“Every picture tells a story, don’t it?”

(ROD STEWART, 1971)

“I just dropped in to see what condition my condition was in”

(KENNY ROGERS & THE FIRST EDITION, 1997)

By Scott Welch, CIMA®, Chief Investment Officer & Partner

Reviewed by Carter Mecham, CMA®, IACCP®

When reviewing the current state of the global economy and investment markets, we recommend focusing on market signals and weeding out market noise. We believe the five primary economic and market signals that provide perspective on where we go from here are GDP growth, earnings, interest rates, inflation, and central bank policy.

This is not to dismiss national and geopolitical issues. But these are “known unknowns” – we are aware of them but have no way to forecast how they will turn out or what effects they will have (or not) on the economy or investment markets.

As we write this, these “known unknowns” include (1) The incoming Administration’s and Congressional success (or not) at implementing Trump’s stated agenda of higher tariffs combined with lower regulatory and tax burdens; (2) the ongoing wars in Ukraine and Israel; (3) the insurrection in Syria; (4) continued tensions between the US and Iran (and its proxies in the Middle East – which seemingly have been badly weakened); and (4) continued tensions on multiple fronts between the US and China and Russia.

Spoiler alert: We believe the risk of recession, while still there, seems to have fallen, as the economy continues to show its resilience. By the time this blog is posted, we believe the Fed will have cut rates by another 25 bps, but we also believe it will then embark on a “cut and pause” approach, as the current economic, inflation, and labor markets simply do not support a continued aggressive rate cut regime. The market currently is not pricing in another rate cut until March.

As we write this, the Q4 earnings season is expected to show continued growth in both revenues and earnings, though at a slower pace than we witnessed in Q3. Valuations remain elevated, however, and investors should not expect the same level of market returns in 2025 we experienced in 2024.

We see renewed interest in the public bond markets as rates have risen, but credit spreads remain tight and, if we are correct in our view that the pressure at the long end of the yield curve is upward, not downward, total return potential is limited.

There continues to be high investor demand for private market investments, both through traditional drawdown and “evergreen” facilities. We are active in both private equity and private credit, we have made interesting investments in the sports sector and have ongoing searches for real estate and energy-oriented infrastructure.

Let’s dive in.

