“Doctor, Doctor, gimme the news

I got a bad case of lovin’ you

No pill’s gonna cure my ill

I got a bad case of lovin’ you… “

(FROM “BAD CASE OF LOVING YOU (DOCTOR, DOCTOR),” BY ROBERT PALMER, 1979)

By Scott Welch, CIMA®, Chief Investment Officer & Partner

Reviewed by Carter Mecham, CMA®, IACCP®

Regular readers know we are firm advocates of both asset class and risk factor diversification. We believe that using both leads to better diversification and, therefore, more consistent portfolio performance regardless of the underlying market regime.

So, we believe it appropriate to periodically check in on risk factor performance, as it tends to be less well-covered than its more famous asset class cousin.

Let’s dive in.

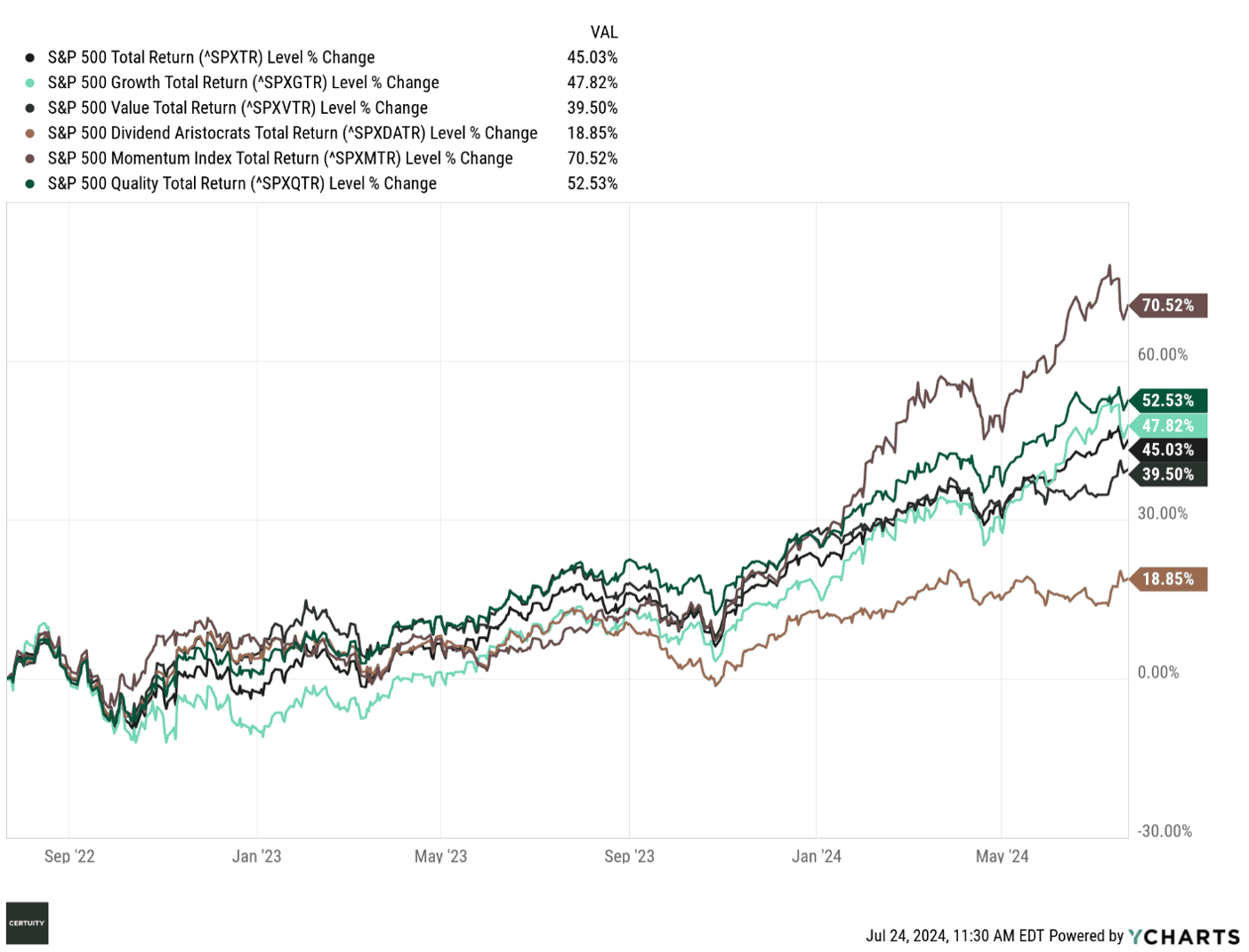

First, let’s look at US large cap risk factor performance over the past two years.

