By Scott Welch, CIMA®, Chief Investment Officer & Partner

Reviewed by Carter Mecham, CMA®, IACCP®

Global growth is slowing and recession risks in the U.S. are rising, with ongoing geopolitical tensions adding to market uncertainty. While credit markets offer real income, volatility and rising delinquency rates make public bonds less attractive. Private credit remains a more compelling option for income-focused allocations. Equity valuations have come down but remain sensitive to policy and earnings expectations; areas of relative value include U.S. large cap value, non-U.S. equities, and international small caps. In alternatives, secondaries, GP stakes, energy infrastructure, and select real estate and venture strategies stand out as attractive opportunities. A neutral stance between equities and bonds reflects today’s disrupted environment, where long-term discipline and selectivity are essential.

See the sections below for more detailed insights.

Economic Outlook

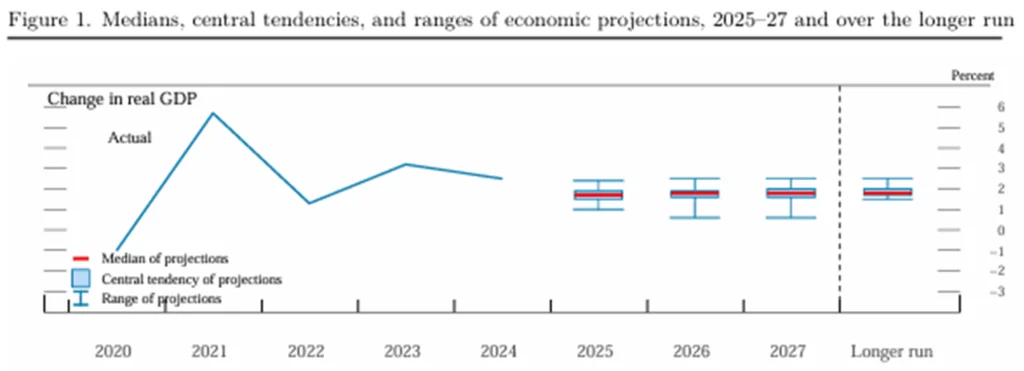

The Federal Open Market Committee (FOMC) is forecasting roughly 2% annual GDP growth through 2025 and into 2026 and 2027. Its forecasting accuracy historically has been poor, but it is helpful to know what they think as it will influence future Fed rate policy. Note that this forecast came out before Trump’s tariff announcements on April 2.

Source: The FOMC “Summary of Economic Projections,” as of March 19, 2025. There is no guarantee that any projection, forecast, or opinion will be realized. Actual results may vary.

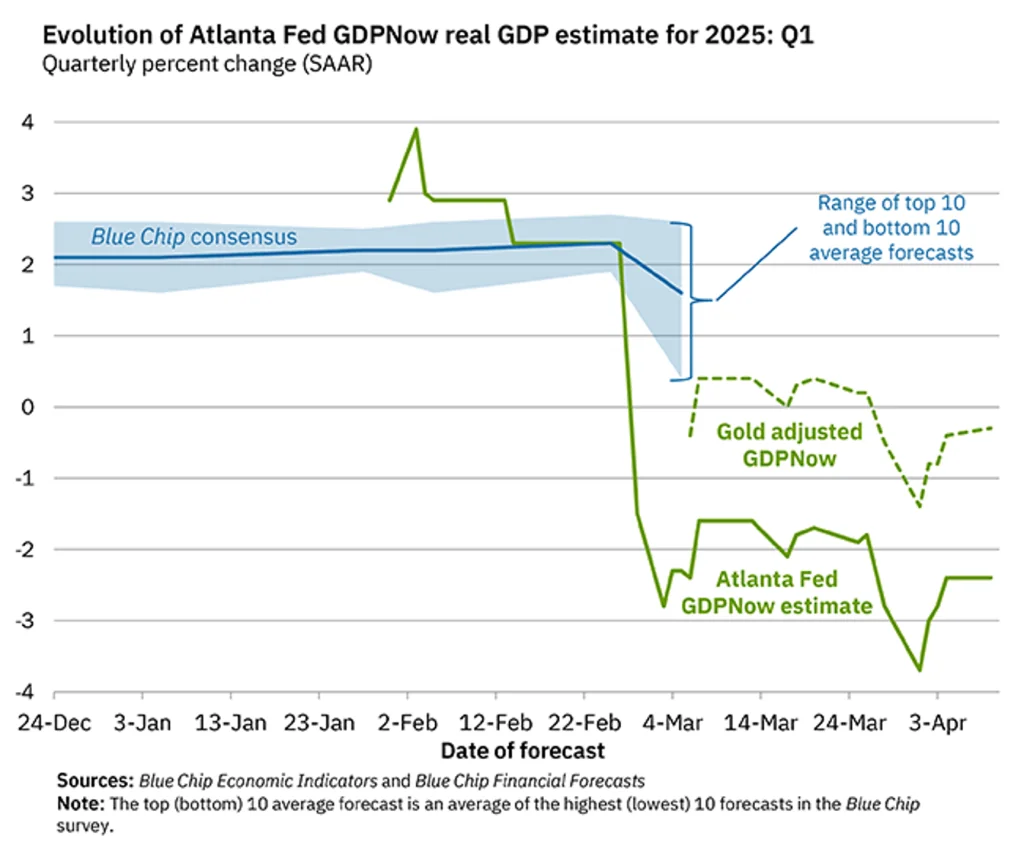

The Atlanta Fed “GDPNow” Forecast currently indicates a negative 2.4% GDP growth for Q1 2025. The tariff announcements on and since April 2 are cause for concern, but we have not yet seen any “ripple effect” from those announcements. The economy had shown signs of cooling throughout Q1 anyway.

Source: The Atlanta Fed “GDPNow Forecast as of April 9, 2025. There is no guarantee that any projection, forecast, or opinion will be realized. Actual results may vary.

