By Scott Welch, CIMA®, Chief Investment Officer & Partner

Reviewed by Carter Mecham, CMA®, IACCP®

We have passed the midway point of the third quarter, and the Fed (as expected) did not raise rates at its FOMC July meeting.

The markets clearly want – and are pricing in – a rate cut in September of at least 25-50 bps, and some analysts still expect as many as three before year-end. One senior economist whom we greatly respect suggested the Fed should cut 75 bps today and another 75 bps in September. With complete respect to him, we just don’t see it.

In his post-meeting press conference last month, Fed Chair Jerome Powell, while emphasizing “data dependency” regarding future policy changes, signaled more strongly than he has previously that the Fed is open to a rate cut in September should the data “continue to cooperate.” The market reacted positively and is now fully expecting that cut to take place.

A wild card is that this is a national election year. The Fed is supposed to be independent and non-partisan, but it will be under increasing political pressure as we approach the September meeting.

If it decides to cut or not cut, it will be criticized by one side or the other. In addition, the market is now so convinced of a September cut that it will most likely react very negatively if there is not one.

Remember, however, that this is the same “market” that priced in six rate cuts at the beginning of the year – a belief we never bought into.

In this posting, we will focus on the three things the Fed, in accordance with its mandate, watches most closely – the economy, inflation, and the labor markets, and see which signals might suggest a Fed rate in September – and which might not. Let’s dive in.

The Economy

US economic growth remains positive. The Bureau of Labor Statistics estimates a Q2 growth rate of 2.8%, following a 1.4% increase in Q1.

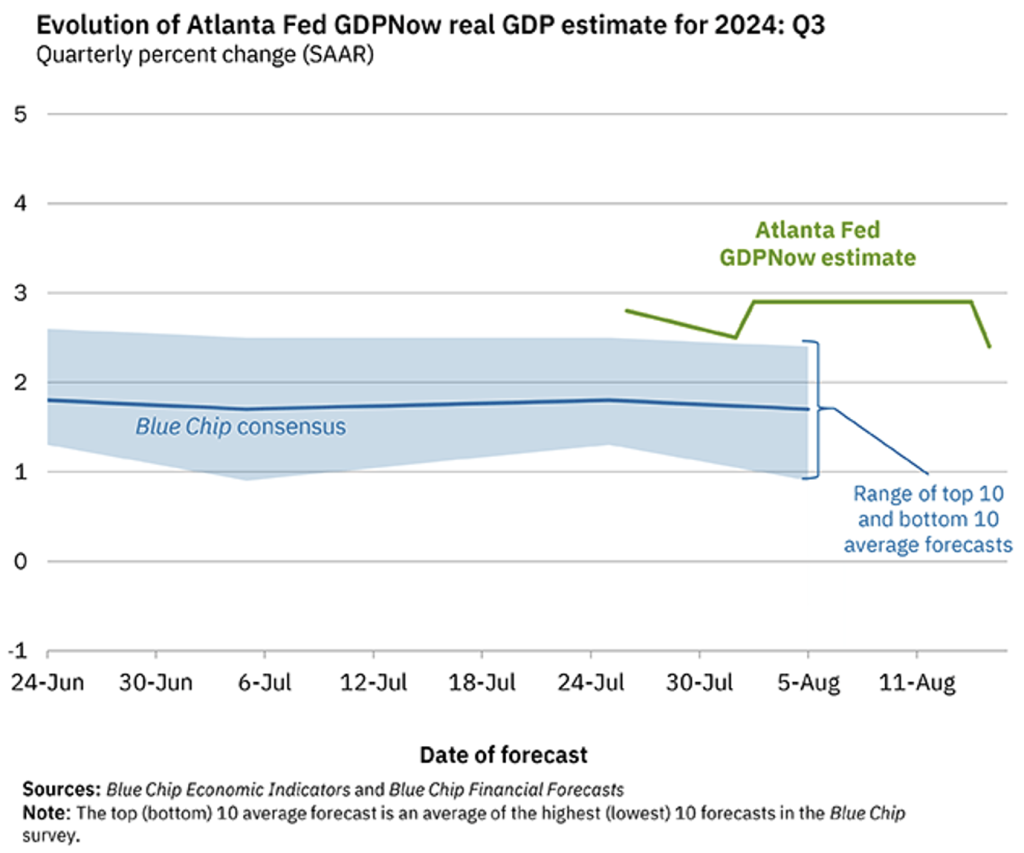

The Atlanta Fed’s “GDPNow” indicator estimates a reasonable Q3 growth rate of 2.4%, suggesting the economy continues to prove more resilient than many analysts forecasted. Note, however, that the “blue chip consensus estimate” is much lower, coming in at under 2.0%.