Source: Ycharts, 2-year data through July 22, 2024. You cannot invest in an index and past performance is no guarantee of future results.

We see that momentum has dominated performance, but we view momentum as a “second order” factor because if any other factor is running then momentum is probably running as well. In this case those other factors are large cap and growth, specifically the mega-cap tech stocks.

We note, however, the consistent strength of the quality factor (dark green line above) – we’ll discuss that more later in this posting.

As a reminder, and using the “DuPont Equation,”[i] quality can be defined as companies with stronger balance sheets, earnings, and cash flows, and therefore better able to maintain or grow dividends, engage in buybacks, and/or maintain margins during economic or market downturns.

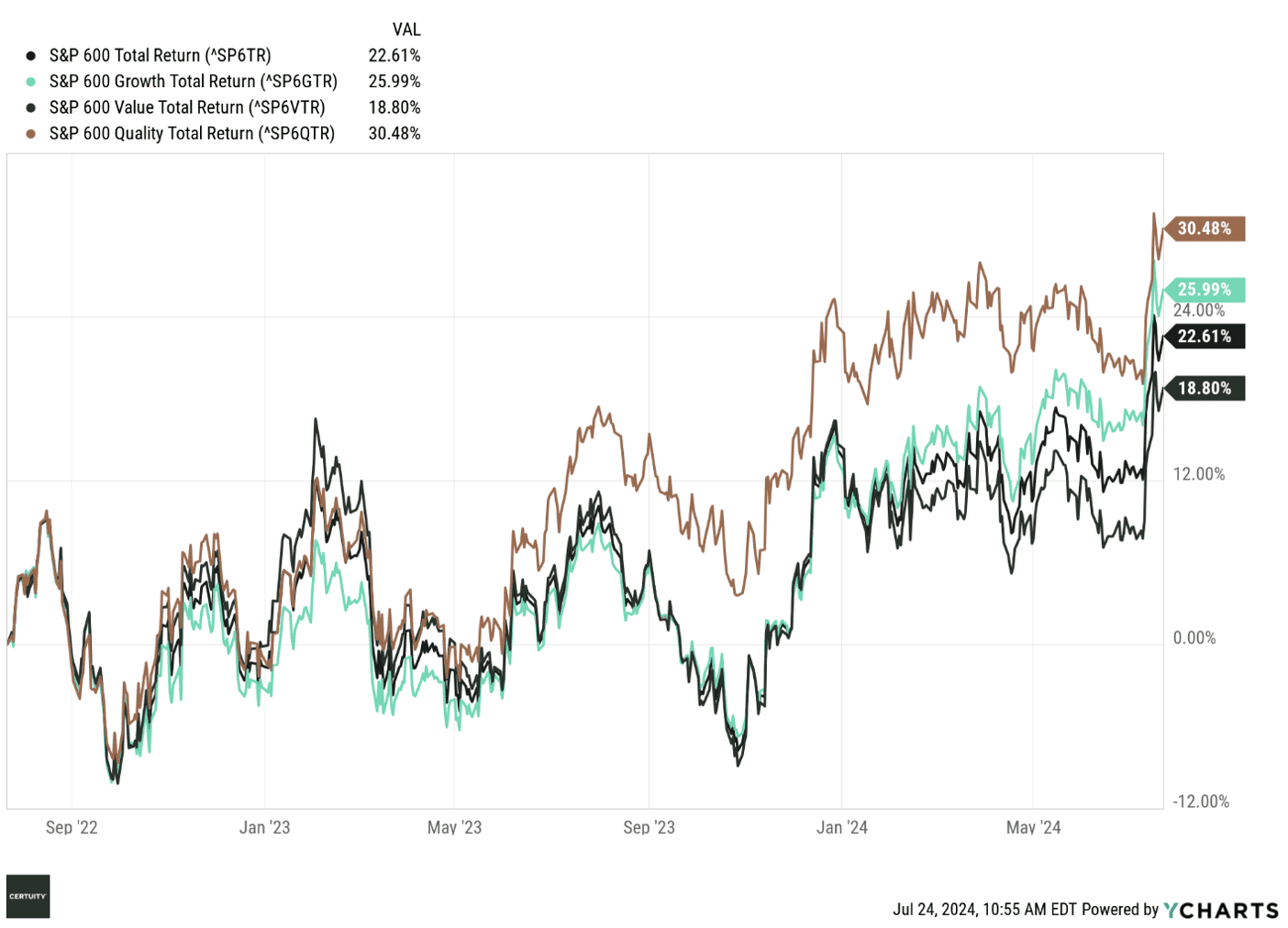

We see similar results for US SMID (small and midcap) cap stocks.