GDP, Inflation and Central Bank Policy

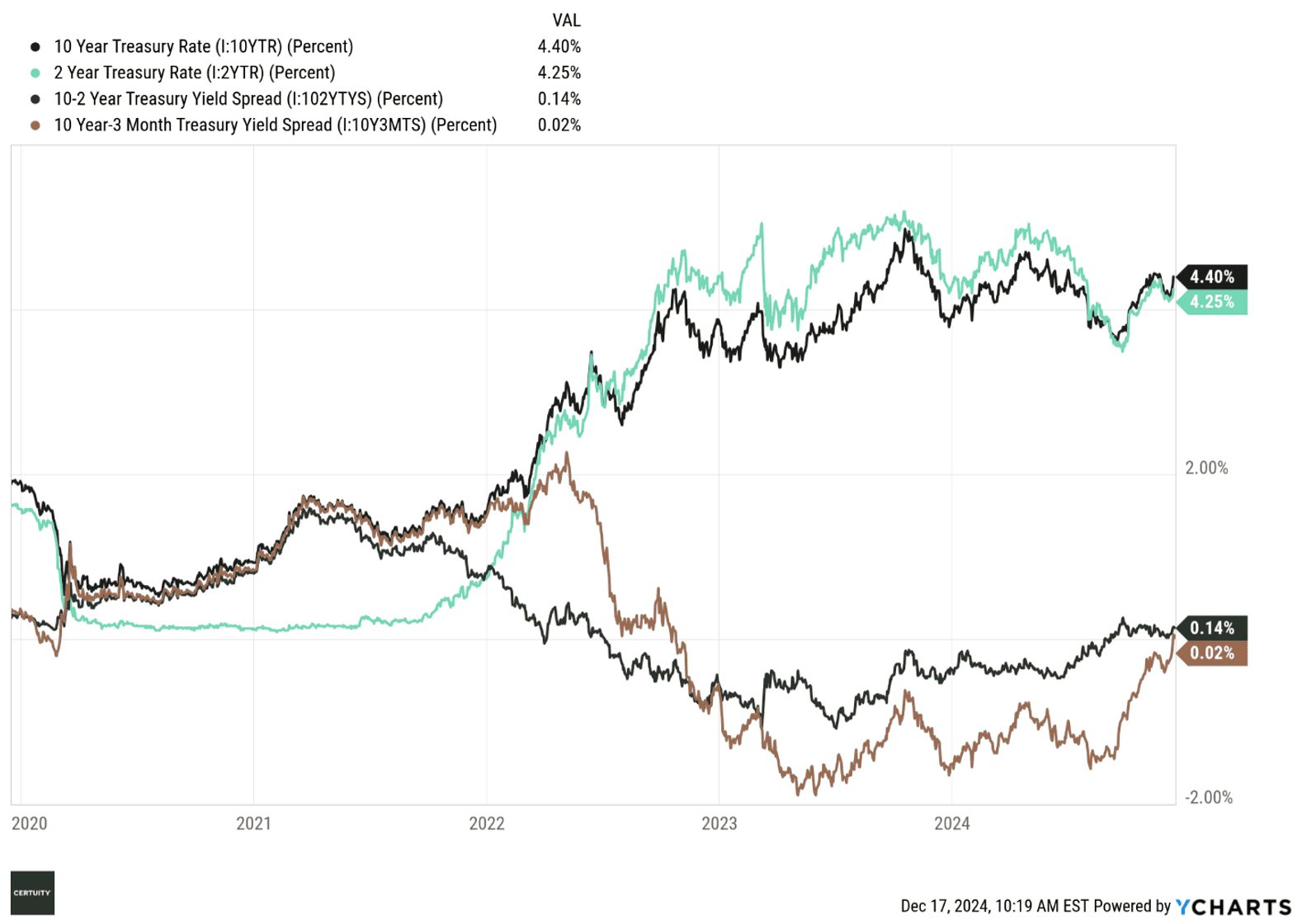

Let’s start with the yield curve (i.e., interest rates), specifically two closely watched “spreads”: the 2-year / 10-year (2s/10s) and the 3-Month / 10-Year (3m/10s).

The yield curve, as measured by the 2s/10s, remains slightly positive, that is, a “normal” upward sloping curve. We expect this to remain the case as the Fed cuts rates and the short end of the curve falls more than the long end.

Over the past few days, the 3m/10s also “un-inverted” for the first time since October of 2022.

Source: Ycharts, 5-year data through December 16, 2024. You cannot invest in an index and past performance is no guarantee of future results.

After an unexpected (at least to us) 50 bps rate cut in September, the Fed followed suit and cut again by 25 bps in November. The market is pricing in with near certainty another 25-bps cut this week, but then believes the Fed will take a “cut and pause” approach in order to more closely follow the data.

In our opinion, this was somewhat inevitable. We did not believe the Fed needed to cut rates at all in September, and the current state of the economic, employment, and labor markets simply do not justify a continued aggressive rate cut regime. That can change, of course, but for now that seems to be the path.