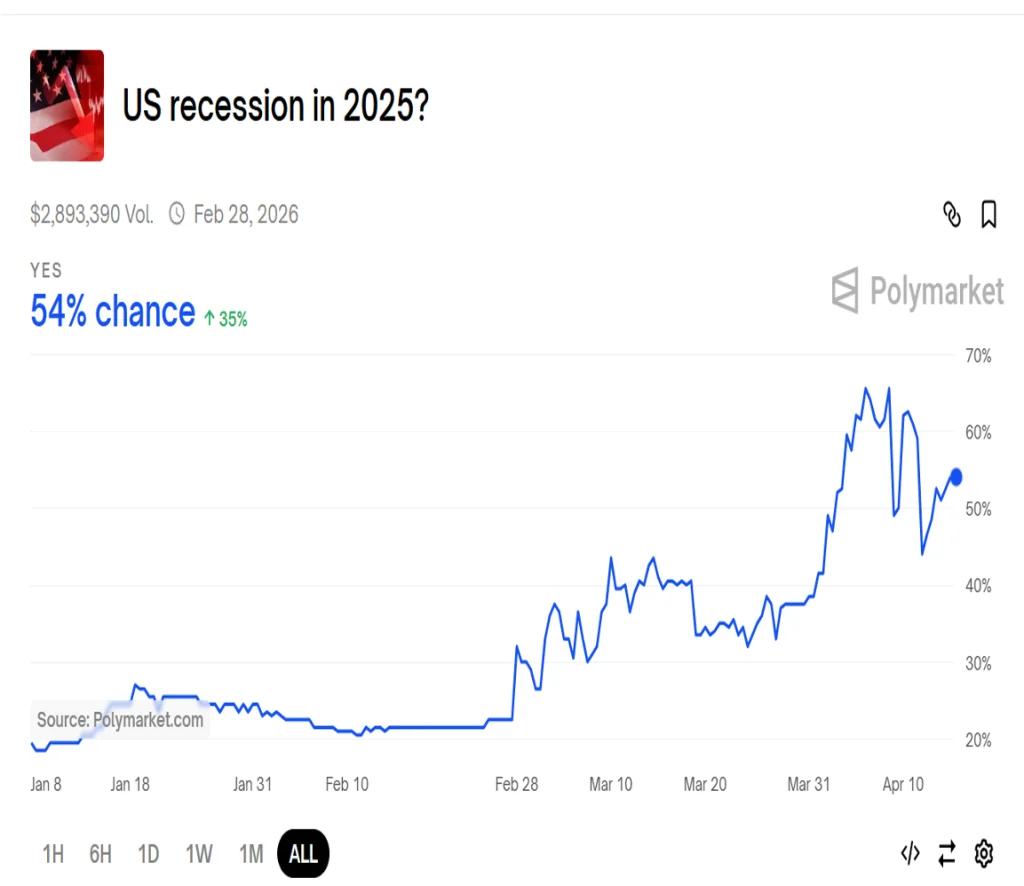

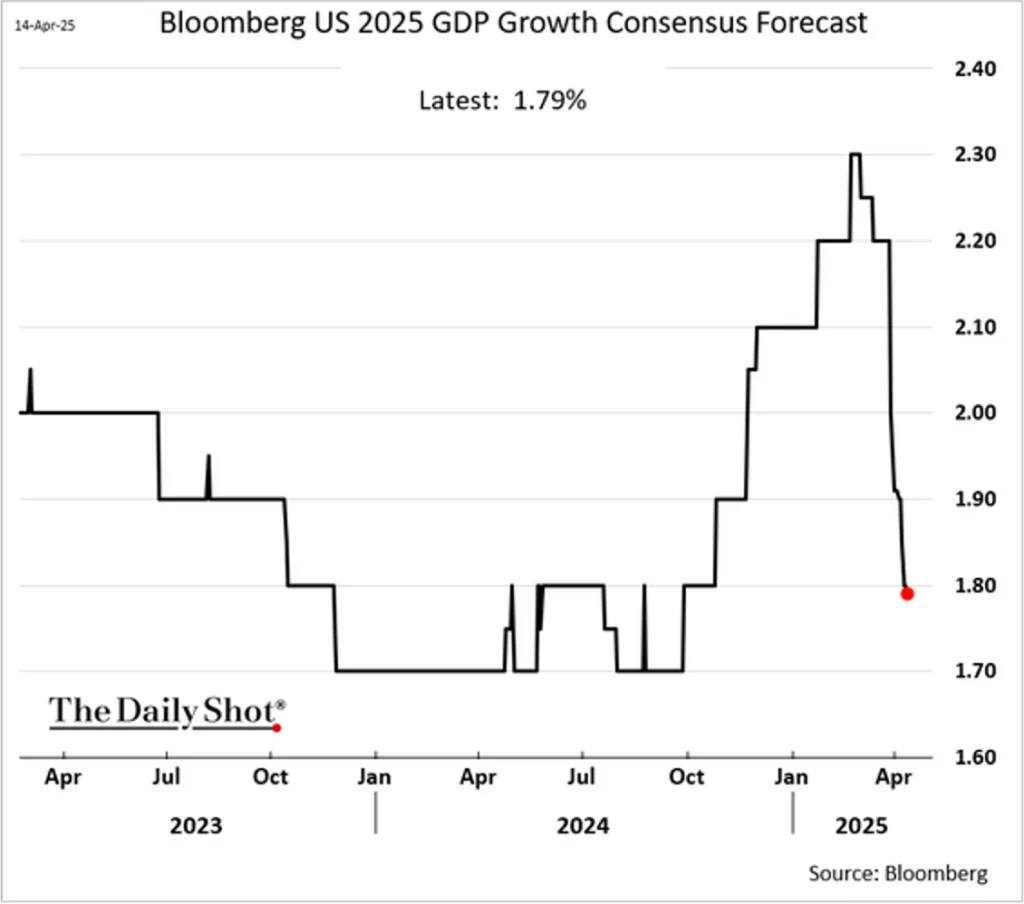

The odds are increasing that the US will be in a recession within 10-12 months.

Sources: (Top): Polymarket, as of April 15, 2025.; (Bottom): The Daily Shot, as of April 15, 2025. All forecasts are estimates and subject to change as more data come in.

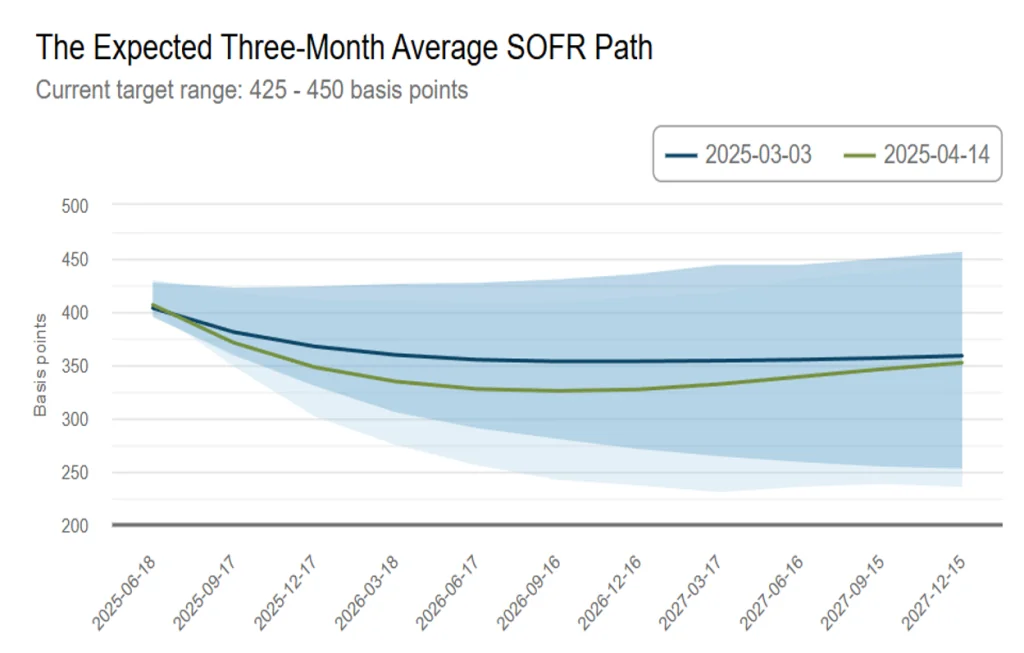

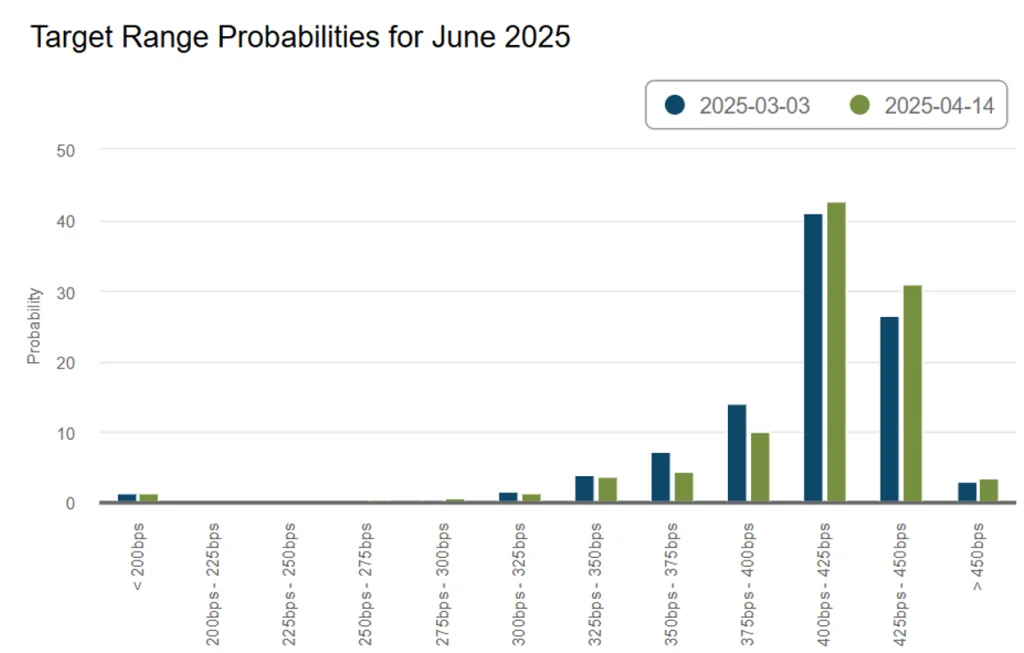

The markets have reversed course on the Fed, from expecting maybe one cut in June to pricing in almost 100 bps of cuts before next June.

Source: The Atlanta Fed “Market Probability Tracker” forecast as April 14, 2025. All forecasts are estimates and subject to change as more data come in.

Non-US GDP estimates are muted but generally positive.

Source: BNP Paribas, as of March 28, 2025. There is no guarantee that any projection, forecast, or opinion will be realized. Actual results may vary.

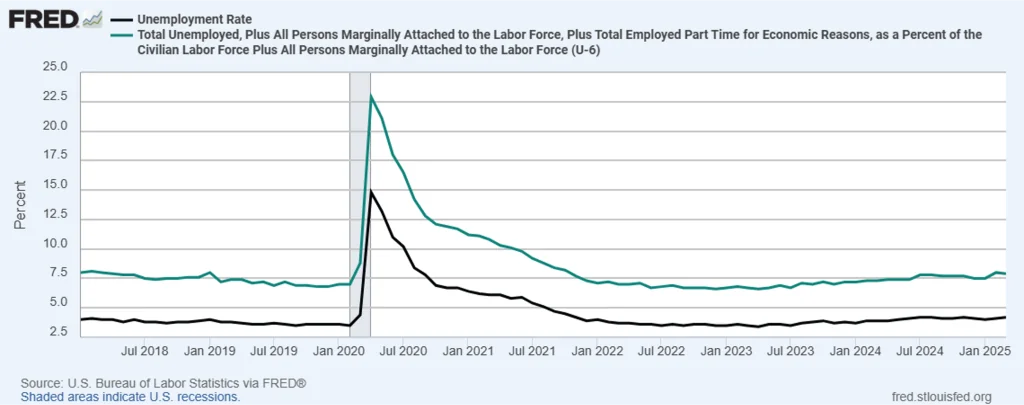

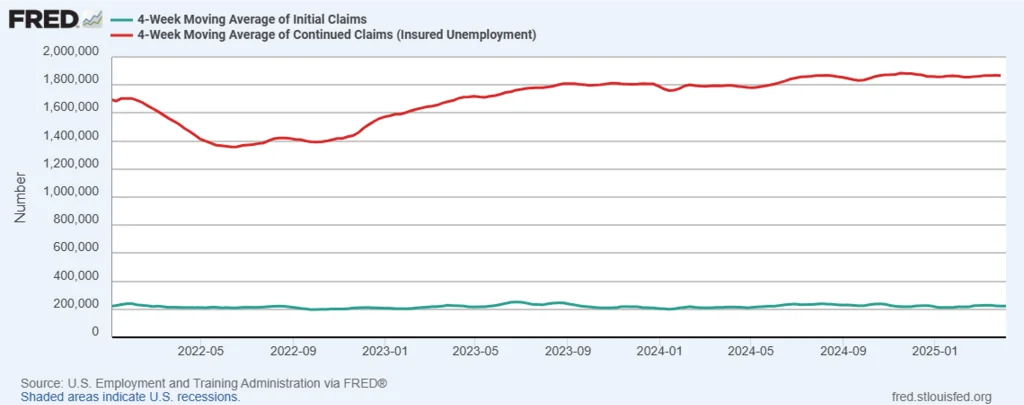

The labor market remains stable but perhaps shows signs of cooling. Again, however, this is only through March. We suspect we will see increases in unemployment as we move through the spring.