Source: Ycharts, 2-year data through July 22, 2024. You cannot invest in an index and past performance is no guarantee of future results.

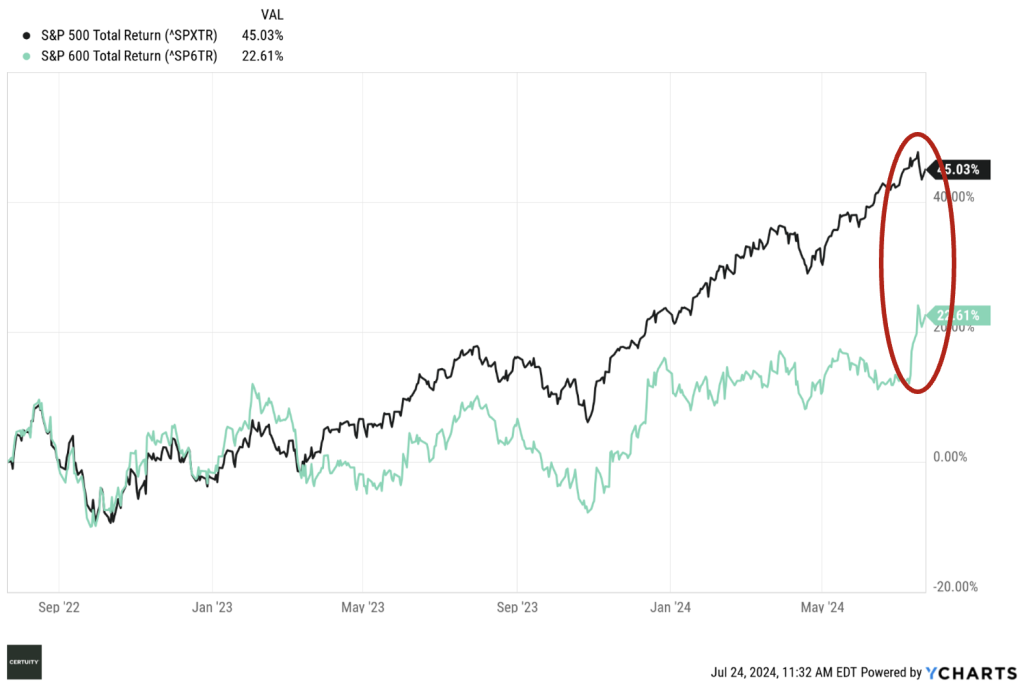

The next two charts illustrate the outperformance of larger cap versus smaller cap stocks. First up is simply the S&P 500 index vs. the S&P 600 index.

We are strong advocates for small cap stocks over longer time horizons, but “yikes” over the past two years. But that tide may have turned over the past month or so as small caps seem to be “re-rotating” back upward.

Small cap stocks tend to be more interest rate sensitive, so as market sentiment rotates toward Fed rate cuts, perhaps as soon as September, small caps have caught a tailwind.

We’re not so sure about the rate cuts, given this is a presidential election year, so anything done before the November election will be viewed (cynically) through a political lens, but that is what the market currently is pricing in.

Source: Ycharts, 2-year data through July 22, 2024. You cannot invest in an index and past performance is no guarantee of future results.

