“Every picture tells a story, don’t it?”

(ROD STEWART, 1971)

“I just dropped in to see what condition my condition was in”

(KENNY ROGERS & THE FIRST EDITION, 1997)

By Scott Welch, CIMA®, Chief Investment Officer & Partner

Reviewed by Carter Mecham, CMA®, IACCP®

We don’t often write mid-quarter reviews, but April was a crazy month, so we thought it was appropriate to check in.

It remains too soon to know the long-term effects of Trump’s tariff policies, and, in any event, those policies change regularly. But what we do believe is that – even if he were to completely reverse course and drop the trade war rhetoric – which we do not expect him to do – the longer-term economic impact will remain uncertain for several months. Perhaps several years.

We have been consistently on the record stating we do not believe in tariffs as economic policy, so we are not changing our stripes here. We believe in free markets, free trade, and the free flow of capital. We are not naïve but that is where we will start any discussion on this issue.

But here we are. We still believe Trump’s desired tax and regulatory reforms can positively impact the economy and the markets, but those will take longer to play out because they require legislative approval from a Congress only narrowly controlled by the GOP, and several so-called conservatives are already arguing against cutting spending in a variety of areas or suggesting tax increases.

In some respects, at least by historical standards, we have returned to a more “normal” market regime, with increased volatility and a renewed focus on fundamentals versus a market driven primarily by sentiment and momentum.

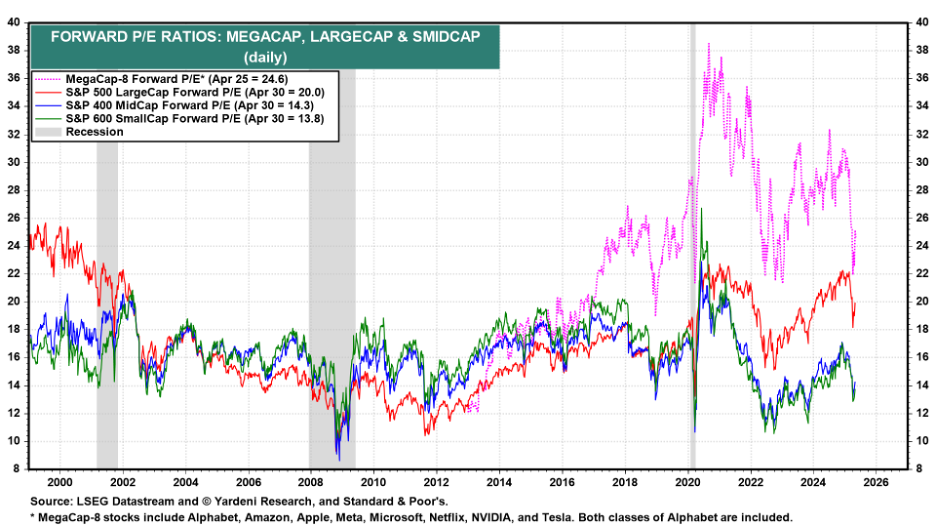

We believe we can see that reflected in the downturn in many of the mega-cap tech stocks over the past few months. They are quality companies but in our opinion were overvalued and due for correction.

So, let’s do a quick review of what we believe are the five primary economic and market signals that provide perspective on where we might go from here: GDP growth, earnings, interest rates, inflation, and central bank policy.

This is not to dismiss national, political, or geopolitical issues. But these are “known unknowns” – we are aware of them but have no way to forecast how they will turn out or what effects they will have (or not) on the economy and investment markets.

Spoiler alert: We believe the risk of recession has risen significantly, but don’t believe we are there quite yet. The Fed remains in a bit of a pickle: the economy is slowing and Trump is “jawboning” loudly for lower rates (though he walked back his recent trashing of Jerome Powell after the market let him know clearly it did not agree with him), but the two primary Fed mandates – optimizing inflation and employment – do not justify (yet) an aggressive rate cut regime. The market disagrees and is pricing in several rate cuts over the next 9-12 months. We’ll see.

As we write this, the Q1 2025 earnings season is in full swing and so far, the numbers are solid – earnings on the reported companies are up roughly 14% year-over-year and roughly 60-70% of companies have beaten both their revenue and earnings estimates. All in line with historical averages.