Source: St. Louis Fed (FRED), through March 2024.

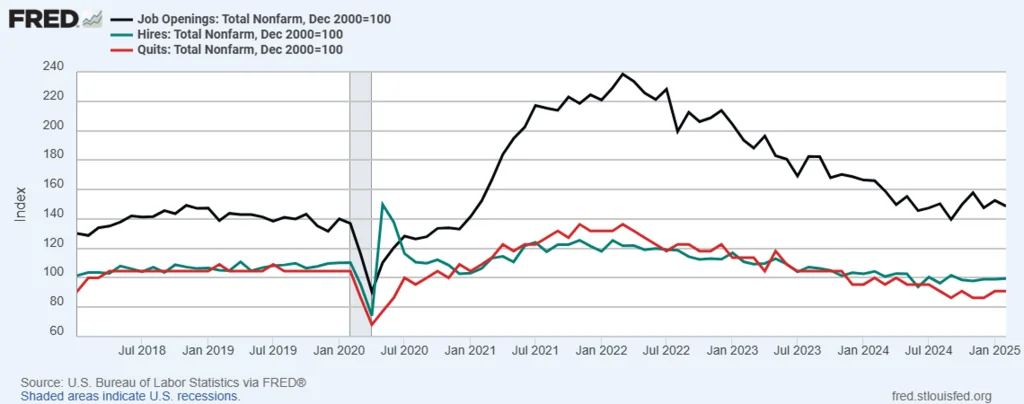

Job openings show a slight uptick but are generally trending downward. The hires and quits rates remain stable – for now. All bets are off until we have more policy clarity.

Source: St. Louis Fed (FRED), through February 2024.

This chart will tell us quickly how the labor market is reacting to policy uncertainty. As a reminder, we use the 4-week moving averages to smooth out weekly volatility, but these metrics will soon begin to show if there are any negative effects from the impending trade wars.

Source: St. Louis Fed (FRED), through March 29, 2025..

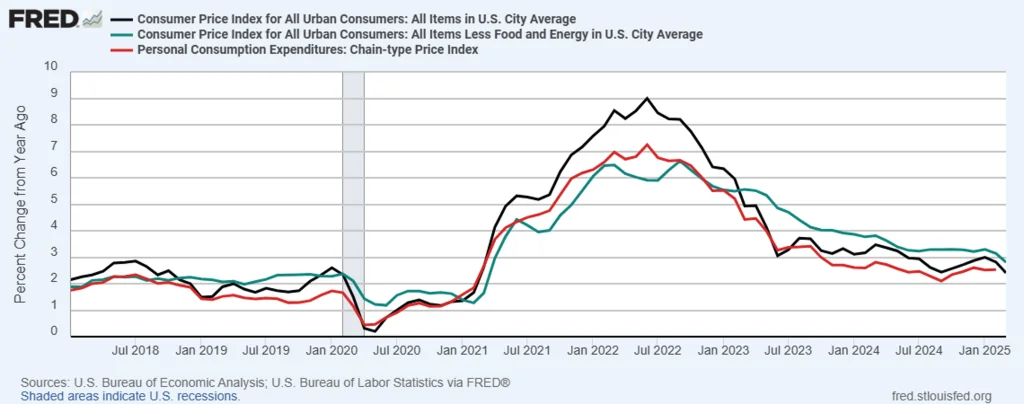

This chart only goes through March, so it’s too soon to see if any tariff-induced inflation is working itself into the economy – but we think it will.

Source: St. Louis Fed (FRED), data though March 2025.

Inflation expectations spiked following the April 2 tariff announcements, but it is too early to know if these raised inflation expectations will translate into actual higher inflation. We need much more clarity on the ultimate trade agreements.

Source: The Daily Shot, as of April 3, 2025. This is a forecast and subject to change.

Economic Outlook Summary

- President Trump is strongly “jawboning” the Fed for lower rates, including talking about removing Jerome Powell as Fed Chair. So far, the Fed is showing independence and its usual “data dependency” but it will still probably cut rates by 25-bps in June (and some analysts believe it may happen in May). After that, we need much more clarity on the state of affairs before even attempting to forecast future Fed moves.

- The market remains hopeful about the economic benefits of regulatory and tax reform, but those will be much slower in implementation (if at all) because they will require legislative action, and the GOP holds only a tenuous majority in the House and Senate.

- China has launched aggressive fiscal and monetary stimulus programs to re-catalyze its economy. It is still too early to tell how effective they will be, especially as trade tensions escalate, but the early signs have been positive.

- The “known unknowns” are geo-politics, specifically the ongoing Russia/Ukraine and Israeli wars, war/tensions in the broader Middle East, and increasing tensions between the US and Iran, China, and Russia. We seem to be facing an impending global trade war – which usually has no winners.