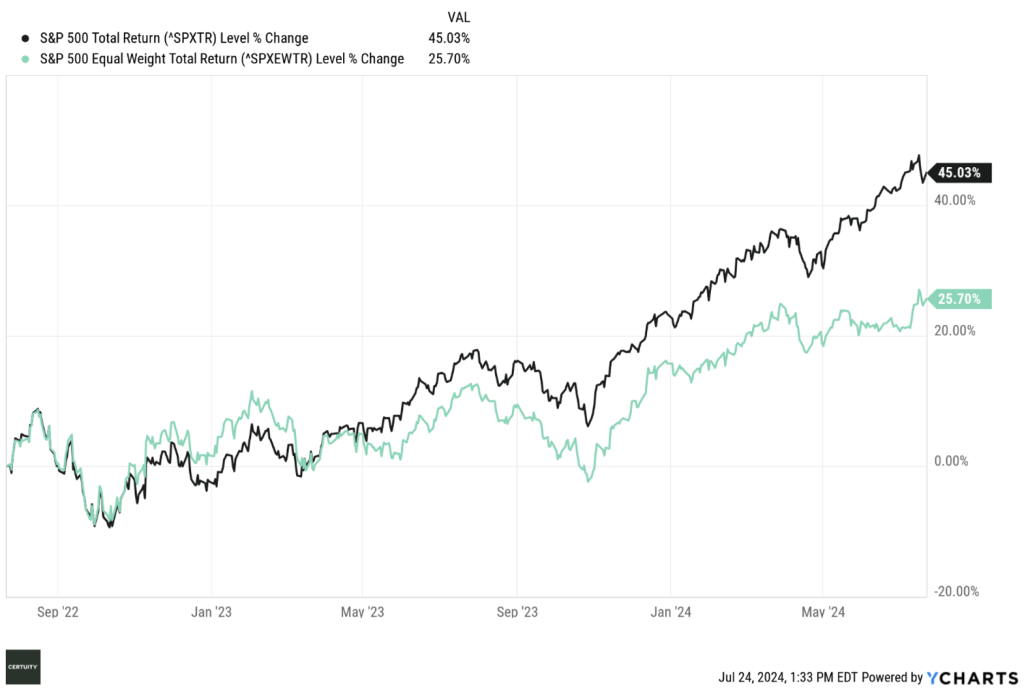

Next is the S&P 500 index vs. the Equal-Weighted S&P 500 index, which illustrates the performance difference between larger and smaller caps within the broader large cap asset class. This highlights the dominating performance of the mega-cap tech stocks over much of the past 2-3 years.

Source: Ycharts, 2-year data through July 22, 2024. You cannot invest in an index and past performance is no guarantee of future results.

Let’s go back to the quality factor, first within large cap stocks. We use 3-year data to capture the relative performance during the dismal calendar year of 2022.

Source: Ycharts, 3-year data through July 23, 2024. You cannot invest in an index and past performance is no guarantee of future results.

