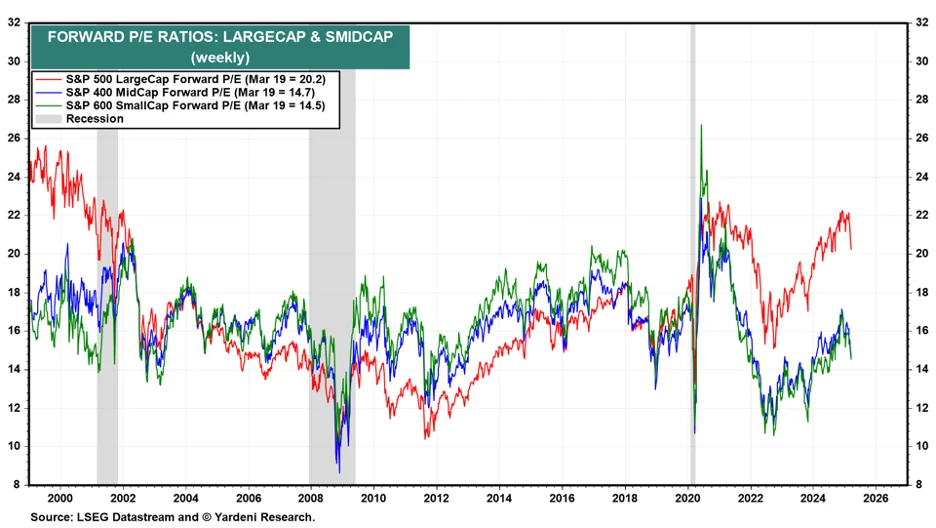

Longer term investors may also find comfort in the relative valuation of small cap vs. large cap stocks.

Source: WisdomTree, as of March 17, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Source: Yardeni Research, as of March 19, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Summary

In conclusion, then, it may be premature for more tactically minded investors to “lean into” small cap stocks at this time.

But patient, longer-term investors should seriously consider allocating to small cap stocks, both domestically and outside the US, for both total return potential and diversification purposes.

History suggests they will be rewarded if they do so.

We hope you find this useful and, as always, are happy to address any questions or follow up.