Public Market Outlook

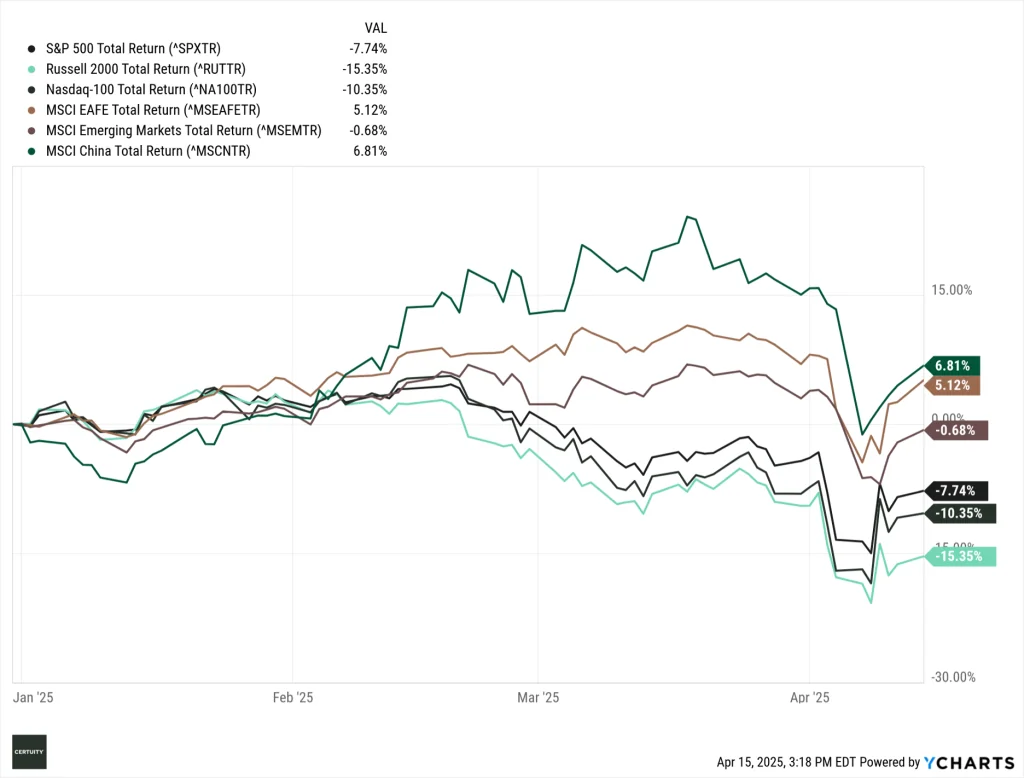

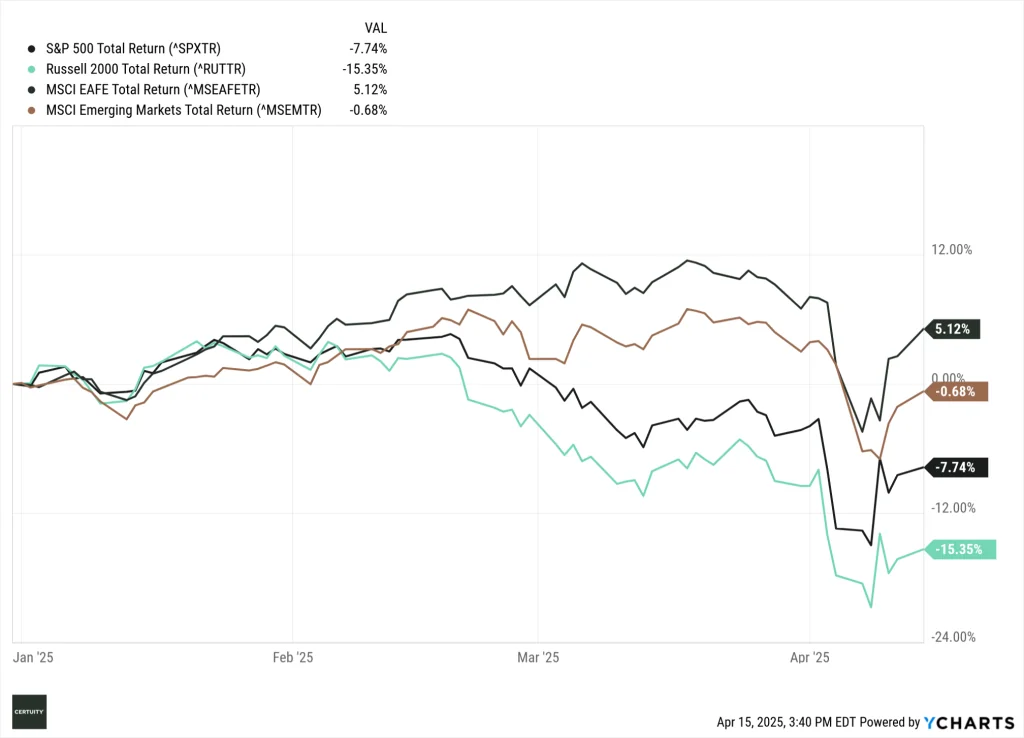

What a wild year so far for global stock markets. The dollar’s continuing decline is helping EAFE and EM returns for US investors, but we expect market volatility to continue. The market hates uncertainty.

Source: Ycharts, YTD performance through April 14, 2025. You cannot invest in an index and past performance is no guarantee of future results.

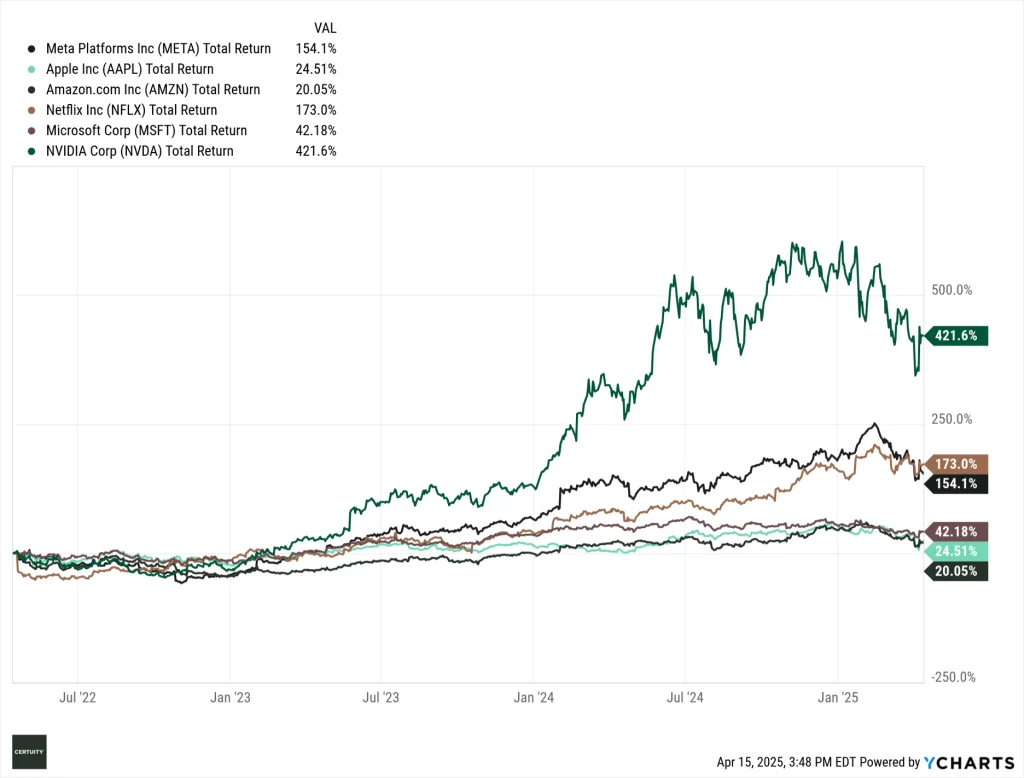

It’s been a rough few months for the mega-cap tech stocks, but’s let’s remind ourselves of the bull run they’ve been on for the past three years. Nvidia is getting crushed by the chip embargos on China. It indicated they would cost the company $5.5 billion.

Source: Ycharts, 1-year data through April 14, 2025. You cannot invest in an index and past performance is no guarantee of future results.

As mentioned, US investors are benefitting from a declining dollar on their non-US investments. This is why we remain committed to global diversification.

Source: Ycharts, YTD data April 14, 2025. You cannot invest in an index and past performance is no guarantee of future results.

The dollar has been declining since January but really took a nosedive after April 2. We expect continued volatility as investors try to navigate the current policy regime.

Source: Ycharts, 1-year data through April 14, 2025. You cannot invest in an index and past performance is no guarantee of future results.

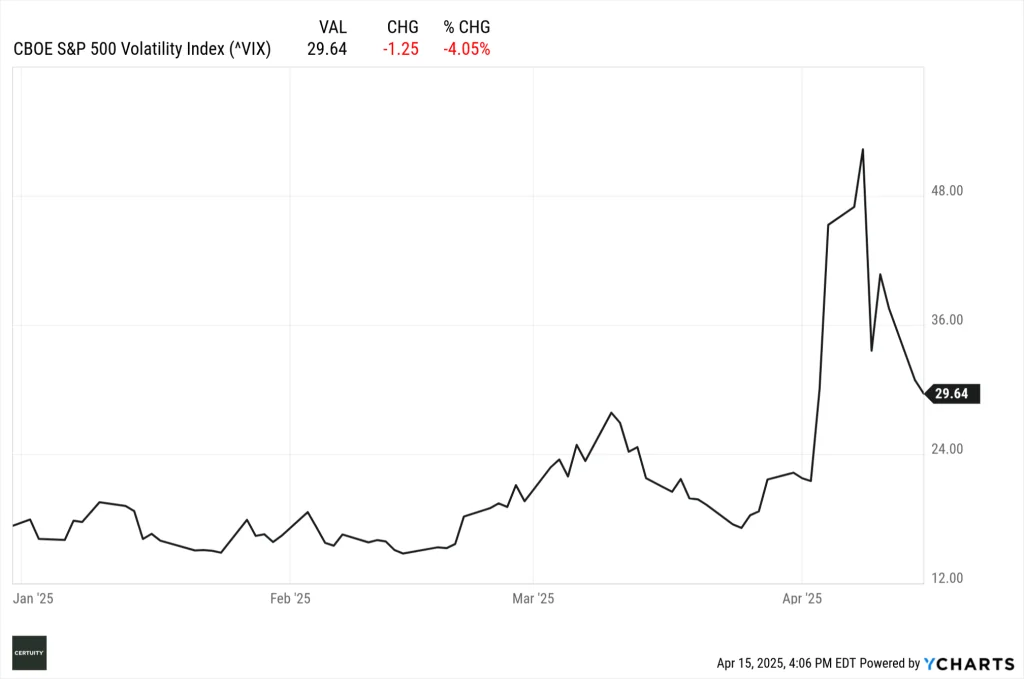

Volatility has been…well…volatile. The market has not faced this much uncertainty in a long time. It is very unusual to see spikes and reversals of these magnitudes in such a brief period of time.

Source: Ycharts, YTD data through April 14, 2025. You cannot invest in an index and past performance is no guarantee of future results.

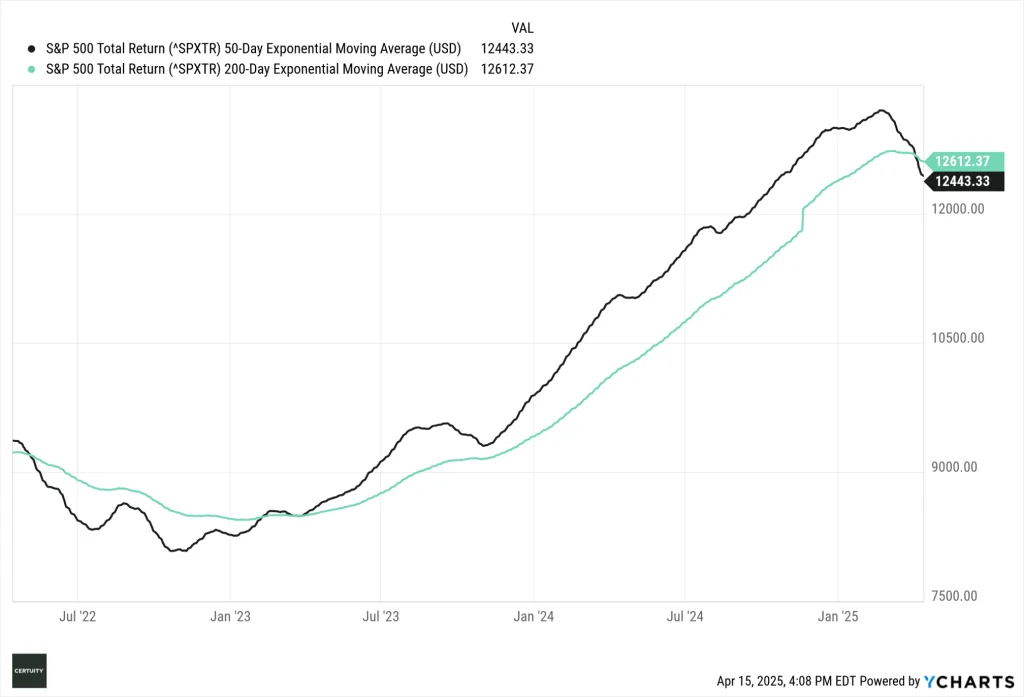

Market momentum, as measured by the 50-day and 200-day moving averages, just witnessed the first “death cross” – when the 50-day falls below the 200-day – in almost three years.