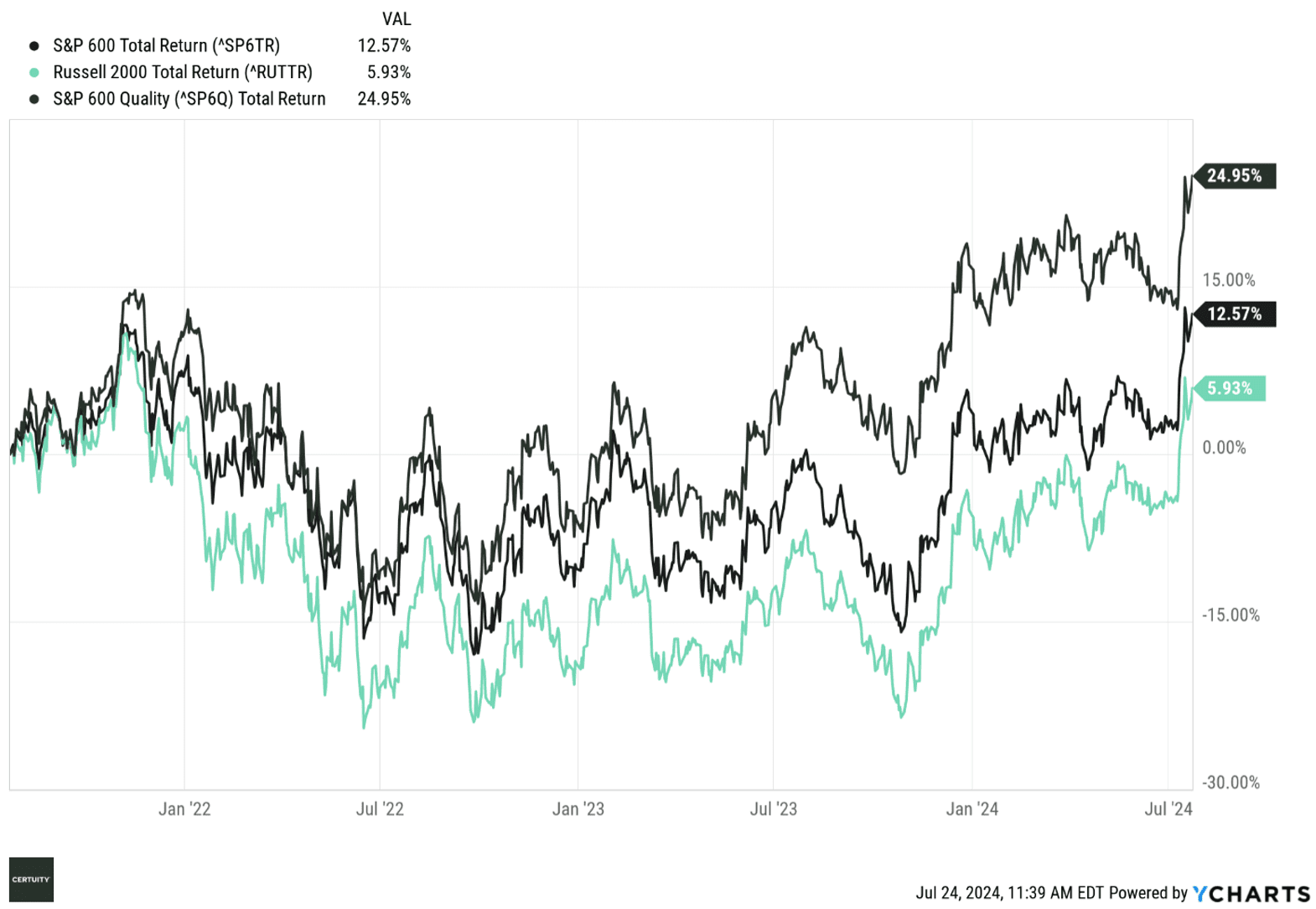

Now we look at SMID cap performances, and we illustrate the outperformance of the quality factor in two ways: (1) the performance of the S&P 600 index vs. the Russell 2000 index (the S&P 600 index is considered higher quality because it excludes a greater percentage of negative earning companies), and (2) the relative performances of the S&P 600 vs. the S&P 600 Quality indexes.

Source: Ycharts, 3-year data through July 23, 2024. You cannot invest in an index and past performance is no guarantee of future results.

All the above charts illustrate the cumulative performances of the different factors across the defined time horizons. We think it also useful to illustrate how the factors performed through time in terms of generating (or not) excess performance relative to a broader cap-weighted benchmark.

The following is a busy chart but focus on the black line – quality. You will see it is never the best but also neither the worst performing factor – it simply is the most consistent, which allows it to outperform cumulatively over time (remember the quote attributed to Albert Einstein – “compound interest in the most powerful force in the universe”).

Note as well the consistency of the “factor mix” performance (dark teal line) – which supports our argument for risk factor diversification.

Source: State Street Global Advisors “SPDR® ETF Chart Pack” and Bloomberg Finance, L.P., as of June 30, 2024. Past performance is not a reliable indicator of future performance. Min. Vol = MSCI USA Minimum Volatility Index | Value = MSCI USA Enhanced Value Index | Quality = MSCI USA Quality Index | Size = MSCI USA Equal Weighted Index | Dividend = MSCI USA High Dividend Yield Index | Momentum = MSCI USA Momentum Index | Factor Mix = MSCI USA Factor Mix A-Series Capped Index. Div. Grower = S&P High Yield Dividend Aristocrats Index. The indexes used above were compared to the MSCI USA Index. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable. All the index performance results referred to are provided exclusively for comparison purposes only. It should not be assumed that they represent the performance of any particular investment.