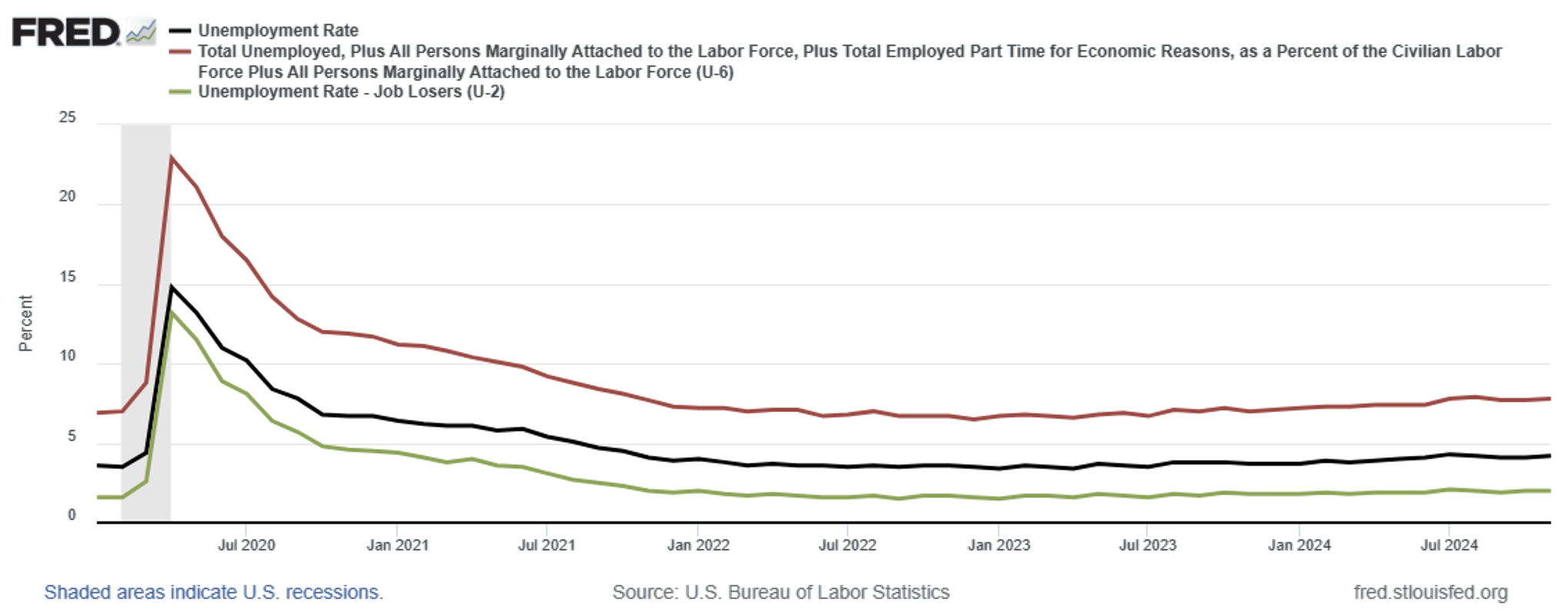

As an example, let’s examine the labor market. Unemployment remains below 5% – historically, the level many economists considered “full employment” for the US economy.

Source: St. Louis Fed (FRED), data through November 2024.

Inflation is trending in the right direction, though it remains above the Fed’s target rate of 2% annualized.

It seems the Fed has backed away from its aggressive rate cutting regime, but the risk remains it will “overplay its hand” and reignite inflation. From our perspective, we are glad the Fed seems to be taking a more cautious path forward.

Source: St. Louis Fed (FRED), data through November 2024.