Source: The Atlanta Fed “GDPNow” Forecast, as of August 15, 2024. This is a forecast and will change as additional data are reported through the quarter.

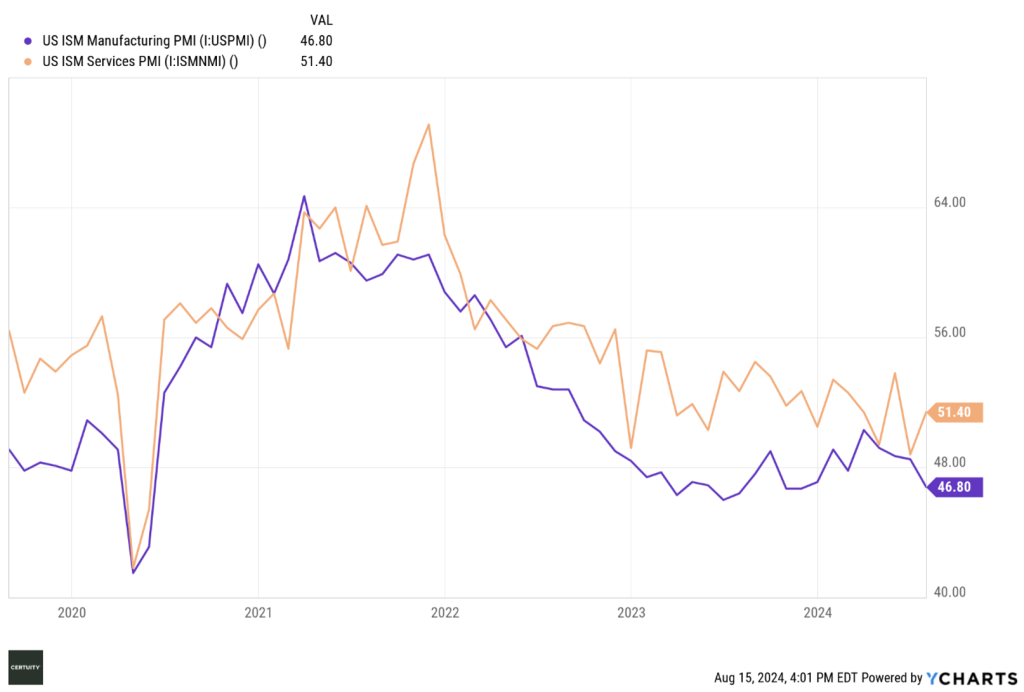

There may be some signs of economic weakening. Through the end of July, the manufacturing sector was in a contractionary environment (i.e., a reading below 50), while the services sector inched back into expansionary mode (i.e., a reading above 50).

Source: Ycharts, 5-year data through July 2024. Readings above 50 indicate expansion; readings below 50 indicate contraction. The ISM Manufacturing and Services metrics are monthly survey-based economic indicators published by the Institute for Supply Management (ISM).