Summary and Interpretation

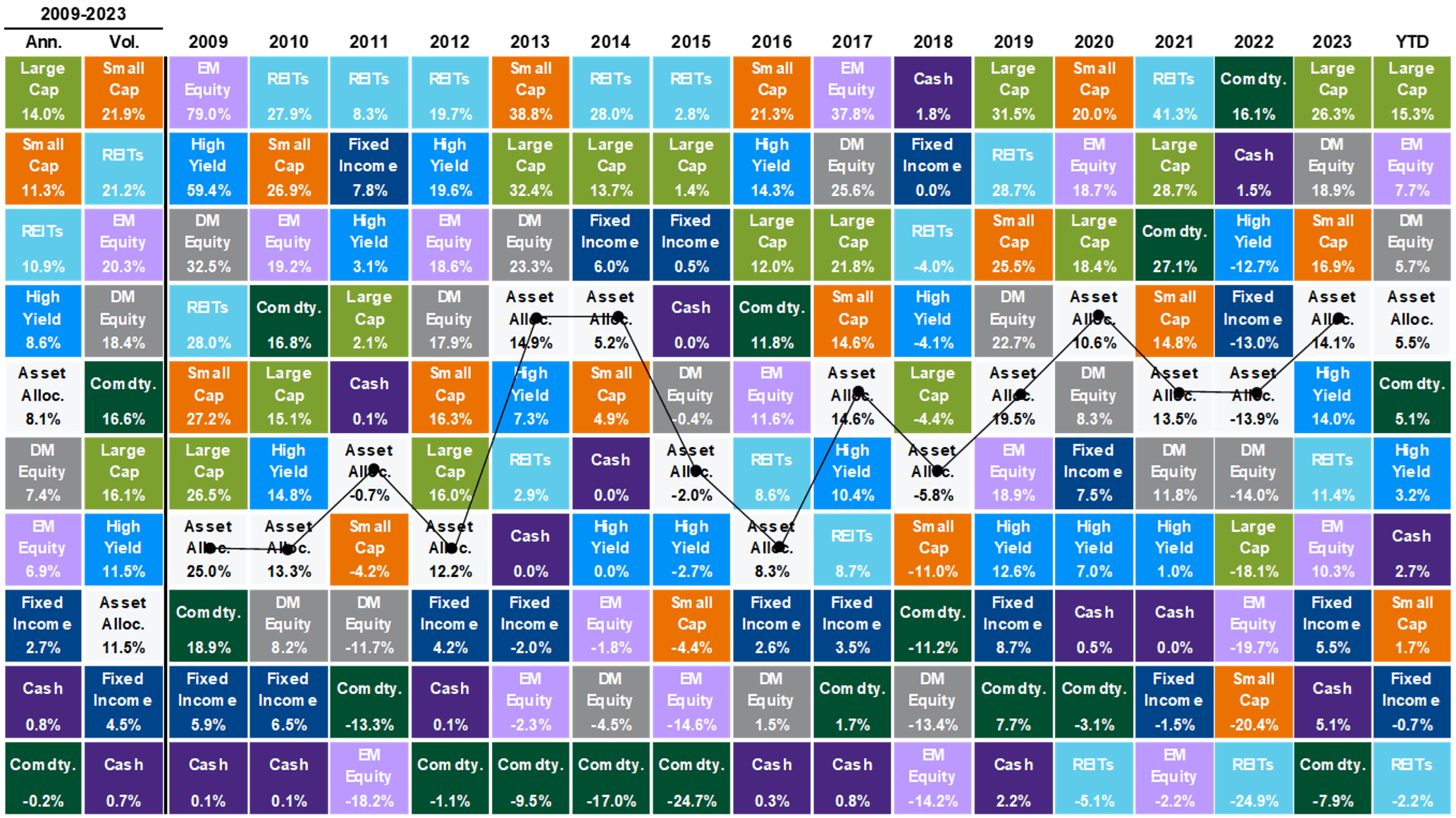

Let’s conclude by reminding ourselves of why asset class diversification is so important, using the well-known asset class “performance quilt”.

Source: Bloomberg, FactSet, MSCI, NAREIT, Russell, Standard & Poor’s, J.P. Morgan Asset Management. Large cap: S&P 500, Small cap: Russell 2000, EM Equity: MSCI EME, DM Equity: MSCI EAFE, Comdty: Bloomberg Commodity Index, High Yield: Bloomberg Global HY Index, Fixed Income: Bloomberg US Aggregate, REITs: NAREIT Equity REIT Index, Cash: Bloomberg 1-3m Treasury. The “Asset Allocation” portfolio assumes the following weights: 25% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI EAFE, 5% in the MSCI EME, 25% in the Bloomberg US Aggregate, 5% in the Bloomberg 1-3m Treasury, 5% in the Bloomberg Global High Yield Index, 5% in the Bloomberg Commodity Index and 5% in the NA REIT Equity REIT Index. Balanced portfolio assumes annual rebalancing. Annualized (Ann.) return and volatility (Vol.) represents period from 12/31/2009 to 12/31/2023. Please see disclosure page at end for index definitions. All data represent total return for stated period. The “Asset Allocation” portfolio is for illustrative purposes only. Past performance is not indicative of future returns. From the JP Morgan “Guide to the Markets” – U.S. Data are as of June 30, 2024.