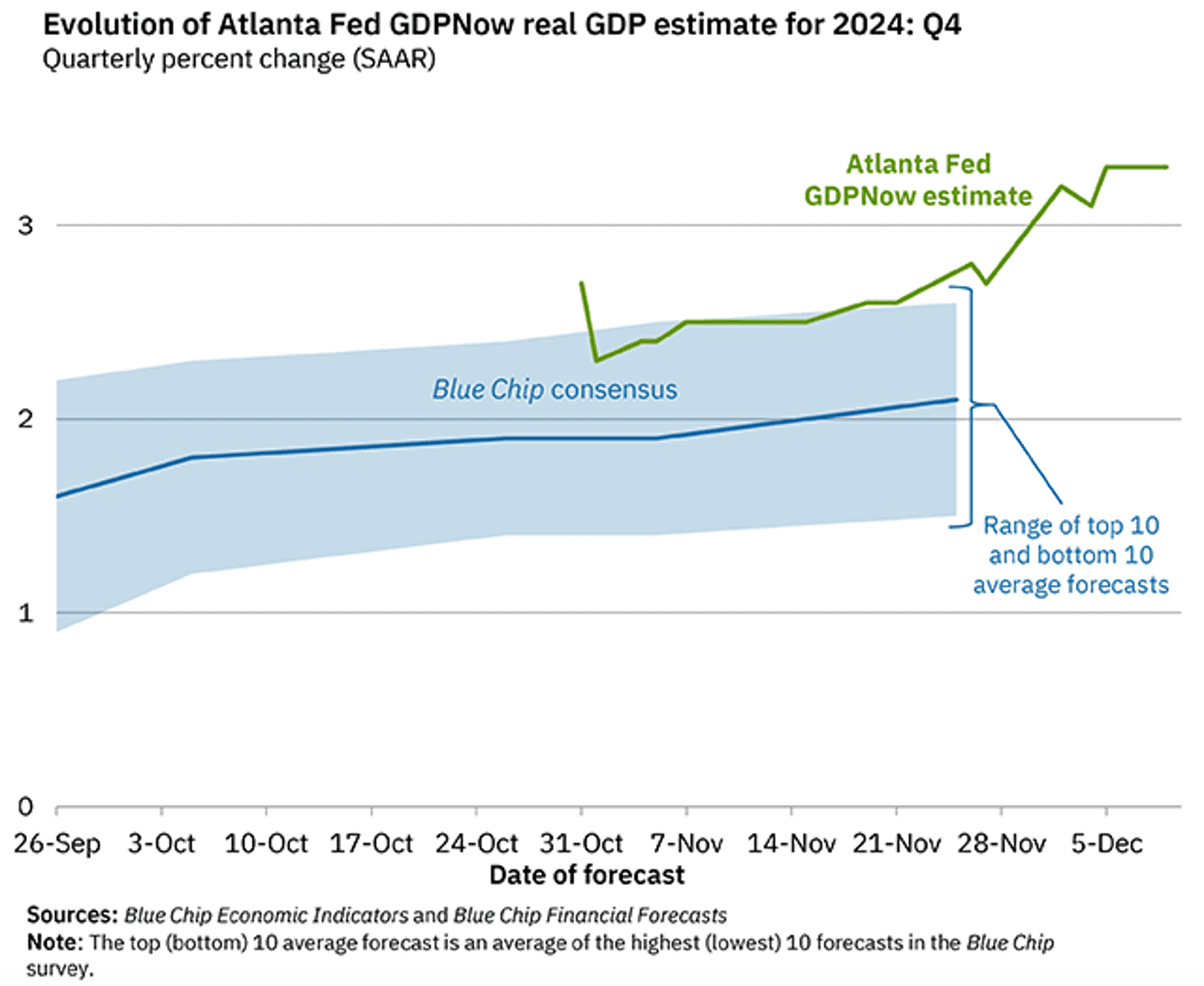

The current consensus estimate for Q4 GDP growth is plus or minus 3% – not booming but still positive. The economy may be cooling but it is still expansionary.

Source: The Atlanta Fed “GDPNow” forecast, as of December 9, 2024. There is no guarantee that any projection, forecast, or opinion will be realized. Actual results may vary.