Source: Ycharts, 3-year data through April 14, 2025. Past performance is no guarantee of future results.

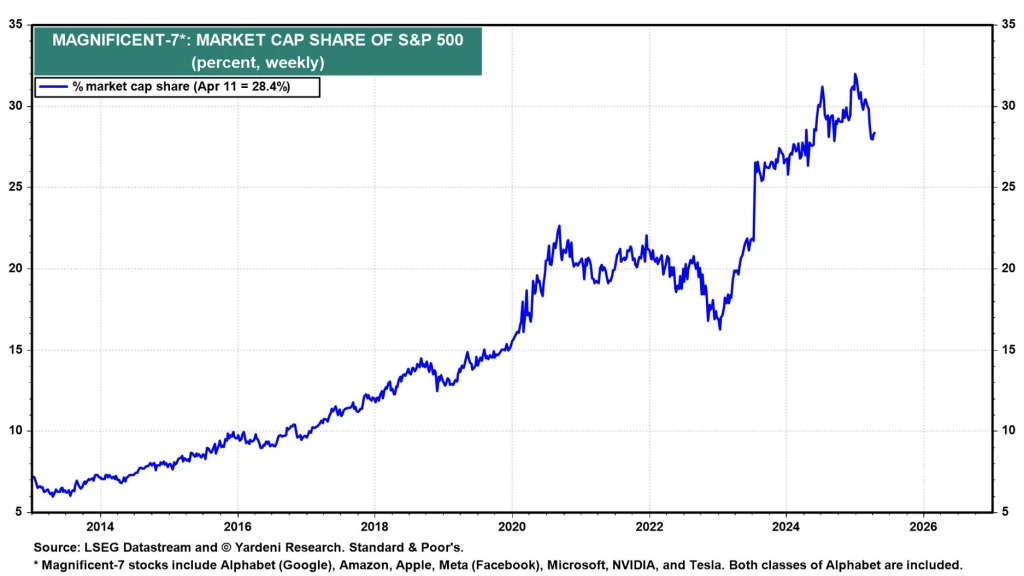

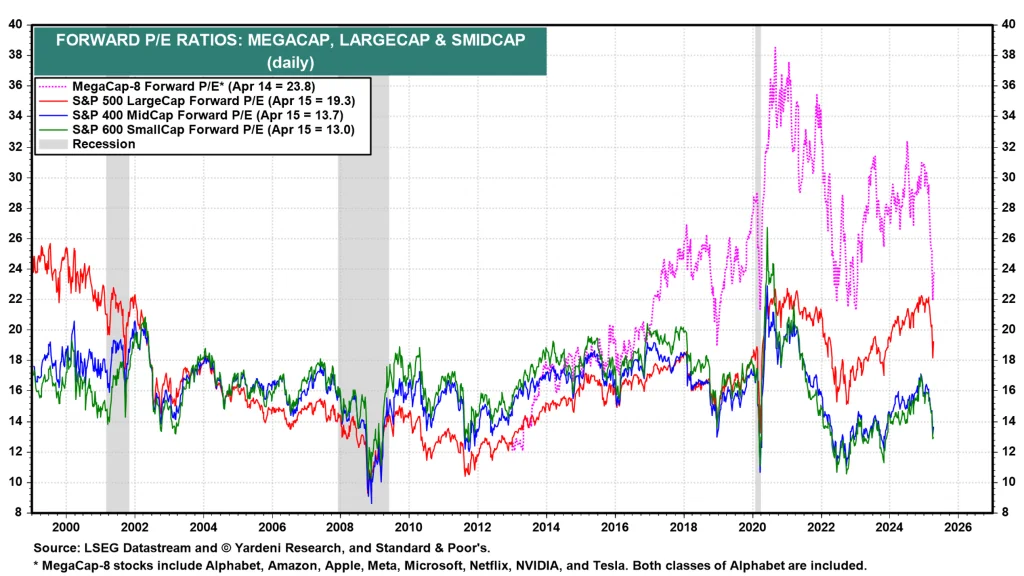

Despite the recent downturn, the S&P 500 index continues to be dominated by the mega-cap tech stocks, which are driven by “AI mania”. We believed that the mega-cap stocks had become quite expensive so, despite the disruption, we view the recent downturn as ultimately healthy.

Source: Yardeni Research, as of April 11, 2025.. You cannot invest in an index and past performance is no guarantee of future results.

The Q1 2025 earnings season is just beginning. The consensus estimates are for (1) a decline in earnings in Q1 (though still positive year-over-year), followed by (2) a reacceleration of earnings as we move through the remainder of 2025.

Source: Zacks Investment Research, as of April 9, 2025. Green bars are earnings and orange bars are revenues. Solid bars are actual results, while hatched bars are estimates and, therefore, subject to change.

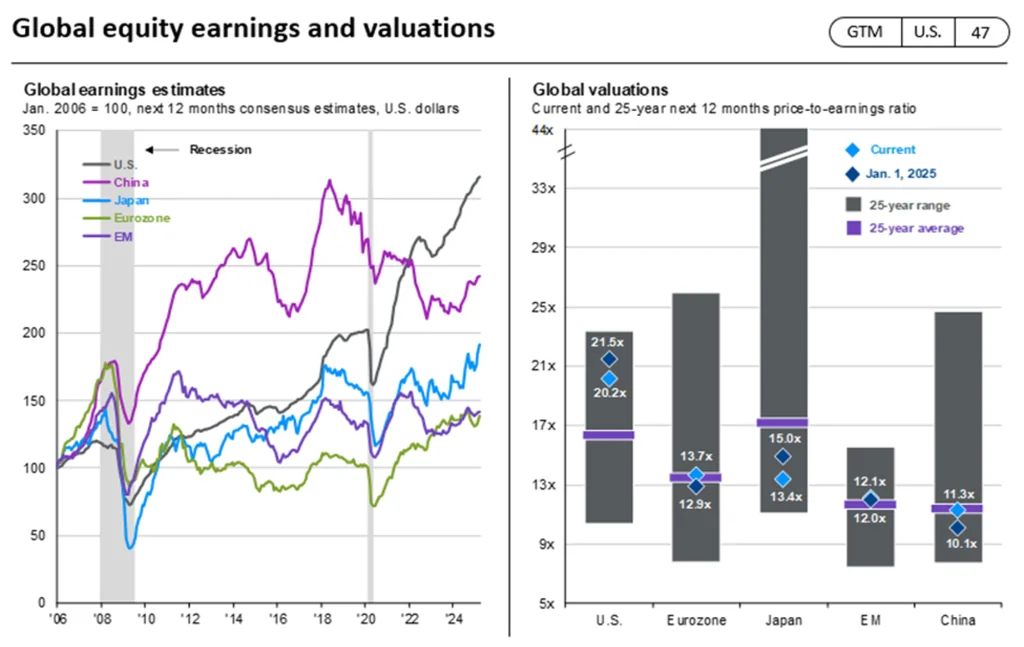

Outside the US, earnings growth estimates are muted but positive. Even China is expected to show earnings growth as the result of significant monetary and fiscal stimulus from the Chinese government. Despite the sell-off in US stocks, global valuations are more attractive outside the US.

Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Next 12 months consensus estimates are based on pro-forma earnings and are in U.S. dollars. Past performance is not a reliable indicator of current and future results. (Right) The purple lines for EM and China show 20-year averages due to a lack of available data. Guide to the Markets – U.S. Data are as of March 31, 2025.

Within the US, and despite the recent rout in the mega-cap tech stocks, there remains a significant valuation dispersion between these stocks and broader large cap, mid cap, and small cap stocks.

Source: Yardeni Research, through April 14 2025. You cannot invest in an index and past performance is no guarantee of future results.