Public market credit spreads have stabilized but continue to widen, and we still prefer private credit for investors seeking to enhance yield.

When we think about “who might benefit” from the current uncertainty, we like the outlook for residential real estate (and the accompanying trade services that surround that market) and energy production and transmission. We also continue to like sports investing as a potential source of lower-correlated returns.

Finally, after years “in the wilderness,” we think multi-strategy hedge funds may be poised for a comeback as investors seek more diversification within their portfolios.

Let’s dive in.

GDP, Inflation and Central Bank Policy

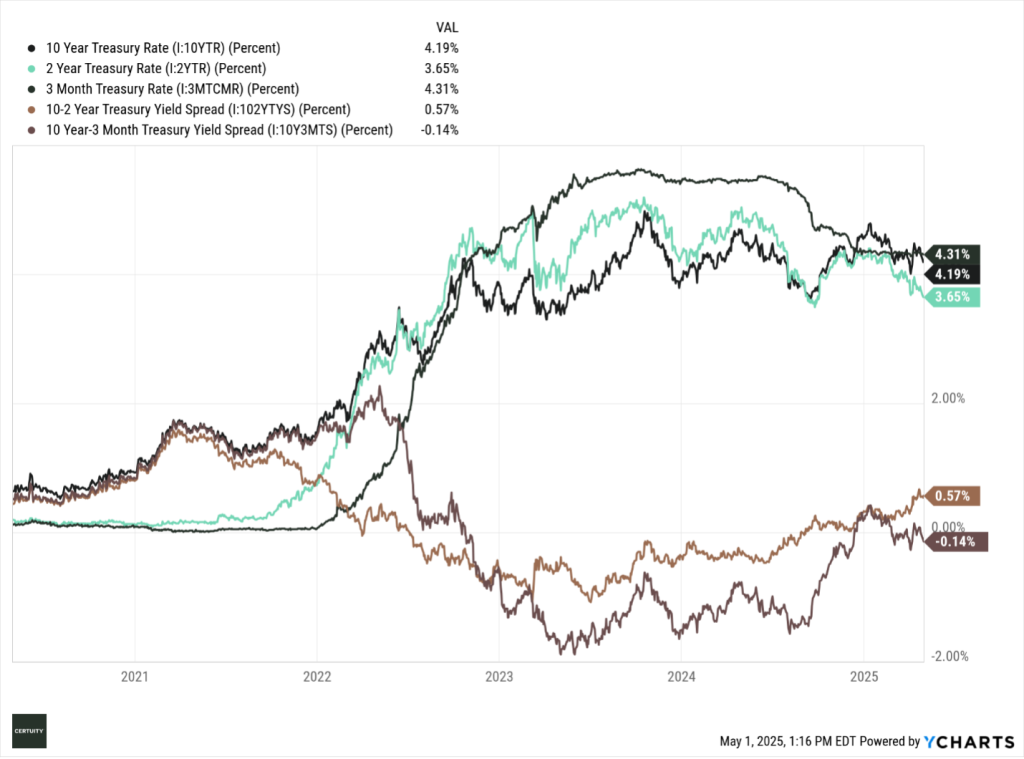

Let’s start with the yield curve (i.e., interest rates), specifically two closely watched “spreads”: the 10-year / 2-year spread (10s/2s) and the 10-year / 3-month spread (10Y/3M) spread.

The yield curve, as measured by the 10s/2s remains slightly positive and upward sloping – that is, “normal”. The flight to quality back in March and April briefly drove down the 10-year rate to below 4% (it has since returned to roughly 4.3%), but we do not expect it to remain that low for an extended period of time unless the tariff-driven “trade wars” accelerate and foreign investors continue to question the US dollar as the world’s reserve currency.

We think those concerns are overblown but that is where we are for now.

The 10Y/3M spread inverted again 6-8 weeks ago, and we are paying attention to that – historically, a continued inversion of this spread has been a harbinger of an eventual recession.

Source: Ycharts, 5-year data through April 30, 2024. You cannot invest in an index and past performance is no guarantee of future results.