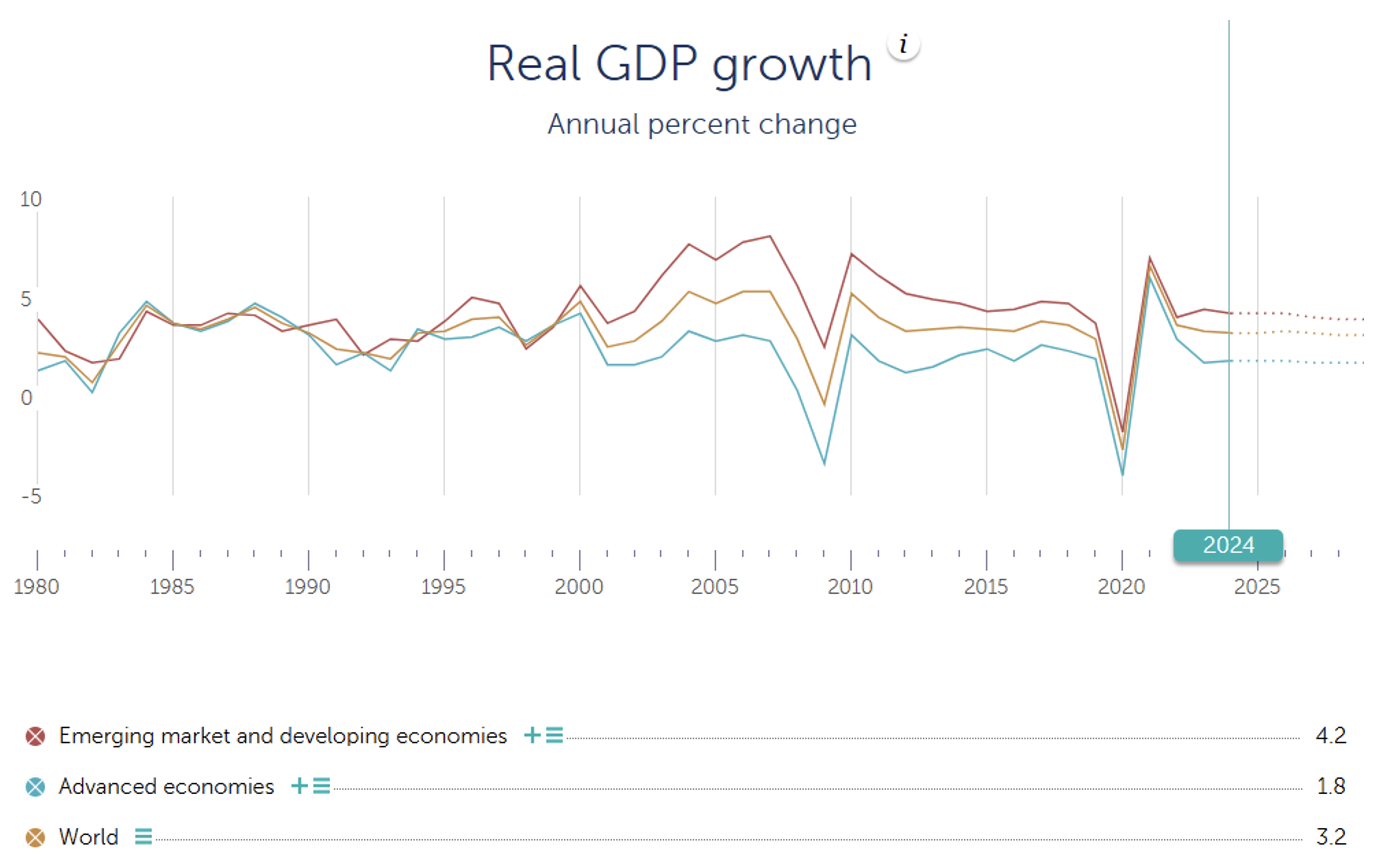

Estimates for economic growth outside the U.S. are also muted but positive, and roughly in line with historical averages.

Source: International Monetary Fund “World Economic Outlook,” October 2024. There is no guarantee that any projection, forecast, or opinion will be realized. Actual results may vary.

Earnings and Valuations

The Q3 earnings season was solid, which was reflected in the continuing market rally. The Q4 earnings season won’t begin until mid-January of next year. But, as we write this, the consensus estimates are for continued growth in both revenues and earnings, albeit at a slower rate than in Q3, followed by an acceleration throughout the remainder of 2025.

Source: Zacks Investment Research, as of December 4, 2024. Green bars are earnings and orange bars are revenues. Solid bars are actual results, while hatched bars are estimates and, therefore, subject to change.