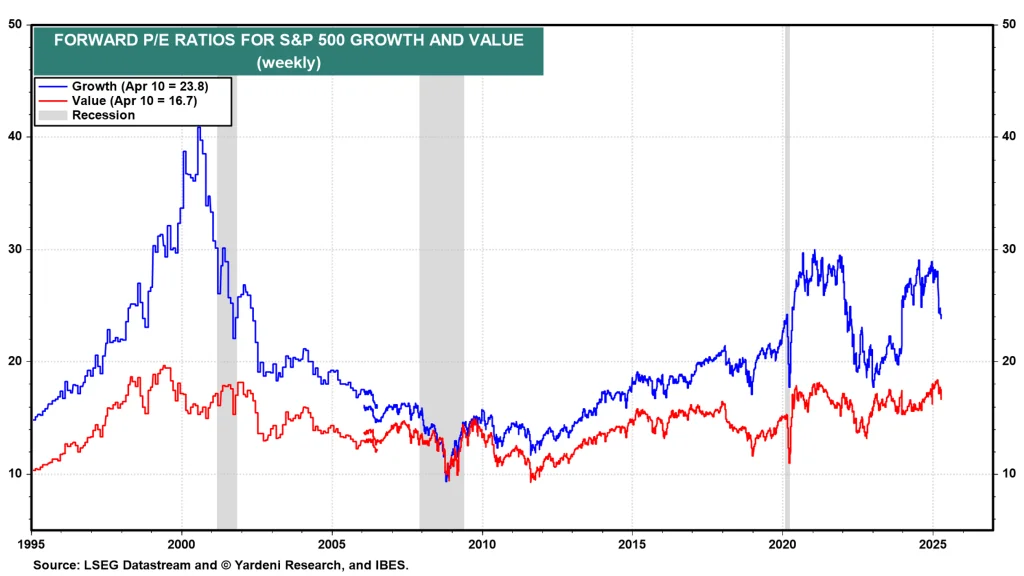

We see a similar valuation dispersion between large cap growth and value stocks, though the spread is narrowing.

Source: Yardeni Research, through April 10, 2025. You cannot invest in an index and past performance is no guarantee of future results.

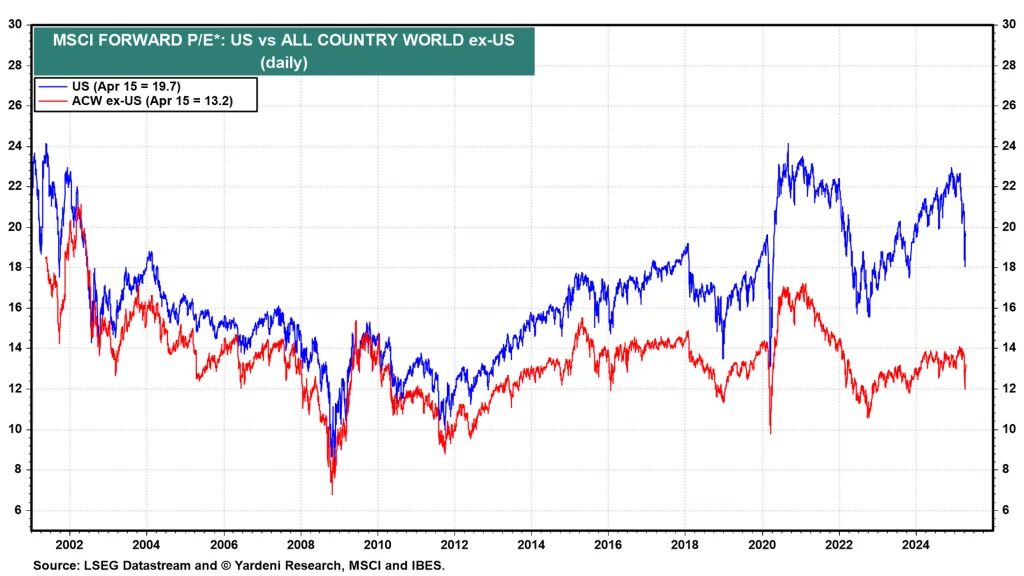

The valuation dispersion between US and non-US stocks is as wide as it has been in more than twenty years. This is due partly to a declining dollar. However, non-US markets are outperforming US markets so far this year.

Source: Yardeni Research, through April 15, 2025. You cannot invest in an index and past performance is no guarantee of future results.

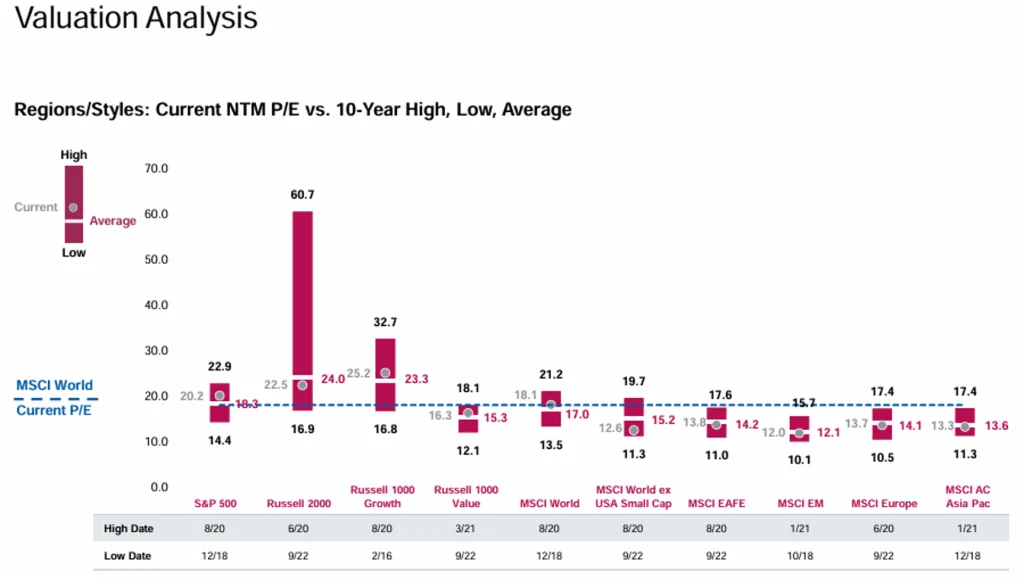

Despite recent market declines, there are no “screaming buys” in global public equities from a valuation perspective. There appears to be a relative value opportunity in international small cap stocks, which we strategically allocate to.

Source: Morgan Stanley Eaton Vance “The BEAT”, April 2025. You cannot invest in an index and past performance is no guarantee of future results.

Public Equity Market Summary

- US equities fell in Q1, which was a function of excessive valuation and increased volatility in the market from the “DeepSeek” AI news, a slowing economy, Fed policy uncertainty, and the Administration’s tariff policy announcements. While painful, we believe the disruption brought US public equity valuations more in line with historical averages.

- There is nothing that looks “cheap” by valuation standards, and investors should manage expectations accordingly. For patient investors, there may be some relative value in international small caps.

- Global earnings estimates are generally positive but return expectations are muted because of heightened volatility and uncertainty.

- Patient and longer-term investors may want to consider the relative valuation opportunities available in US large cap value and non-US stocks. We continue to like US SMID cap stocks from a strategic perspective, but believe it is too soon for heavy reallocation there. There’s too much uncertainty over economic growth and interest rates – two important drivers of SMID cap performance.

Rates and Credit Outlook

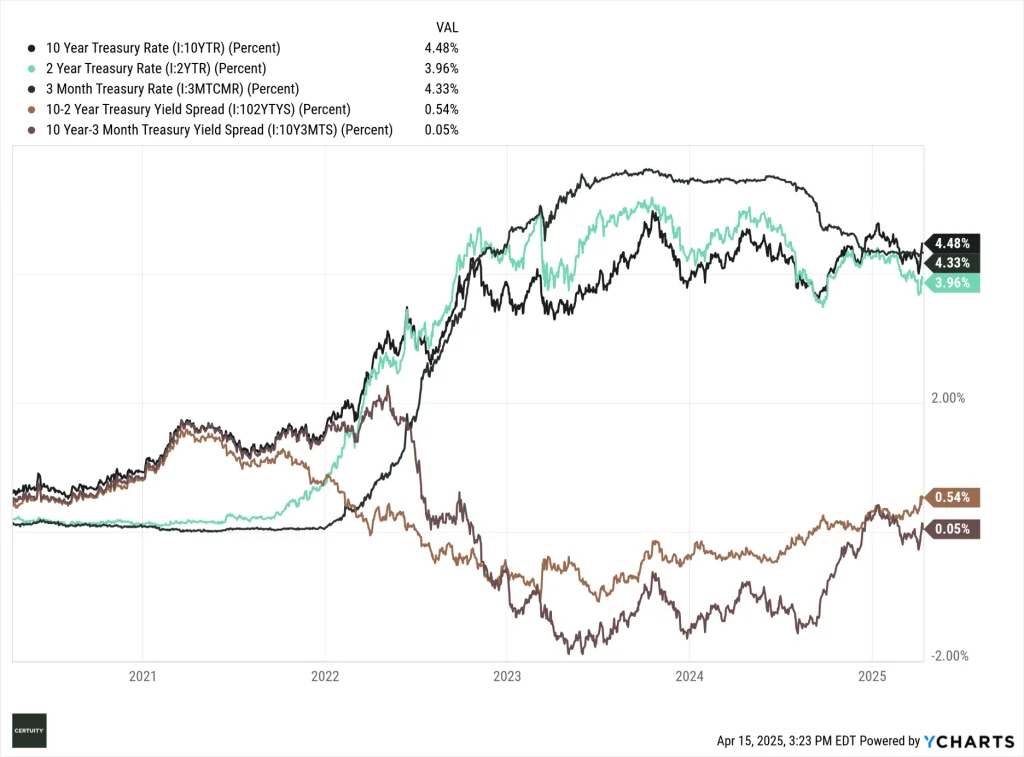

The yield curve has “normalized” again despite the decline in the 10-year rate due to the “flight to quality” trade. We do not anticipate rates to fall below 4% again, barring a major geo-political event. But that risk is certainly there.