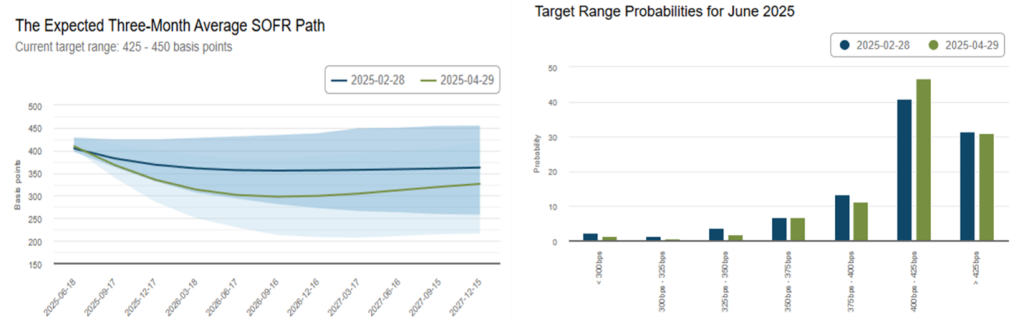

The Fed continues to lay the groundwork for a June cut of 25 bps, but uncertainty remains. President Trump came out strongly against the Fed, arguing it was “too slow and too late” in cutting rates.

But Fed Chair Powell came back equally as strong – and the markets agreed with him. Trump toned down his anti-Powell rhetoric in just a few days, and the market bounced back accordingly.

Regardless, the market has changed its tune on rate cuts and is now pricing in up to 100 bps of cuts over the next 9-12 months.

Source: The Atlanta Fed “Market Probability Tracker,” as of April 29, 2025. These are forecasts and therefore subject to change.

The challenge facing the Fed is that neither inflation nor the labor market are (yet) signaling the need for any dramatic reductions in rates. We think that may change over the next 2-3 months as the impact of the “trade wars” starts to filter through the hard economic numbers, but we do not see it yet in the numbers we have available.

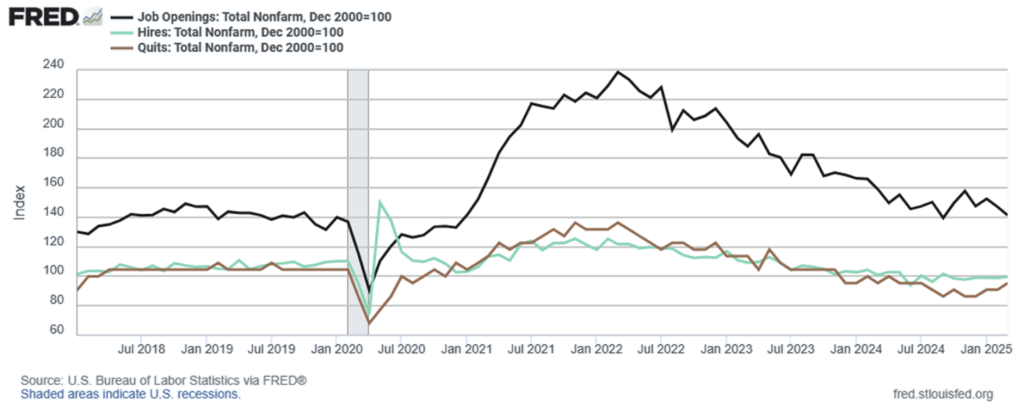

Unemployment remains below 5% – historically, the level many economists considered “full employment” for the US economy. That said, job openings are trending downward, as are the “hires” and “quits” rates. We follow the quits rate closely because it is an indicator of employee confidence in changing jobs.

Source: St. Louis Fed (FRED), data through March 2025.