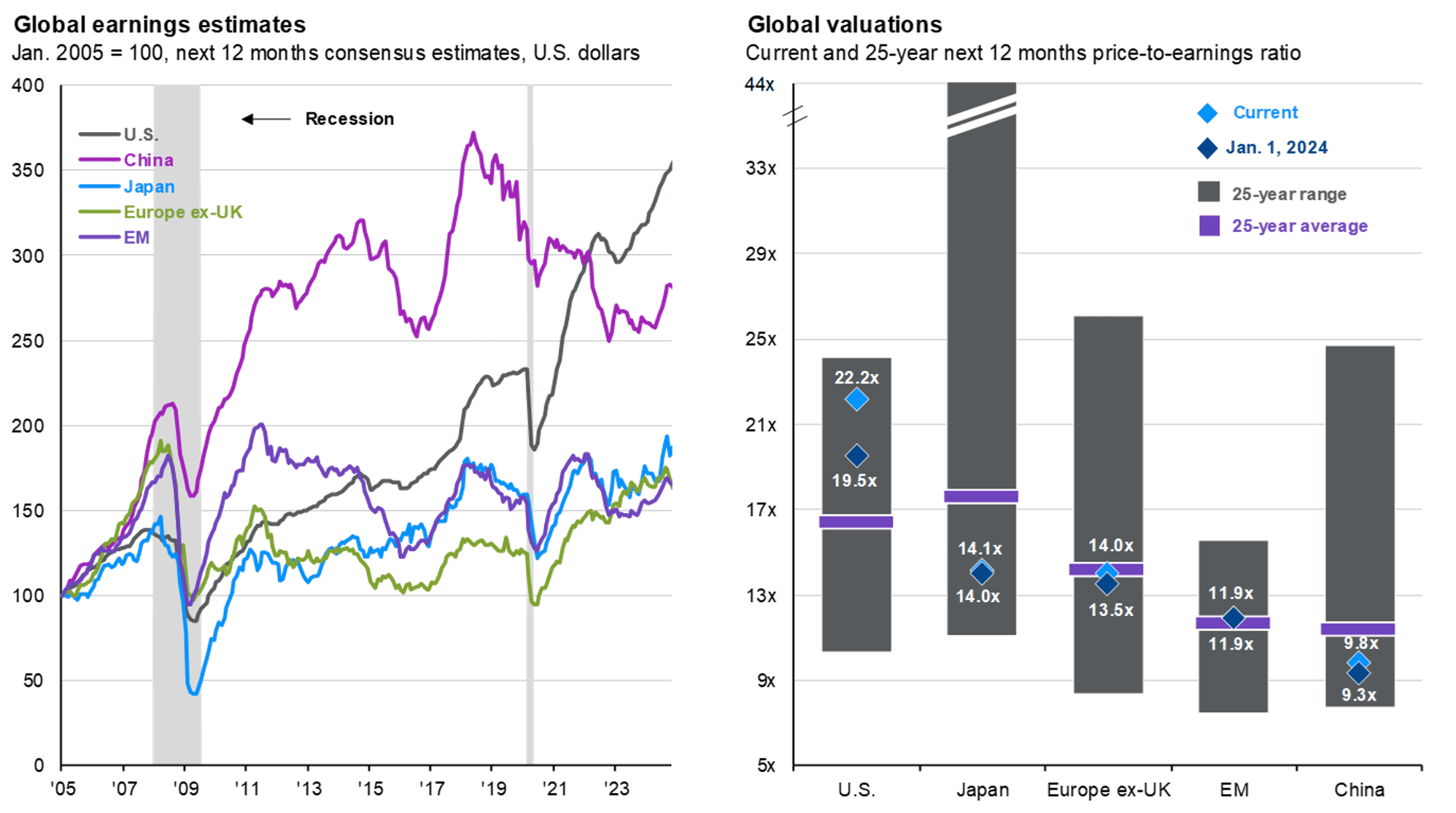

Outside the US, earnings growth estimates are muted but positive, even in China, which remains mired in a sluggish economic environment despite an aggressive series of both fiscal and monetary stimulus programs.

Global valuations are more attractive outside the US (though the S&P 500 index valuation is skewed upward by the mega-cap tech stocks), but the global equity rally of the past 12-18 months has resulted in few, if any, “screaming buys” across the equity spectrum.

Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Next 12 months consensus estimates are based on pro-forma earnings and are in U.S. dollars. Past performance is not a reliable indicator of current and future results. (Right) The purple lines for EM and China show 20-year averages due to a lack of available data. Guide to the Markets – U.S. Data are as of November 30, 2024.