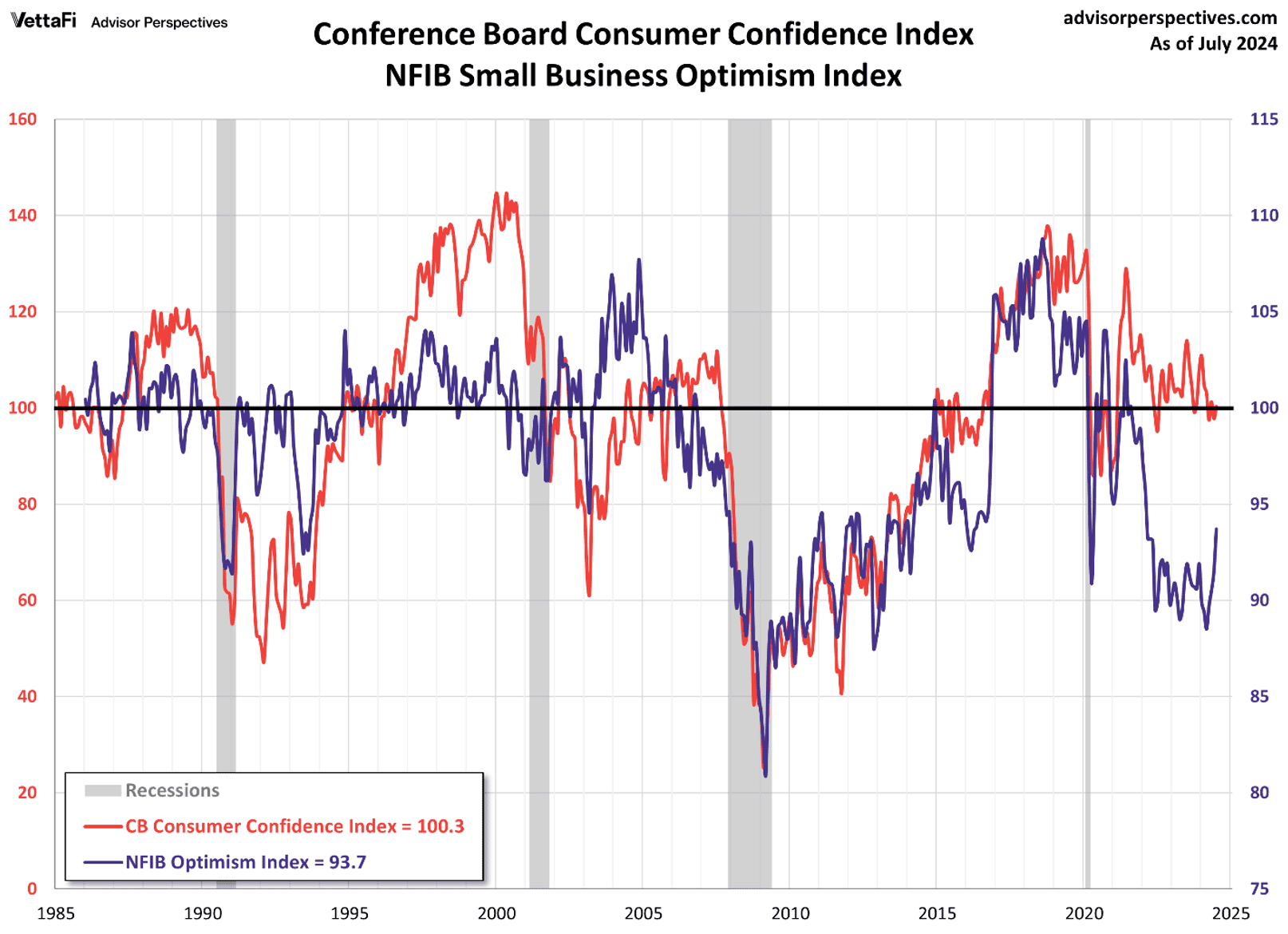

In addition, both consumer and small business owner sentiments are trending in the wrong direction (though the small business owner optimism index jumped in July), which may result in reduced consumption and hiring in the months ahead.

Source: d.Short.com, through July 2024. The Conference Board Consumer Confidence Index measures the consumers’ attitudes and confidence in the economy, business conditions, and labor market, with higher readings indicating higher optimism. The National Federation of Independent Businesses (NFIB) Optimism Index is a monthly compilation of member surveys regarding optimism toward various aspects of their business. Both indicators are survey based and therefore can be volatile as perceptions and attitudes change.

In summary, the economy is maintaining a slow but steady expansion, with some signs of weakening, suggesting the Fed needs to be neither “dovish” or “hawkish” in its policy decisions until additional data come in.