Source: Ycharts, 5-year data as of April 14, 2025. You cannot invest in an index and past performance is no guarantee of future results.

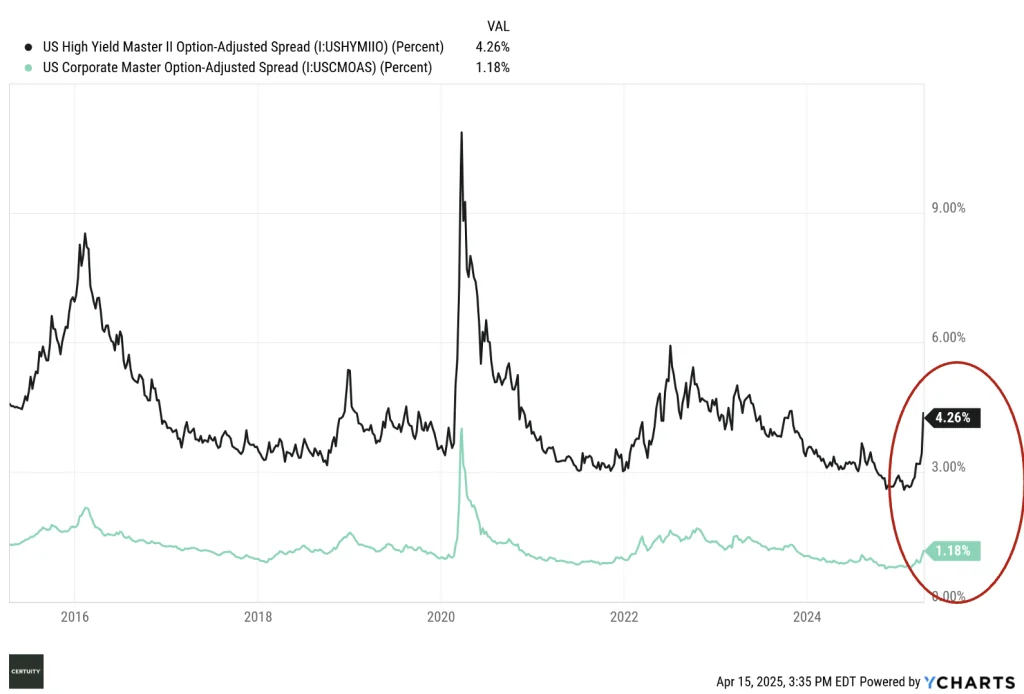

Credit spreads continue to widen, especially in high yield, and delinquencies and defaults are rising. Investors seeking higher yields should focus on private credit.

Source: Ycharts, 10-year data as of March 18, 2025. You cannot invest in an index and past performance is no guarantee of future results.

Rates and Credit Summary

- Given the current levels of real rates and credit spreads, investors can once again generate real income from their bond portfolios.

- Corporate balance sheets are generally in solid shape, so coupons (at least on investment grade bonds) should be reasonably safe, although delinquency and default rates are increasing.

- That said, we believe the pressure on spreads is upward from current levels due to heightened uncertainty, and volatility in the rates market make it unclear if the pressure is up or down on the long end of the curve. As a result, we do not love the total return potential available in most public income sectors and are bearish on public market high yield.

- Given the uncertainty in the market, we see no reason to overly extend duration. We continue to recommend a balanced approach between short-dated and longer duration exposures and to maintain a duration profile that is slightly lower than the aggregate index.

- For investors seeking higher yield from their income allocations, we much prefer private credit for those investors who can access that space.

Alternatives and Private Markets Outlook

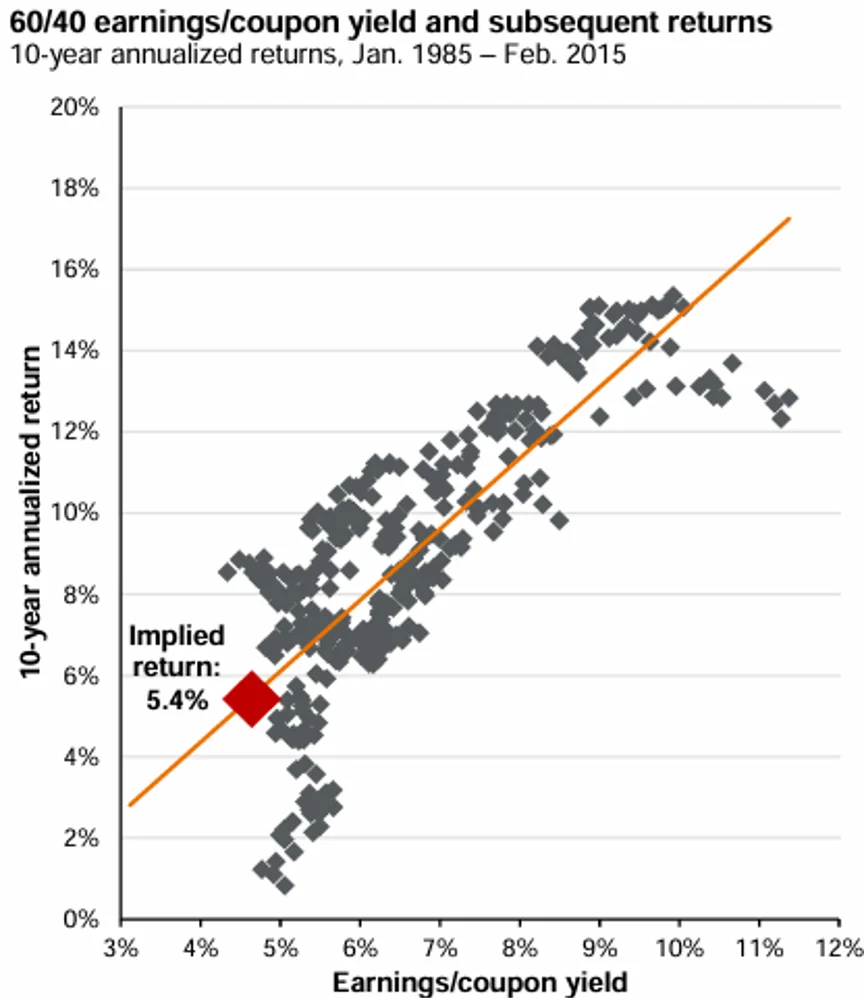

Forecasted returns for the traditional “60/40” portfolio suggest the need for non-traditional investments, including alternatives and private investments.

Source: JP Morgan “Guide to Alternatives”, as of February 28, 2025. You cannot invest in an index and past performance is no guarantee of future results

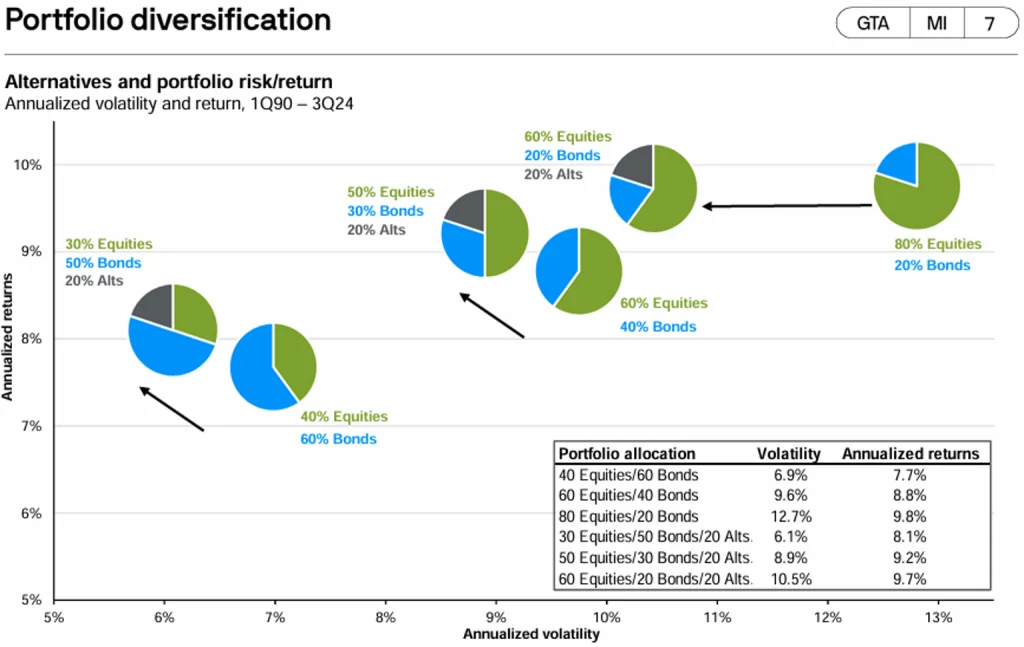

Here’s a reminder of why the inclusion of alternative and private investments can be beneficial to the overall risk/return profile of diversified portfolios.