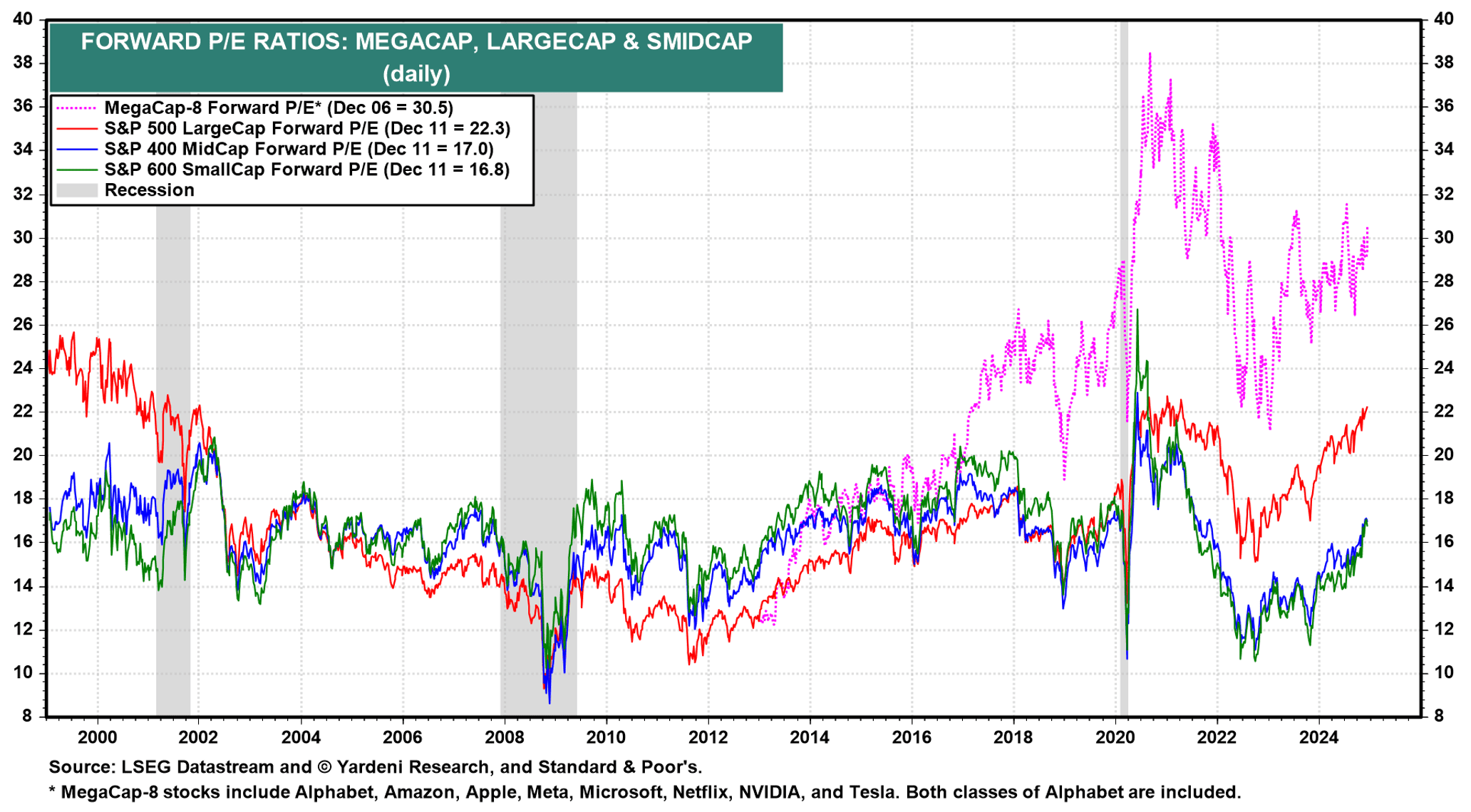

Within the US, there remains a significant valuation dispersion between the mega-cap tech, broader large cap, mid cap, and small cap stocks. We see a similar dispersion between large cap growth and value stocks. And the valuation difference between US and non-US stocks is as wide as it has been in more than 20 years.

Patient and fundamentally driven investors should consider this as they position their portfolios for longer-term time horizons.

Source for both charts, Yardeni Research, through December 11, 2024. You cannot invest in an index and past performance is no guarantee of future results.