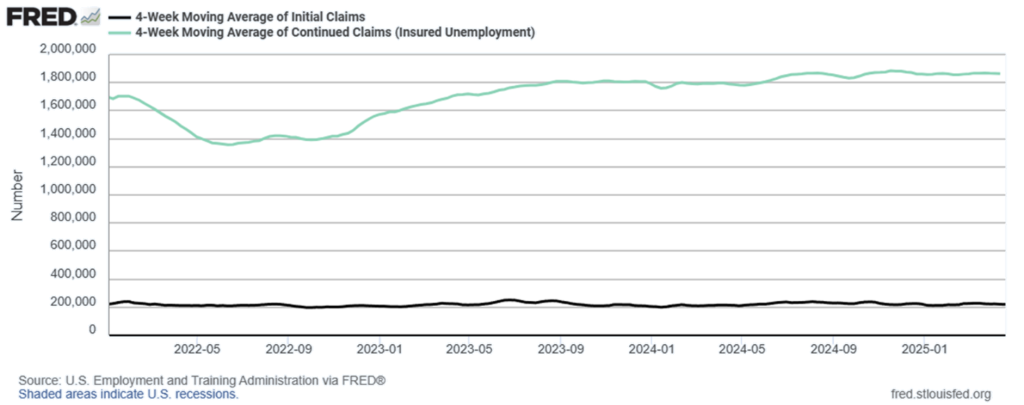

The most contemporaneous metrics we have regarding employment are jobless claims (initial and continuing), which come out weekly. So, it is probably here we will first see the impact of the current economic uncertainty.

We see a slight trend upward in “continuing” jobless claims, but “initial” claims (workers filing for unemployment benefits for the first time) have proven to be remarkably resilient since Covid ended.

We use the 4-week moving averages of these numbers to smooth out the weekly volatility. We expect to see these numbers increase over the next 3-6 months.

Source: St. Louis Fed (FRED), data through April 19, 2025.

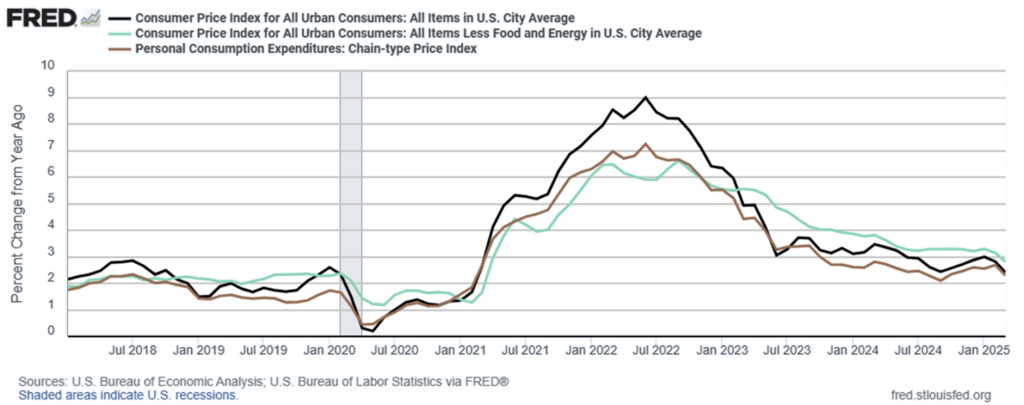

Inflation continues to trend in the right direction (though it remains above the Fed’s annualized target rate of 2%) but, again, we don’t have current data that price in the ongoing tariff negotiations.

Fed Chair Powell has suggested we will see increased inflation as a result of the tariff uncertainty – one of the reasons Trump spoke out against him. But until we have greater clarity, it will be difficult for the Fed to be overly aggressive in cutting rates.

Source: St. Louis Fed (FRED), data through March 2025.