Inflation

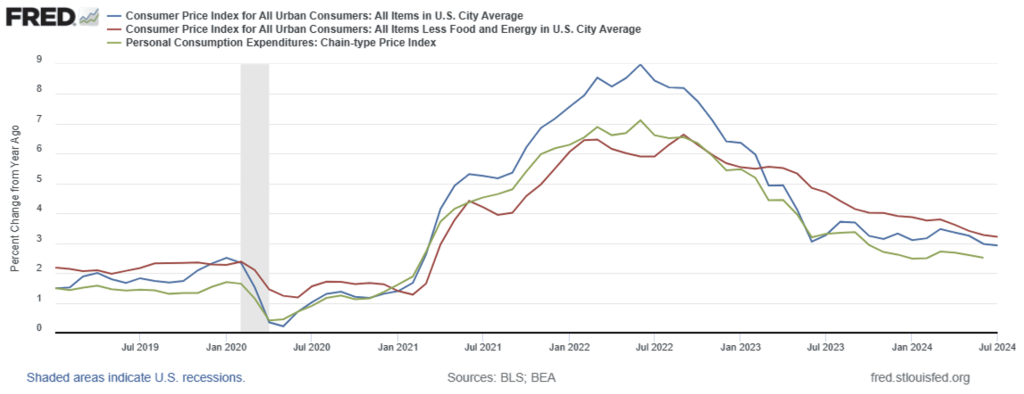

In general, inflation has moved in the right direction but remains above the Fed’s target of 2% annualized. An unexpected upturn in Q1 frightened the markets into thinking we may see a reacceleration of inflation moving forward, but there are no recurring signs of that now.

Source: St. Louis Fed (FRED), through July 2024.

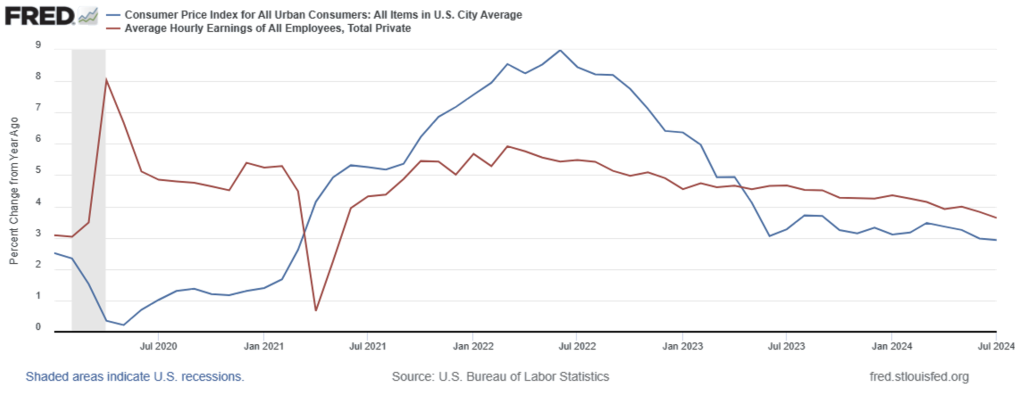

Next, we look at wages in comparison to inflation. After a steady increase in wages post-Covid, we see them now leveling off and trending downward.

While the year-over-year rate of wage increases remains higher than that of inflation (which would tend to have an inflationary effect), we see the trend lines converging, suggesting wage pressures may not contribute significantly to inflation moving forward.

Source: St. Louis Fed (FRED), data as of July 2024.

Inflation remains probably the most uncertain aspect of the current economic landscape. The upturn in Q1 caused some analysts to fear not only the Fed not easing going forward, but perhaps even tightening if the inflationary rise continued.