As we saw in the above chart, risk factor performance rotates over time as well, and it is difficult to predict which factor will perform best at any given time.

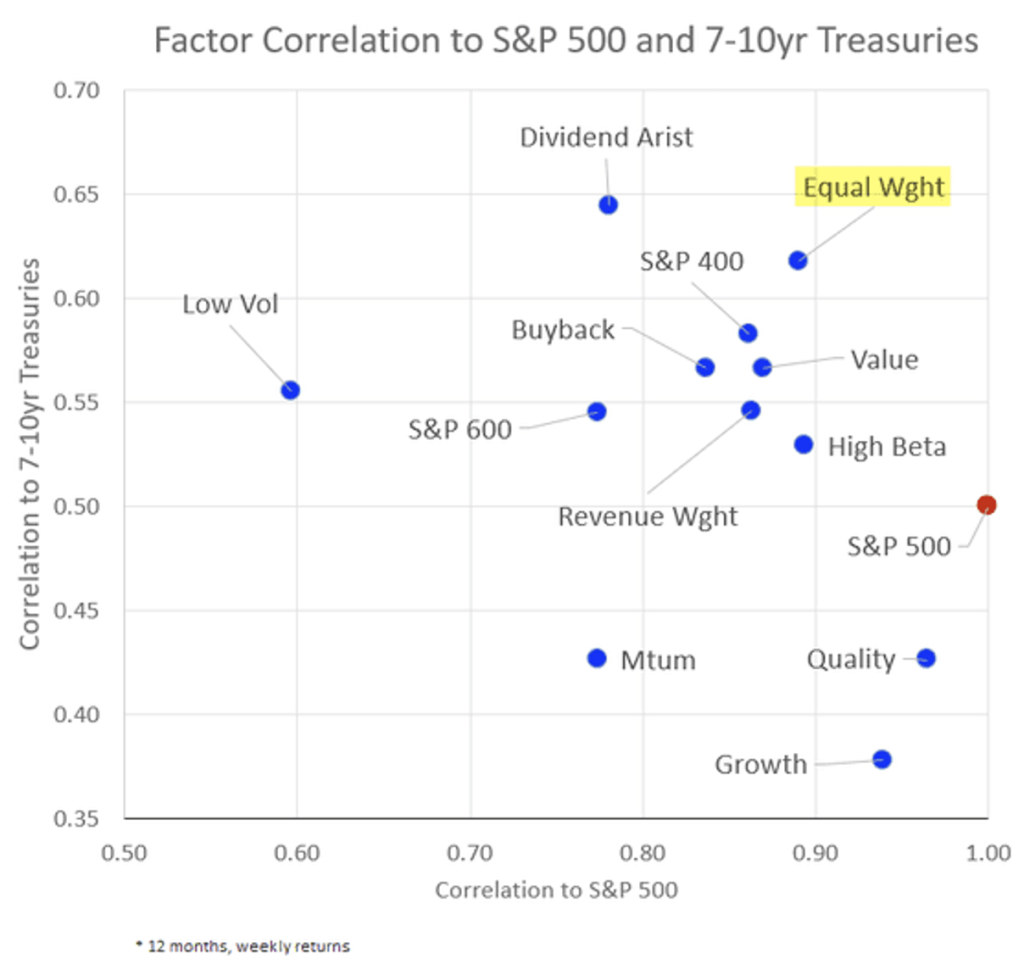

This final (and we think interesting, which is why we frequently find ourselves standing alone at cocktail parties) chart illustrates the correlation of different risk factors to the broad equity market and to interest rates. While all have a high-ish correlation to the equity market, we see we can pick up overall portfolio diversification by diversifying across factors.

Source: The Daily Shot, May 3, 2024. You cannot invest in an index and past performance is no guarantee of future results.

There may be signs that factor performance has begun to rotate again over the past month or so, especially re: small caps (we clearly are not there on value yet but think that day is coming) but quality maintains its consistent performance.

This is why we believe that in building portfolios diversified at the risk factor level, quality should be the “anchor” or core holding while building satellite factor exposure around it.

We will never apologize for being overweight quality in any portfolio we are asked to build or advise upon.