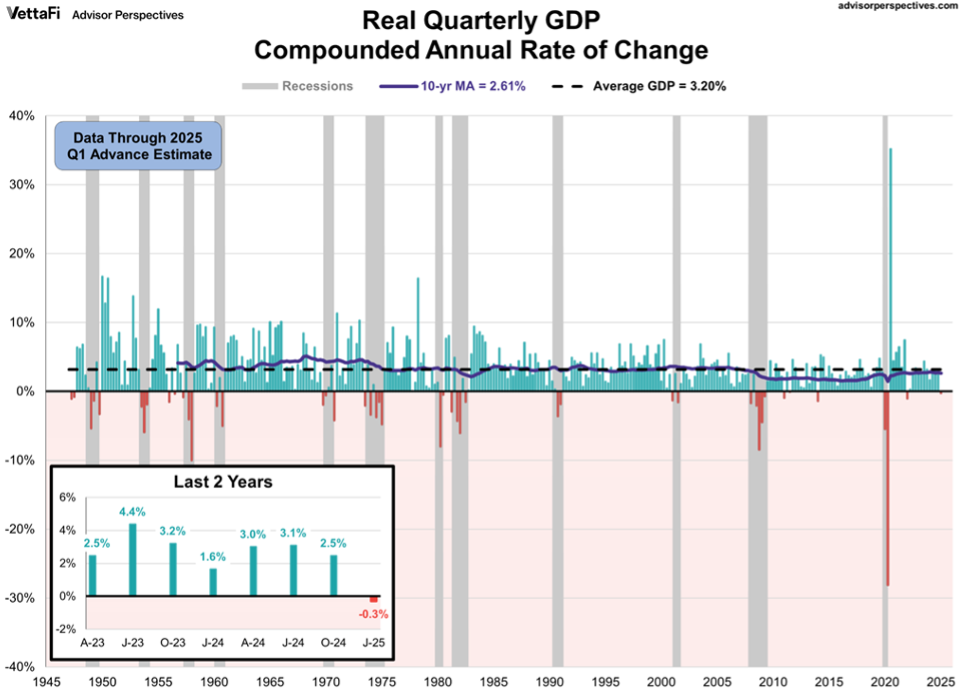

The first official estimate for Q1 GDP was a negative 0.3%, down from a positive 2.5% in Q4 of 2024. Most of the drag was from a dramatic increase in imports (which reduce the US GDP measurements) as manufacturers and service vendors tried to get ahead of anticipated tariff increases.

When viewed in that context, things were not as bad as might have been expected.

Source: VettaFi and Advisor Perspectives, as of April 30, 2025.

Earnings and Valuations

As mentioned previously, we are slightly more than halfway through the Q1 earnings season, and the results so far are solid.

We suspect analysts, while of course they care about the Q1 numbers, will be equally as interested in hearing what CEOs and CFOs have to say about future capital expenditures and hiring plans in the wake of the current trade uncertainties.

Source: Zacks Investment Research, as of April 30, 2025. Green bars are earnings and orange bars are revenues. Solid bars are actual results, while hatched bars are estimates and, therefore, subject to change.

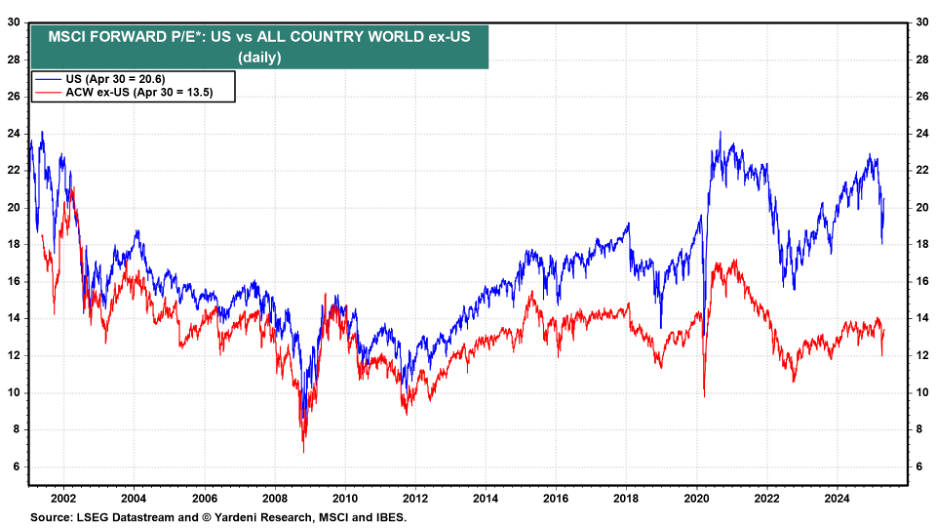

Despite the sell-off in US stocks, global valuations are still more attractive outside the US (though the S&P 500 index valuation remains skewed upward by the mega-cap tech stocks), but the global equity rally over most of the past 12-18 months has resulted in few, if any, “screaming buys” across the equity spectrum.

Source: Eaton Vance and FactSet as of 3/31/25. NTM P/E is market price per share divided by expected earnings per share over the next twelve months. Forecasts/estimates are based on current market conditions, subject to change. You cannot invest in an index and past performance is no guarantee of future results.