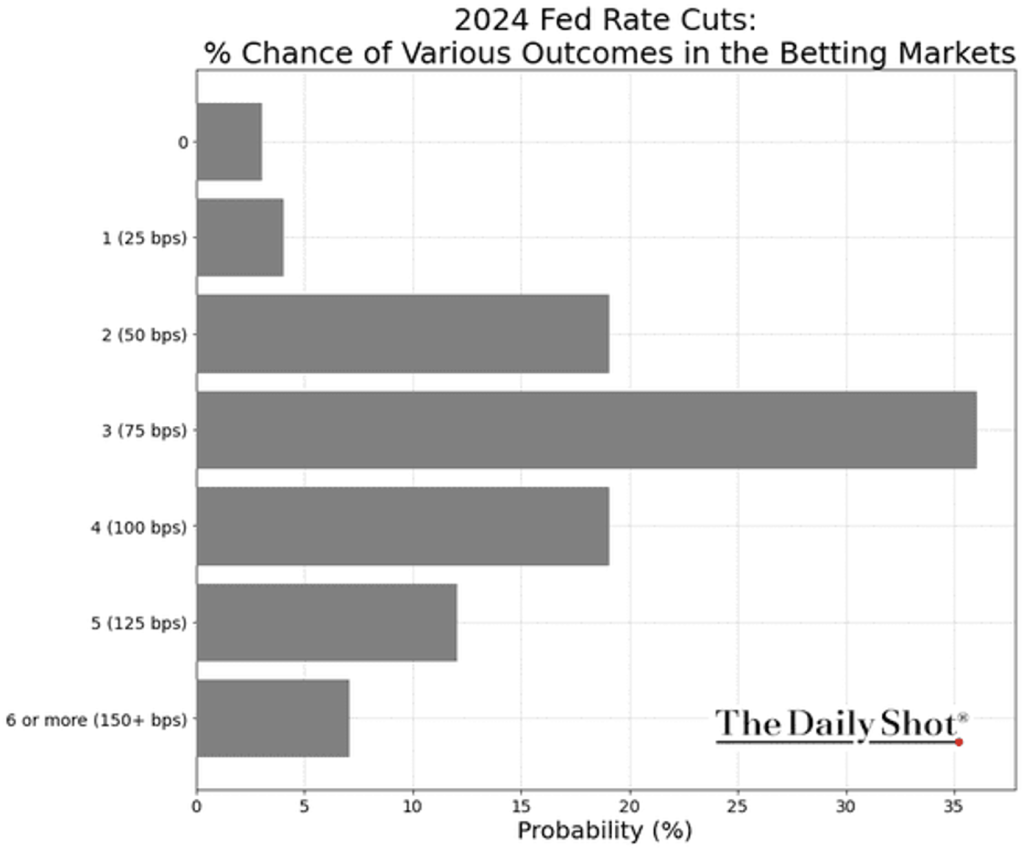

More recent data, however, indicates a “cooling” in inflation from previous months. This calmed the market, and it is now once again pricing in 2-3 rate cuts over the remainder of 2024.

Source: The Daily Shot, as of August 15, 2024.

In summary, while inflation is trending downward, it remains above the target rate of 2% annualized. As with the economy, there is nothing here to suggest the Fed needs to move aggressively toward a rate cut unless further data indicate a continued “cooling.”

The Labor Markets

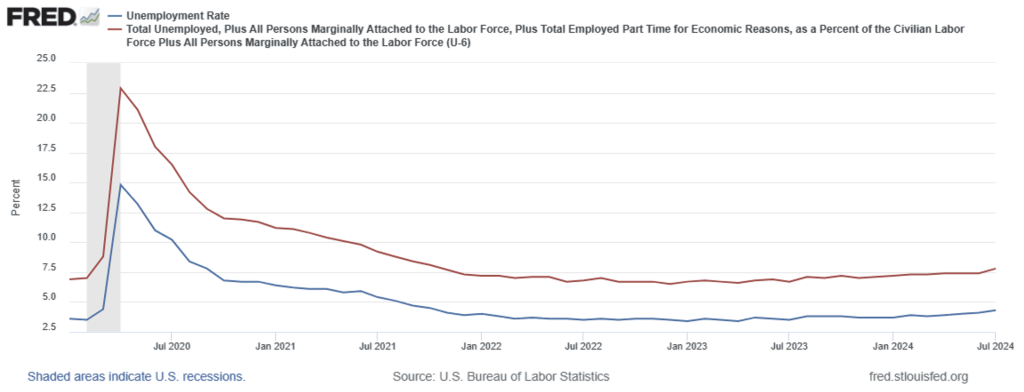

We’ll start with the headline “U-3” (unemployment) and “U-6” (partial employment) rates. Overall unemployment remains low but, as with inflation, we may be seeing signs of an upward trend, which is what the Fed would prefer if it wanted to initiate rate cuts.

Source: St. Louis Fed (FRED), as of July 2024.