Source: JP Morgan “Guide to Alternatives”, as of February 28, 2025. You cannot invest in an index and past performance is no guarantee of future results

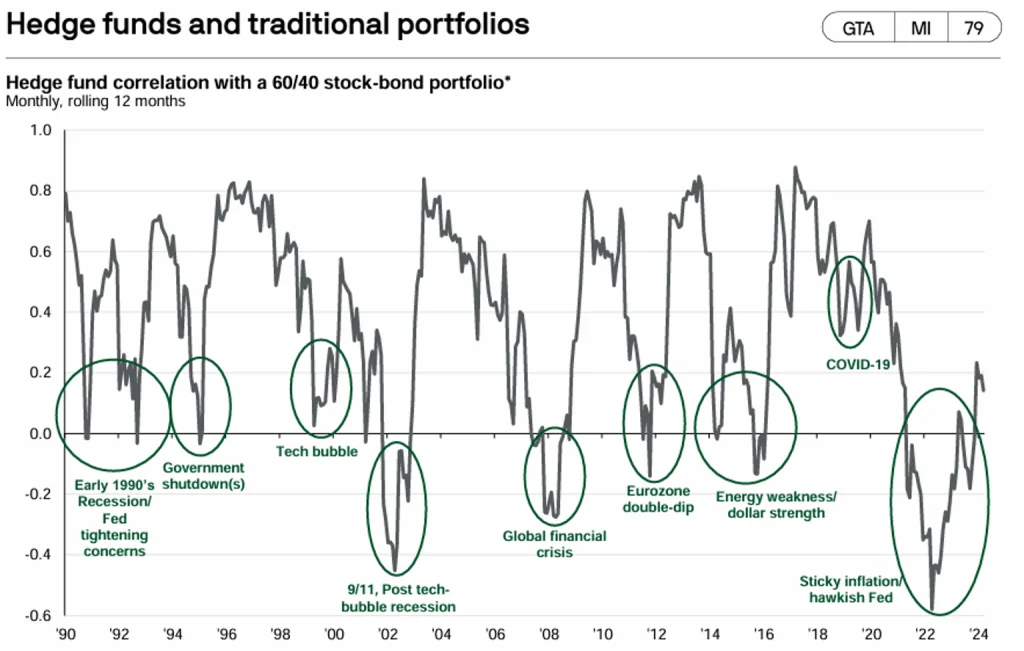

Historically, hedge funds have performed better in rising volatility environments – which we seem to be in today.

Source: JP Morgan “Guide to Alternatives”, as of February 28, 2025. You cannot invest in an index and past performance is no guarantee of future results.

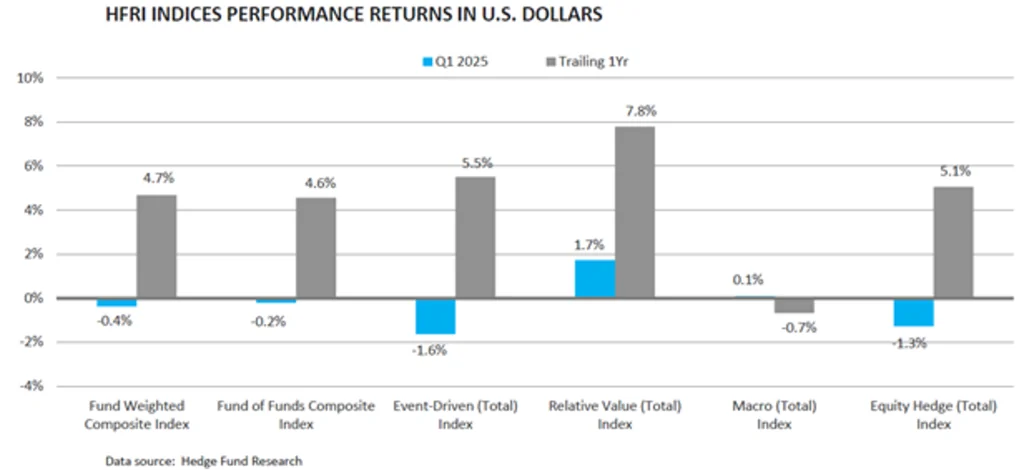

Hedge funds continue to do their job, which is to not outperform a bull equity market, but deliver consistent returns and improve portfolio diversification.

Source: FEG, through March 2025. You cannot invest in an index and past performance is no guarantee of future results.

Historically, hedge funds have been excellent sources of diversification during turbulent market regimes.

Source: JP Morgan “Guide to Alternatives”, as of February 28, 2025. You cannot invest in an index and past performance is no guarantee of future results.

We continue to like private equity for those investors who can access it. We are especially interested in sports investments, secondaries, energy infrastructure, real estate, GP Stakes, and potentially VC at the current time. Below highlights some of the discounts that are available in the secondaries market.

Source: JP Morgan’s “Guide to Alternatives”, as of November 2024. Private investments may carry additional liquidity and leverage risks and are often limited to more sophisticated investors accordingly. Past performance is no guarantee of future results.

Alternatives and Private Market Investment Themes for 2025

- Given market valuations in the public markets – and the current global disruption from the April 2 tariff announcements – we continue to like the private markets for those investors who can access them.

- Sports Investing: This entails lower correlated strategies, a growing opportunity set, and a differentiated solution. We have been active in this space, and continue to see additional opportunities

- Secondaries: We suspect that ongoing global trade and market disruption will put a damper on both the IPO and M&A markets – the traditional “exit strategies” for many PE investments. Thus, we continue to believe there are attractive opportunities available in the secondaries space, many of which are at interesting discounts.

- GP Stakes: These are funds buying minority interests in other funds. It’s a rapidly growing space as the selling funds seek permanent expansion capital. We have an active search on in this area.

- Infrastructure: We’re specifically interested in energy infrastructure, due to the exploding demand for energy, transmission, and AI data centers.

- Real Estate: We believe this sector is poised for a comeback following its “beat down” during COVID. We currently have income-oriented strategies available and are focusing our current search on growth/value add equity solutions.

- Venture Capital: This is another “beat down” sector we believe may be poised for a comeback. We have a search on in this space as well.

- Private Credit: We have good solutions already on the platform, so we’re interested in exploring more “niche-oriented” strategies going forward.

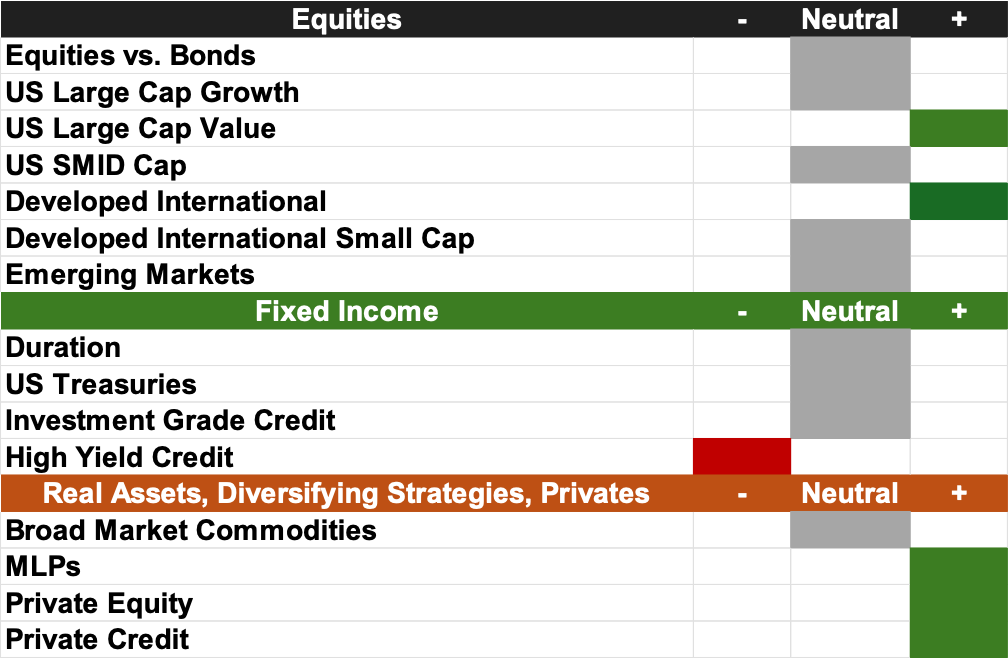

The Certuity Asset Class Positioning and Outlook

Here are the Certuity Asset Allocation Guidelines, as of March 31, 2025. Valuations are still slightly expensive across the globe. This is a period of heightened uncertainty, and we are cautious as a result. Investors should stay invested but not be looking for excessive risk.

Source: Certuity, as of March 31, 2025. Evaluations are subject to change as market conditions change. This is for illustration purposes only and does not represent investment advice. All evaluations are on a relative and not absolute basis. Red = a negative relative evaluation; gray = a neutral relative evaluation; green = a positive relative evaluation. You cannot invest in an index, and past performance is no guarantee future results.

Our Current Model Portfolio Guidelines

- We have shifted to a more “neutral” position on stocks vs. bonds. Long term, we will always favor stocks, but the current market disruptions have moved us to a more neutral short-term stance.

- Market and corporate fundamentals (earnings, balance sheet strength, cash flows, and valuations) will become increasingly important as we enter a turbulent and disruptive market regime. We are longer-term strategic investors and do not attempt to “time the market” – but for now, caution is appropriate.

- We believe longer-term and disciplined investors should consider allocating to US large cap value and non-US stocks. We are strategic allocators of US SMID cap, but the current market environment – especially in view of interest rates and economic growth – gives us pause for now.

- We don’t like the total return outlook for public bonds. We much prefer private credit for those investors who can access it and are seeking enhanced yield.

- We continue to like MLPs but are otherwise neutral on the broader public real asset sector.

- We believe there continue to be interesting opportunities in the private markets for those investors who can access them.