Within the US, and despite the recent downdraft in the mega-cap tech stocks, there remains a significant valuation dispersion between these stocks and broader large cap, mid cap, and small cap stocks. We see a similar dispersion between large cap growth and value stocks. And the valuation difference between US and non-US stocks remains as wide as it has been in more than 20 years.

Even though we like US small cap stocks from a strategic perspective, we believe it may be too early to recommend rotating back into them for now – there is too much uncertainty regarding future economic activity and interest rates.

But patient and fundamentally driven investors should consider re-allocating back into US large cap value and developed international stocks as they position their portfolios for longer-term time horizons. We believe fundamentals are coming back into “style.”

Source for all three previous charts: Yardeni Research, through April 2025. You cannot invest in an index and past performance is no guarantee of future results.

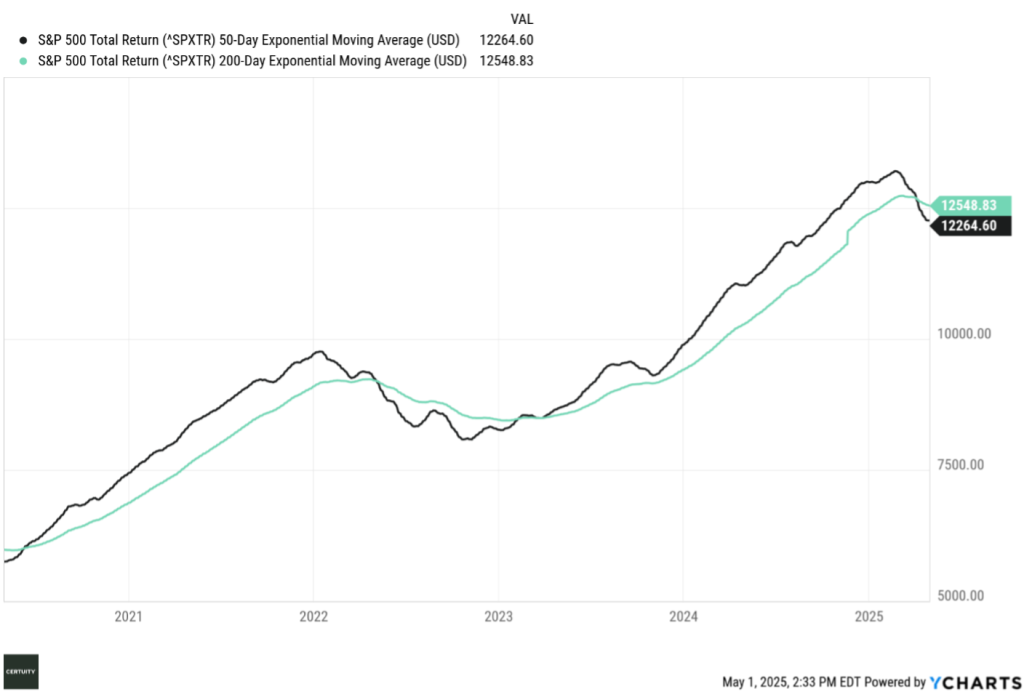

Market momentum (as measured by the 50-day/200-day moving averages) remains in negative territory – investors are not happy.

Source: Ycharts, 5-year data through April 30, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Interest Rates and Spreads

Let’s visit credit spreads next.