Interest Rates and Spreads

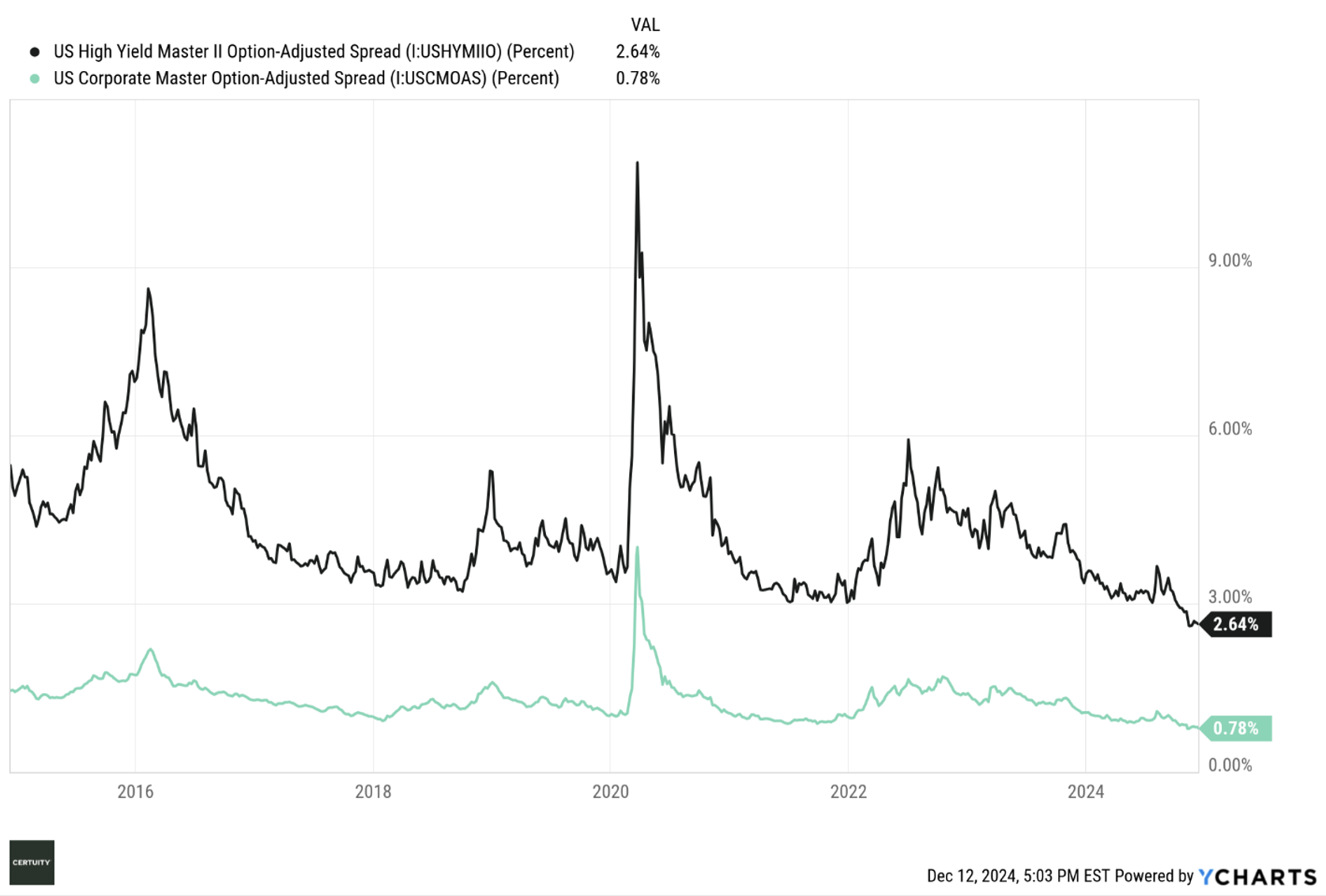

We discussed the level and shape of the curve above, but what about credit spreads?

Spreads are trading at the bottom end of their 10-year historical levels, driven partially by heavy flows out of money market funds and into investment grade and high yield bonds. Corporate balance sheets generally are in solid shape (though there are signs of increased delinquency and default rates).

Given what we believe is greater upward than downward pressure on rates, combined with the tightness of spreads (where the risk is definitely upward from current levels), we continue to hold modest expectations for the total return potential of public bonds.

Given the shape of the yield curve, investors are still not being appropriately compensated for taking excessive duration (interest rate) risk – the yield on short-term bonds is still roughly the same as longer term bonds (though that will change if the Fed continues to cut rates).

We continue to recommend balancing fixed income exposures between the two in a “barbell” approach as a means of generating acceptable levels of yield while controlling duration risk.

Source: Ycharts, data through December 11, 2024. You cannot invest in an index and past performance is no guarantee of future results.

Summary and Interpretation

When focusing on what we believe are the primary economic and market signals, the “condition our condition is in” is “resilient.” Our economy and labor markets are holding up and inflation, while “sticky,” is moving in the right direction. At this point, the primary uncertainties seem to be the success (or not) of incoming President Trump and his majorities in both the House and Senate in enacting his economic policies. If he is successful, it will likely spur economic growth but carries the risk of heating up inflation.

Global geopolitical issues abound and remain a primary “known unknown.”

To summarize our investment views as we head into 2025:

- We believe the equity market can continue to rally from current levels, but not at the rate it has over the past 12-18 months. Valuations are simply too high. At some point the market adage is true – how much you can earn on any investment is at least partially a function of what you pay for it today. We believe we will begin to see this phenomenon play out as we move through 2025.

- There is income available in fixed income, but the total return potential is muted. We continue to favor balancing short-term and longer-term allocations to manage duration risk without sacrificing yield. We much prefer investment grade versus high yield bonds at this point in the economic cycle. Investors seeking higher yields should consider the private credit market versus public high yield bonds.

- Fundamental and strategic asset class rotation investors should look at the relative value attractiveness of US value and small cap stocks, as well as non-US allocations (ex-China).

- Active management and intelligent risk factor tilts should be rewarded versus passive management.

- We continue to like the private credit markets for those investors who can access them.

- Specific private equity segments – specifically VC, sports, secondaries, and direct investments – may offer better potential relative value. After being beaten down for much of the past 3-4 years, there appears to be some relative value in opportunistic and distressed real estate. Given the exponential growth in demand for energy from artificial intelligence and data centers, there may be interesting infrastructure opportunities in the energy generation and transmission spaces.

- As always with private market investments, manager selection is critical to longer-term success.

As philosophically strategic investors, we continue to recommend focusing on a longer-term time horizon and the construction of “all-weather” portfolios, diversified at both the asset class and risk factor levels.

Enjoy the holiday season, and we look forward to supporting and advising you as we move through 2025.