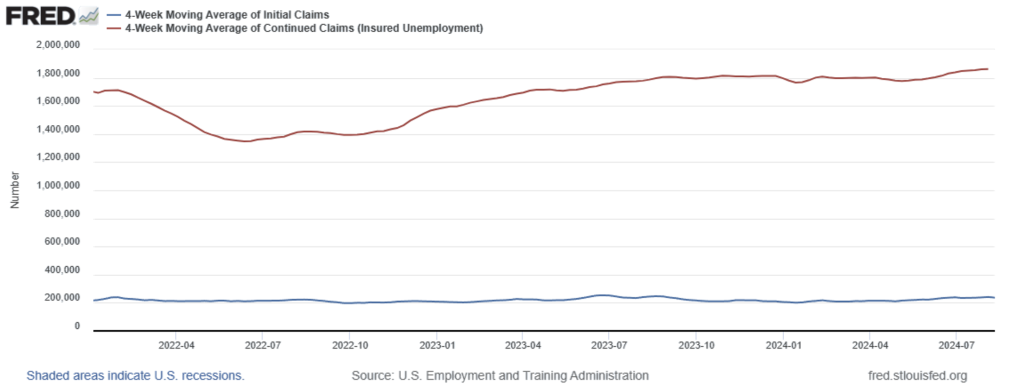

Let’s now review jobless claims, both initial and continuing. These weekly reports can be volatile but provide a “real time” snapshot of what’s happening in the labor market. Using the 4-week moving average helps to smooth out the volatility in the weekly numbers, and what we see is a continuance of the stability of the labor market over the past 2-3 years, with a slow rise in continuing claims.

Source: St. Louis Fed (FRED), as of August 10, 2024.

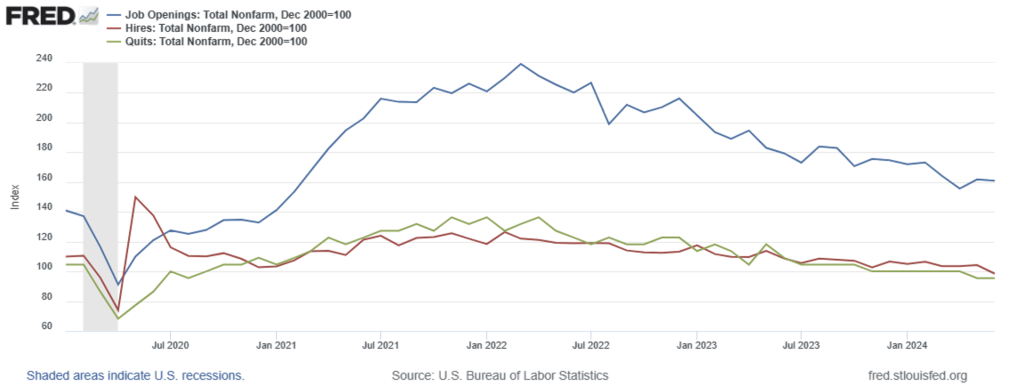

Finally, let’s review some “behind the headlines” numbers, in this case job openings, the “hires” rate, and the “quits” rate. Job openings and the hires rate are self-explanatory, but the “quits” rate requires some additional explanation.

Definitionally, it is exactly what it sounds like – how many employees are quitting their current jobs. But the informational value of the number is that it indicates employee confidence – the higher the quits rate the more confident workers are they can find other employment, and vice versa.

What we see is a slow but steady decline in both job openings and hires, as well as a steady decline in the quits rate – suggesting workers are becoming less confident of finding work elsewhere and so are remaining in the jobs they have. These trends certainly signal at least a potential softening of the labor market.

Source: St. Louis Fed (FRED), data through June 2024.

This potential “softening” of the labor market is perhaps the most compelling signal for a Fed rate cut.

Summary and Interpretation

No single metric, index, or survey provides a perfect forecast of future economic conditions, and we’ve only illustrated a handful of the more well-known and followed.

All things will change as more data come in, and we’ve chosen to not dive into the “known unknowns” that may affect the economic environment over the remainder of this year – a chaotic presidential election cycle and continuing geopolitical upheaval in Ukraine, Israel, Iran and the broader Middle East, Russia, and China.

But, regarding future Fed policy, we’ve been consistent in our belief that the market was engaging in wishful thinking regarding rate cuts and, so far, that has played out.

We currently don’t see anything in the numbers that proclaim with certainty it is time for the Fed to cut rates. The economy continues to be resilient and inflation, while moving in the right direction, remains above the Fed’s target rate.

The most compelling metric for a rate cut is the softening of the labor market, and Fed Chair Powell signaled this in his post-FOMC remarks that the Fed will remain focused on both of its mandates – stable prices and employment.

It would be against its supposed independence for the Fed to make a move due to political and market pressure. But that pressure will mount as we approach the September FOMC meeting and the November election.

So, while the data do not seem to support the notion that the Fed must act in September, we now strongly suspect that it will.