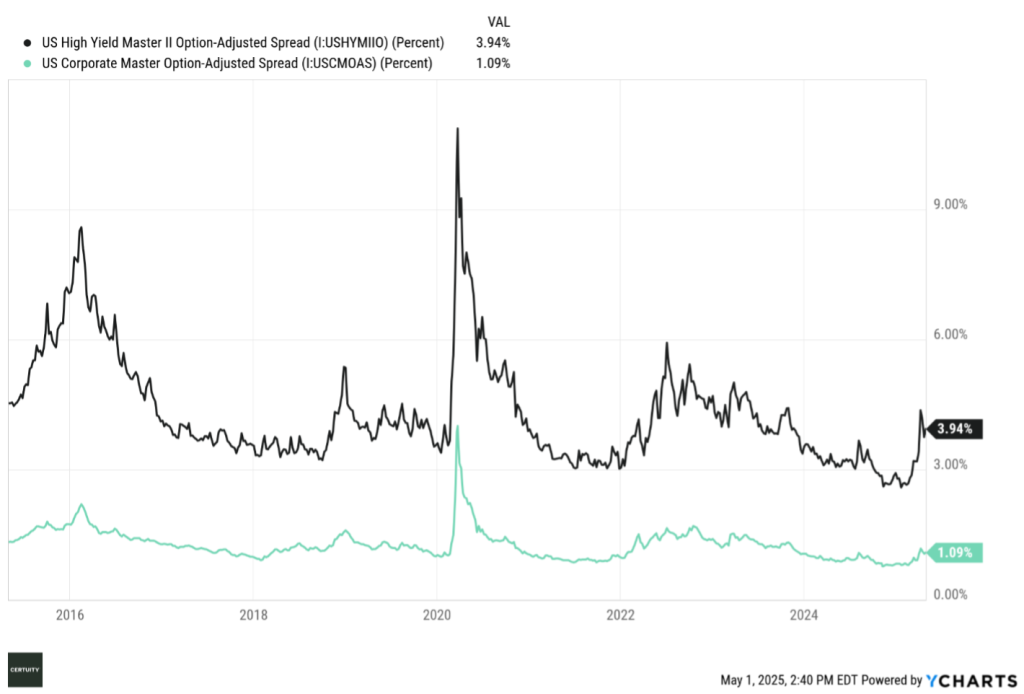

As we anticipated, spreads widened recently (especially in high yield) but remain low by historical standards and seem to be stabilizing. Corporate balance sheets remain (generally) in solid shape, though there are signs of increased delinquency and default rates.

We continue to hold modest expectations for the total return potential of public bonds and prefer private credit for investors who can access it and are seeking enhanced yields.

Given the shape of the yield curve, investors are still not being appropriately compensated for taking excessive duration (interest rate) risk – the yield on 2-year Treasuries is only 55-60 bps less than the 10-year yield.

We continue to recommend balancing fixed income exposures between the two in a “barbell” approach as a means of generating acceptable levels of yield while controlling duration risk.

Source: Ycharts, 10-year data through April 30, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Summary and Interpretation

When focusing on what we believe are the primary economic and market signals, the “condition our condition is in” is uncertain and volatile, driven by uncertainty over tariff policies, unclear economic growth, future Fed policy, success (or not) in implementing tax and regulatory reform, and continuing geopolitical tensions.

To summarize our investment views for the remainder of 2025:

- We believe global equity markets will continue to be volatile until we have greater clarity on tariffs and economic growth. But we do not believe this volatility will last forever. At some point market fundamentals (rather than sentiment and momentum) will matter again, and we may actually see interesting buying opportunities over the next several months and potentially through the remainder of 2025. But we need clarity first.

- We still believe in staying fully invested. We read recently of a major market “pundit” who recommended going to a 95% cash position. We do not agree, primarily because it is incredibly difficult to time when to get back into the markets, not to mention the friction resulting from fees and taxes along the way.

- As we learned during the Great Financial Crisis, no matter how uncertain things may look at a given time, there is always something to buy. We maintain our conviction in global diversification, the use of both passive and active strategies to optimize fees, taxes, and performance, and the prudent use of alternative and private market investments.

- Investors seeking higher yields should consider the private credit market versus bank loans or public high yield bonds.

- Fundamental and strategic asset class rotation investors should look at the relative value attractiveness of US value and non-US allocations. We are bullish longer-term on smaller cap stocks but think it may be too early to make that trade just yet.

- Active management and intelligent risk factor tilts should be rewarded versus passive management as we move through 2025.

- Specific private equity segments – secondaries, energy production and infrastructure, residential real estate, venture capital, and sports investing – seem to be offering interesting opportunities.

- We have an active search on for multi-strategy hedge fund solutions, as we believe the current market regime is favorable for lower correlated and more diversifying strategies.

- As always with alternative and private market investments, manager selection is critical to longer-term success.

As philosophically strategic investors, we continue to recommend focusing on a longer-term time horizon and the construction of “all-weather” portfolios, diversified at both the asset class and risk factor levels.

Now is the time for patience, discipline, and a focus on longer-term investment objectives. Don’t listen to the noise – pay attention to the signals.

We hope you find this helpful and, as always, we welcome your feedback and questions.